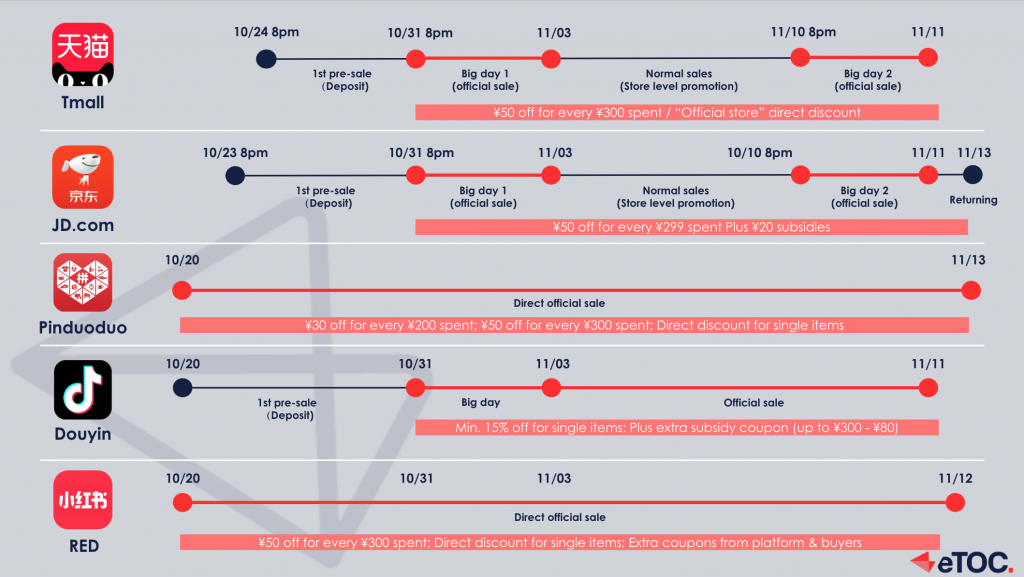

Event duration

All other platforms started their promotion earlier than Tmall in 2023 Double 11.

Tmall duration: 10/24 – 11/11

JD duration: 10/23 – 11/13

PDD duration: 10/20 – 11/13

Douyin duration: 10/20 – 11/11

RED duration: 10/20 – 11/12

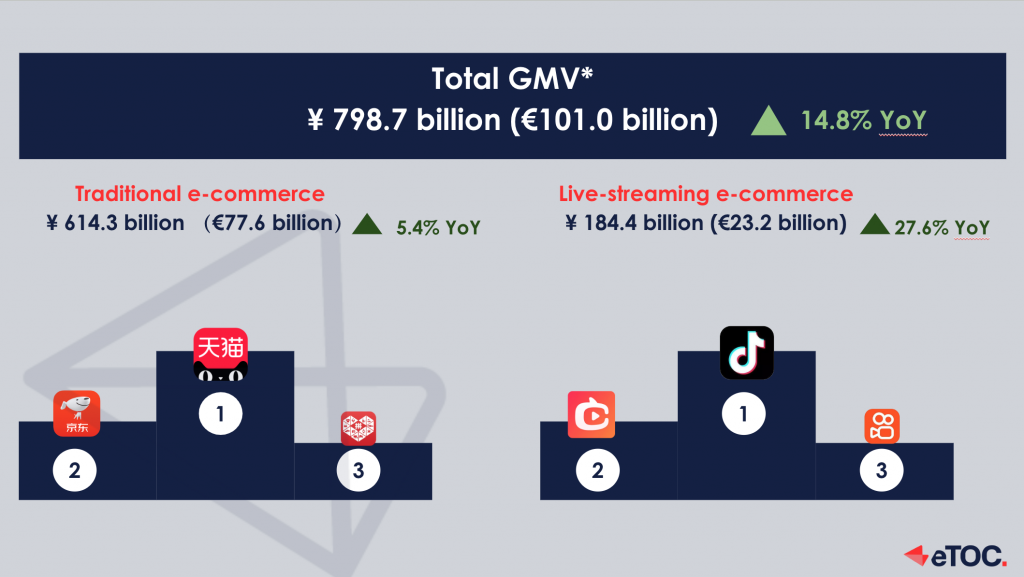

2023 D11 performance overview

1.Tranditional e-commerce platform declined and live-streaming e-commerce slows down

During the 2023 Double 11 promotion (from 20:00 on Oct. 31st to 23:59 on Nov. 11th), major e-commerce platforms achieved a GMV of ¥1,139 billion, representing a slight YoY increase of 2.1%.

Traditional e-commerce (¥923.5 billion) maintained a dominant sales share (81.1%) but experienced a slight drop (-1.1%). Tmall, JD, and Pinduoduo maintained their market dominance with consistent rankings, although the platforms no longer disclose specific sales figures. To enhance competitiveness, leading e-commerce platforms have implemented unprecedented low-price mechanisms.

The live streaming e-commerce market (¥215.1 billion) continued to grow (18.5%) but encountered challenges in replicating the remarkable growth rate (146.1%) seen during the 2022 Double 11. Douyin retained its No.1 position in the live streaming e-commerce, while KuaiShou surpassed Taobao Live for the first time.

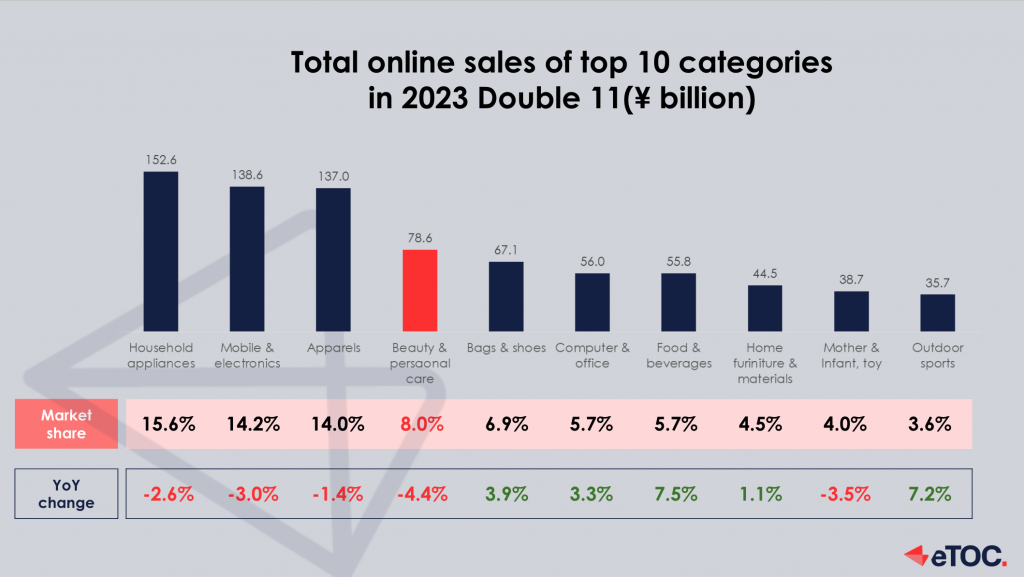

2. Category performance

The Double 11 shopping extravaganza showcased a dynamic mix of consumer preferences, with the top five categories leading the charge. Household appliances took center stage, elevating everyday living with innovative solutions. Following closely, mobile & electronics continued to captivate tech enthusiasts, while apparel, beauty & personal care, and bags & shoes made a stylish impact. Despite the overall excitement, the top four categories experienced a slight decline compared to the previous year’s Double 11, prompting a closer look at consumer behaviors.

However, amidst this dip, food and beverage surged with a 7.5% growth, satisfying culinary cravings, and outdoor sports saw a robust 7.2% increase, reflecting a growing interest in active lifestyles.

2023 D11 performance trends

Trend 1: Low price competition, rational consumer base

As the Double 11 shopping extravaganza unfolded, a pervasive trend emerged, ushering in an era marked by intense low-price competition and a discernibly rational consumer base. Leading the charge in this dynamic landscape were major platforms like Tmall, JD, and Douyin, each employing distinctive strategies to appeal to the increasingly cost-conscious and discerning shopper.

Tmall’s price revolution:

Tmall, a prominent online marketplace, disrupted norms by offering the lowest prices online. In addition to the cross-store discount mechanism (¥50 off over ¥300; ¥30 off over ¥200), for the first time, Tmall introduced a direct reduction of up to 15% on a single item, presenting consumers with unparalleled affordability. A staggering 80 million items experienced their lowest prices of the year, reshaping the Double 11 narrative with a focus on accessible pricing.

JD’s budget-friendly quality:

JD, in response to the evolving consumer mindset, emphasized high-quality products at budget-friendly prices. Encouraging consumers to confidently proceed with orders, they synchronized in-stock sales and pre-orders, while an expansive hundred-billion subsidy doubled the number of subsidized products compared to the previous year.

Douyin’s instant savings:

Douyin, a frontrunner in social commerce, embraced immediacy by offering instant discounts on single items with no fulfillment requirements. In a move to enhance transparency, they eliminated cross-store discounts and introduced direct official reductions of up to 15% on individual items.

Trend 2: Declining influence of top KOLs and decentralization of live streaming traffic

In the ever-evolving landscape of Double 11, a significant trend has emerged, characterized by the diminishing influence of top KOLs and the decentralization of live streaming traffic. Platforms like Tmall, JD, and Douyin are spearheading this transformation, employing innovative strategies to distribute influence more broadly.

Tmall’s booming store live:

Tmall witnessed a surge in store live activity on Taobao LIVE, with 280 store live sessions exceeding an impressive ¥10 million in turnover. To facilitate merchant growth during Double 11, Taobao Live implemented strategic policies like the “Super Merchant Stream,” “New Alliance Program,” and the “Eco New Star Entry Plan.”

JD’s procurement live streaming debut:

JD responded to the changing dynamics by introducing procurement live streaming. Their inaugural broadcast, marked by a “No Collaboration Fee, No Influencer Commission” policy, focused on offering products at lower prices than industry influencer Austin Li, initiating direct discounts starting at 10%.

Douyin’s traffic redistribution:

Douyin took a bold step towards decentralization, redirecting traffic from top anchors to long-tail influencers and merchants. Live competitions were introduced, incentivizing participants with cashback rewards and increased exposure based on task completion.

Trend 3: Integration of content and e-com to enhance consumer shopping experience

As the Double 11 shopping festival evolves, a transformative trend has taken center stage: the integration of content and e-commerce to create an immersive and enriched shopping experience. Platforms such as Douyin, JD, and RED are at the forefront of this evolution, leveraging diverse content collaborations to empower e-commerce and enhance consumer engagement.

Douyin’s diverse content empowerment:

Douyin is driving a more dynamic e-commerce ecosystem by continually enriching its platform with diverse content. From engaging celebrity variety shows to short playlets by Key Opinion Leaders (KOLs), Douyin has become a hub where content seamlessly intertwines with shopping, creating a holistic and enjoyable consumer journey.

JD’s collaborative efficiency unlock:

JD is pioneering collaboration with platforms like RED and Bilibili to unlock seeding efficiency. The JD & RED league (小红盟) operates online, enabling brands to execute precise re-operations based on new crowd asset data. The collaboration with Bilibili aims to enhance the seeding ecosystem, merging content and commerce for a more streamlined and effective shopping experience.

RED’s buyer e-commerce boost:

RED is making significant strides in e-commerce with substantial investments in traffic support and subsidies. Introducing matchmaking programs and support policies for the growth of buyers and merchants during the 2023 Double 11, RED is innovatively merging the world of content and e-commerce to create a vibrant and lucrative marketplace.

Conclusion

2023 Double 11 has been marked by transformative trends. The landscape witnessed a shift towards low-price competition and consumer rationality, with platforms like Tmall, JD, and Douyin leading the charge. Simultaneously, the dynamics of live streaming traffic evolved, diminishing the influence of top anchors and distributing it more broadly. Additionally, the integration of content and e-commerce emerged as a key trend, creating a seamless and enriched shopping experience. As the retail landscape continues to evolve, businesses must adapt to these trends to effectively engage the discerning and dynamic consumer base.

Want to expand to the Chinese market? Contact us for a first free consultation.