The Emerging Success of Chinese Beauty Brands Case Studies

“Guo Huo” (“Chinese domestic products”) is undoubtedly one of the new trends of Chinese e-commerce which companies should pay attention to most this year. On the one hand, Alibaba launched the “New Domestic Products Plan 2020”, intending to strive for three more Chinese brand products in each consumer’s shopping cart. On the other hand, since 618, Tmall has launched the “New Domestic Products” channel, which has become the first-level mobile Taobao portal. Under the influence of this series of preferential policies, on the first day of Tmall 618, the turnover of over 37,000 Chinese brands on the Tmall platform increased by at least 100% YoY. (Source: iwshang.com)

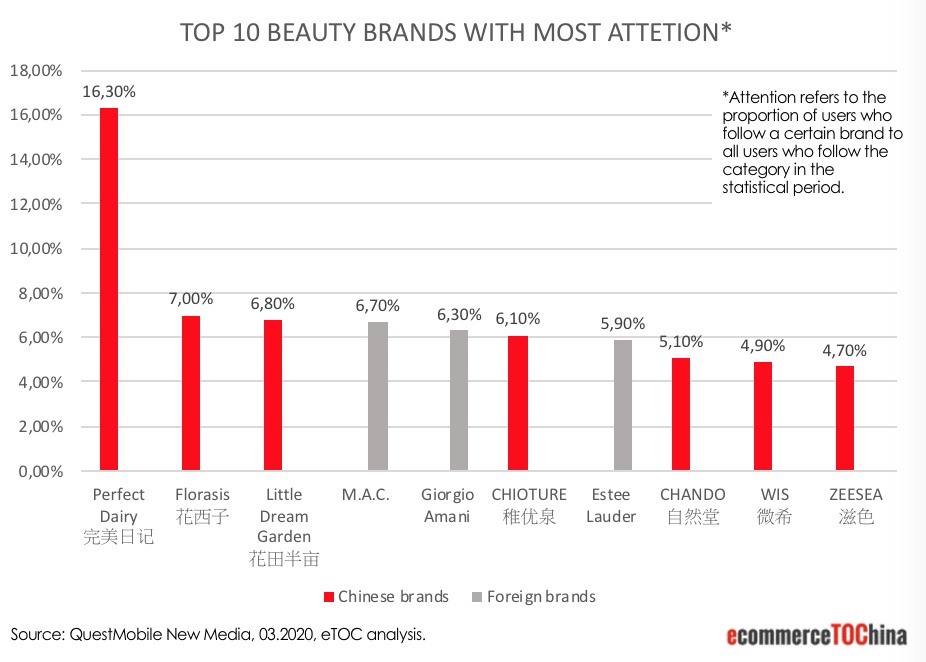

Domestic products are especially outstanding in the beauty industry. According to the “2020 Beauty Makeup Crowd and Brand Insight Report” recently released by QuestMobile, among the top 100 brands with the most attention of Chinese cosmetic consumers, 37 Chinese brands are on the list. 7 of the Top 10 brands are Chinese brands, and Perfect Diary topped the list with apparent advantages.

Conversely, foreign beauty brands have not escaped the negative impact of the epidemic in the first half of this year. According to a Pinguan APP survey, the beauty and personal care-related sector sales of ten international beauty companies that have released their first-half year performance reports (January 1-June 30, 2020) have totally dropped by 42.82 billion RMB. All of them experiencing negative YoY growth, and seven of them experienced double-digit declines.

In the current Chinese beauty market, Chinese beauty brands have the following three apparent characteristics:

1. Chinese beauty brands dominate certain product categories

In comparison, European and American cosmetics brands are more dominant in essence, foundation, lipstick, and perfume categories. (Source: QuestMobile NEW MEDIA, 03.2020)

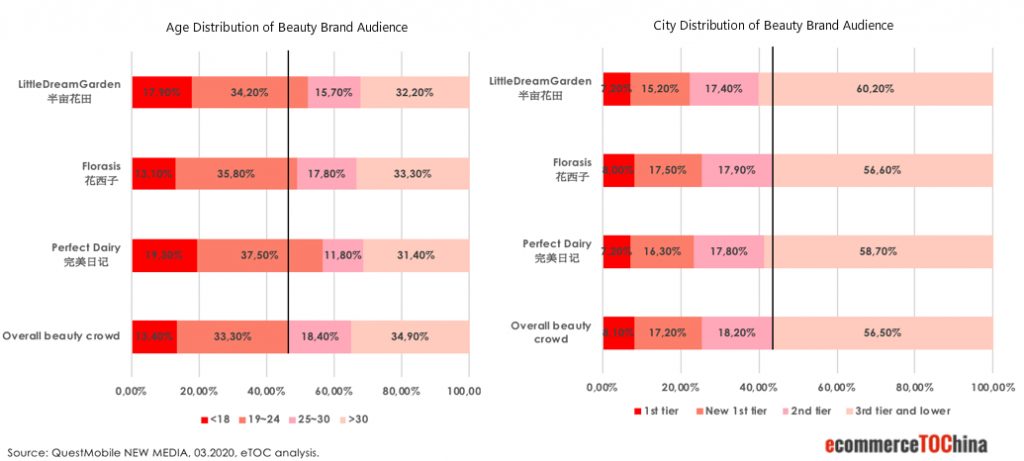

2. Audiences are mostly under 25

3. Wider geographic distribution

1. Brand Positioning

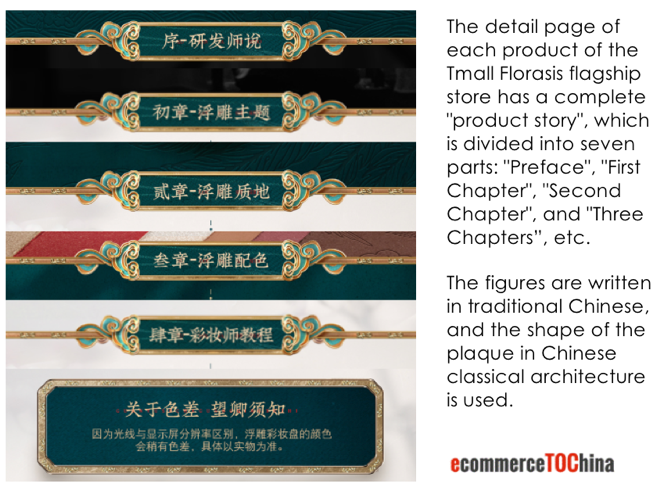

“Oriental Makeup” is the brand positioning of Florasis (Hua Xi Zi), which was also established in 2017. Since its establishment, Florasis has continued to explore the wisdom of ancient Chinese recipes for beauty, adhere to the inheritance of oriental aesthetics, extract the essence of natural flowers, and use modern manufacturing techniques to create makeup products suitable for Asian women.

It is worth mentioning that Florasis successfully created a very clear image in the minds of consumers. Florasis implemented its unique brand positioning of “Oriental Makeup” into brand symbols, product name, product packaging design, store design, marketing text, and other dimensions, telling customers a complete brand story.

2. Endorsement

The spokespersons of domestic beauty brands are mostly male idols born after 1995. The consumers they attract are mostly the 00s and female consumers.

In August 2018, Perfect Diary announced its first lip makeup spokesperson Zhu Zhengting. In the following two years, successively announced Luo Yunxi and other highly popular young spokespersons. The reading volume of Weibo topics related to the Perfect Diary endorsement has reached 1.34 billion.

The spokespersons selected by Chinese beauty brands also have outstanding characteristics, which are very suitable for their brand positioning.

Florasis has not only invited Li Jiaqi (Austin Li), the most famous and popular “live-streaming anchor” in China, as its “chief recommendation officer.” This year, Zhou Shen, a well-known singer who has a prominent Chinese classical style, was also invited to sing a tailor-made theme song for Florasis. From January to February 2020, 40% of Florasis flagship store’s sales came from Li Jiaqi’s live-streaming studio. The song “Hua Xi Zi” sung by Zhou Shen also tops the major Chinese music lists.

3. Social media marketing strategy

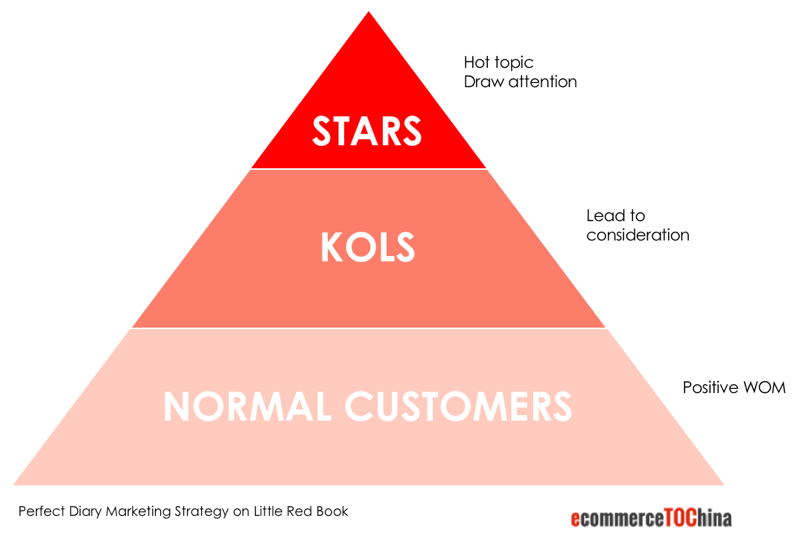

Little Red Book is undoubtedly the best promotion platform for beauty brands. More than 80% of users here are young women, and most of the content is makeup, skincare, and fashion.

Till now, the Little Red Book brand account of Perfect Diary has 1.35 million fans, 833 thousand likes and favorites. The number of fans far exceeds that of well-known foreign cosmetics brands (MAC: 62 thousand, L’Oreal: 109 thousand).

Perfect Diary adopts a traffic pyramid strategy of “Stars/celebrities – KOLs – normal customers” on Little Red Book. Firstly, the celebrity’s recommendation caused explosive attention and discussion among consumers. For example, the young female star Ouyang Nana born after the year of 2000, received 83 thousand likes and 36 thousand favorites under her Perfect Diary video. Then, through the product use evaluation of KOLs, consumers are led into consideration and even purchase stage. At the end, the large number of user-generated content shared by normal consumers about their positive user experiences will further increase the credibility of the brand and products. In this way, Perfect Diary allows a large number of Little Red Book users to remember this brand subconsciously.

Florasis not only promotes the brand on social media but also focuses on interaction with the customers. Florasis often posts tutorials on its new products on social media platforms and answers questions for customers. At the same time, Florasis launched various social media challenges, encouraging users to participate and speak out. These challenge activities create popularity and secretly show the excellent features of the products to potential customers.

4. Product innovation

Perfect Diary often releases novel and interesting new products. It is good at IP co-brandings, such as co-branded lipstick with the Metropolitan Museum of Art and co-branded eye shadow with China National Geographic. In April this year, Perfect Diary and Discovery Channel launched the co-branded “Explorer Twelve Color Eyeshadow Palette”. The packaging is pretty eye-catching, with realistic pictures and an uneven surface. Before this product has been officially launched online, nearly 110,000 people have already prepaid.

Unlike the Perfect Diary’s emphasis on new trends, Florasis insists on inheriting Eastern culture and replicating traditional Eastern craftsmanship. The characteristics of the “oriental makeup” are not only reflected in the product name and product design, but also the ingredients. Most of Florasis’s beauty products are made of natural flowers and plants, which gently nourish the skin. Florasis launched a unique carved lipstick product in April 2019 (called “花隐星穹口红”). Unlike other lipstick products that only work on the outer packaging, this product moves the micro-engraving process to the lipstick paste. According to statistics from ECdataway, the sales of this carved lipstick in Florasis’s flagship store in 2019 reached more than 10 million RMB.

5. Customer-centric services

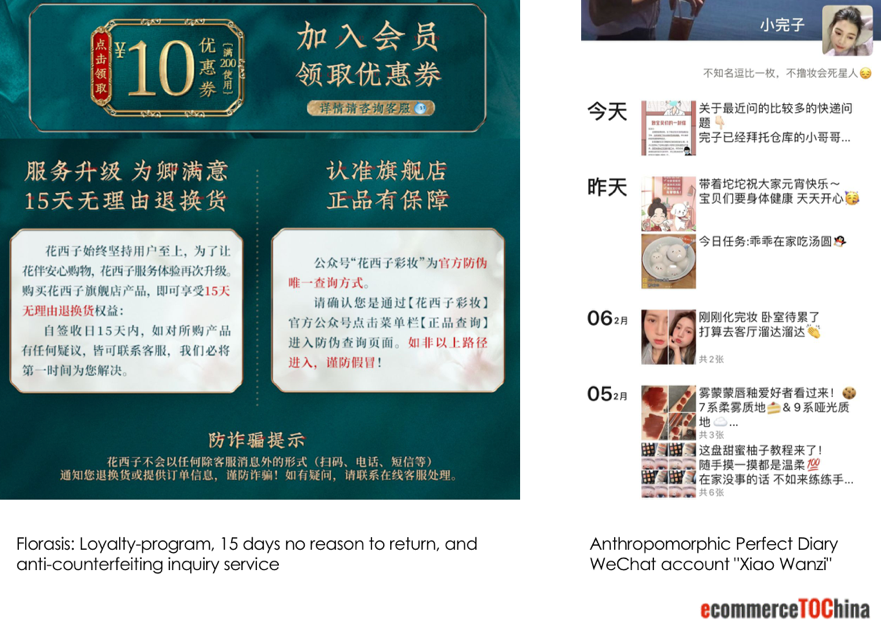

However, with the growing popularity of Florasis, a large number of fakes appeared on the market. In order to ensure that customers can buy authentic products and have a good shopping experience, Florasis provides not only various anti-counterfeiting verification services but also recruits anti-counterfeiting officers with an annual salary of 300 thousand RMB to be responsible for counterfeit detection. Anyone who successfully reports a fake product will get a valuable gift box in return.

Perfect Diary also emphasizes customer-centric thinking. Customers who purchase Perfect Diary products will get a QR code and add “Xiao Wanzi” as their WeChat friends. Besides the WeChat official account and mini-program that provide after-sales and point redemption services, the “Xiao Wanzi” account of Perfect Diary is operated like a real girl. She will share her daily activities, her mood, and skincare experience with customers in her WeChat Moments. In this way, customers will feel “Xiao Wanzi” is like a real friend without a sense of distance.

6. Pricing

Perfect Diary focuses on “cost-effective”. Relying on the supply chain advantages of “the same manufacturer as the big brands”, Perfect Diary reduces costs as much as possible and ensures high quality and low prices. Most of its products are below one hundred RMB. Taking lipsticks as an example, comparing the top-selling lipstick products of major brands, the unit price of Perfect Diary is only half of most big-brand lipsticks (Perfect Diary: 79.9 RMB, MAC: 170 RMB; Dior: 299 RMB; source: growthbox).

Florasis (top-selling lipstick: 129 RMB) did not adopt a low-price strategy like Perfect Diary. Its prices are almost at the same level as that of the well-known foreign beauty brand Maybelline. However, with excellent product design, unique brand positioning, and positive WOM, it has also won the title of “high-cost performance” in the same price range.

Takeaways:

- Consumers who love Chinese beauty brands are concentrated in groups under 25 years old, in second-tier cities and below.

- Brands should have their own unique positioning. The brand story must be told entirely, immersed in product design, product name, ingredients, marketing, and other dimensions.

- The product spokesperson must conform to the product positioning and be distinctive. Male celebrities born after 1995 have a strong ability to promote buying behavior for beauty products.

- Perfect Diary’s traffic pyramid strategy of “stars – KOLs – normal customers” on Little Red Book is worth learning.

- Brands should attach more importance to the novelty and fun of the product. Co-branding with big IP and distinctive product names are all good strategies.

- Focus on customers, proceed from customer needs, and protect customer interests.

- The prices of domestic cosmetics are generally lower than those of foreign cosmetics brands.

Follow us for more China e-commerce and digital marketing trends and insights OR contact us to get a first free consultation: