How to build a compelling product story for China?

According to TalkingData 2019 E-commerce Crowd Insight Report, China has the world’s largest e-commerce market, and it still maintains double-digit high-speed growth at a compound growth rate of nearly 24% in the past three years.

Especially under the challenge of the Covid-19 epidemic, e-commerce plays an even more important role. Merchants rely on e-commerce to communicate uninterruptedly with consumers and sell products. E-commerce has become the preferred channel for major overseas brands to accelerate their China entry as well, thanks to its huge consumer coverage, operational transparency and convenience as well as relatively lower investment.

Along with consumption upgrade and continuous segmentation trend, the China e-commerce market is very lucrative and dynamic but also strongly competitive.

There are more possibilities for new brands to succeed, but it´s definitely not easy to succeed in China as a new brand. Success surely lies on multiple reasons: clear & sharp brand positioning and go-to-market strategy, value-for-money pricing, comprehensive & sufficient marketing investment, category competition, precise executions…

However, one success factor is agreed in common: brands have to build a few top sellers with convincing product stories to be successful in China.

How to create an attractive product story as a new brand?

eTOC has summarized the comprehensive product story structure taking the highly competitive beauty category as an example. Of course the product story structure can also be applied to other categories.

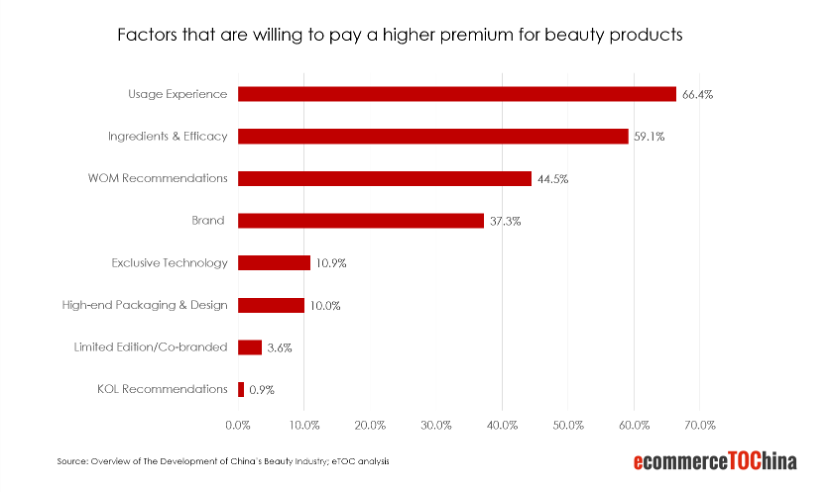

Knowing what´s important for the Chinese consumers, a compelling product story shall clearly address these purchase considerations to convince the consumers.

1. Market challenge

Use Balea hydration ampoule as example, it presents major life scenarios of getting skin dryness to engage and resonate with consumers before introducing the product.

1) Overnight working (typical situation for working class in tier 1 cities in nowadays, overtime working pressure is quite common)

2) Air pollution (A lot of areas in China still facing this challenge)

3) Sunlight and season change (similar scenarios in Westerns)

2. Product USPs (unique selling points)

Chinese consumers are getting more and more sophisticated in researching and selecting the right skin care products. They are passionate about studying the ingredients & formulas in great details to evaluate its quality and efficiency. They have been called “ingredient manias”.

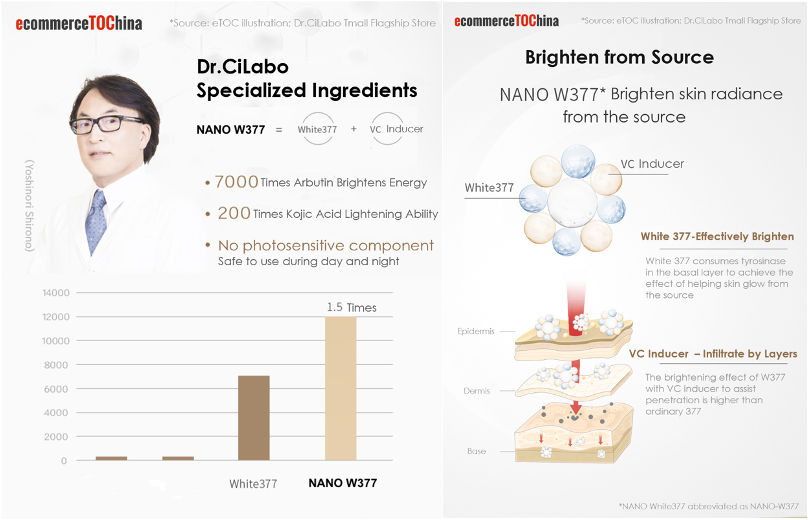

Take one of the bestselling whitening serum products from Tmall Global as an example.

Dr. CiLabo is a Japanese skin care brand created by Dr. Shirono in 1999. The brand value is to create simple, scientific & efficient skin care solution. Super White 377VC serum based on ingredient “White 377 (Phenylethyl Resorcinol)” but further improved by Dr. Shirono and made it a better performance (NANO W377 = White 377 + Acetify VC): about 1.5 times better than “White 377” skin whitening & brightening effect, 7000 times better than the effect of “Arbutin”, 200 times better than the effect of “Kojic Acid”.

How the NANO W377 ingredient get functioned and bring out the outstanding skin whitening & brightening effect?

“NANO W377” combined with “White 377” & “Acetify VC”. “White 377” penetrates into the muscle base from epidermis via “Acetify VC” support, which dissolves the tyrosinase (the key enzyme of melanin formation) in every skin layer, the skin whitening & brightening effect is complete.

3. Endorsement/WOM

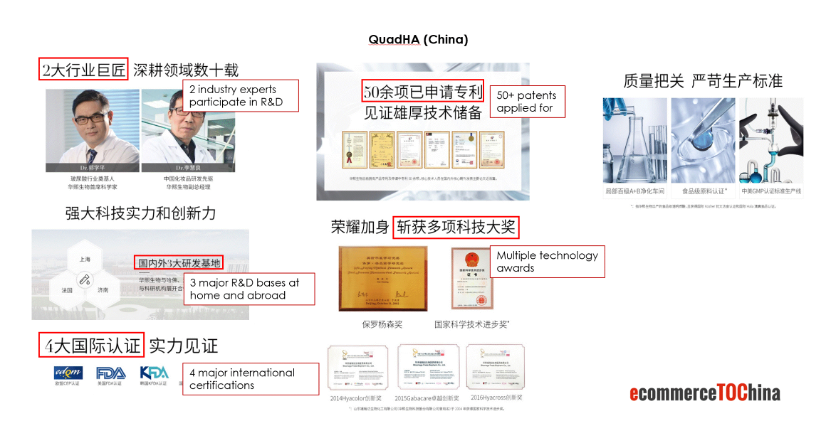

Use QuadHA brand endorsement as example: QuadHA is a local cosmeceutical skin care brand established only 6 years ago, but has become one of the bestselling cosmeceutical skin care brands nowadays. The products are developed by Huaxi biology with strong professional biomedical science background.

QuadHA presents multiple strong endorsements in their product stories, including experts participating in R&D, research and development bases, authoritative certifications, patented technologies, and scientific awards. These all well demonstrate the professional image of the brand and enhance consumers reliability.

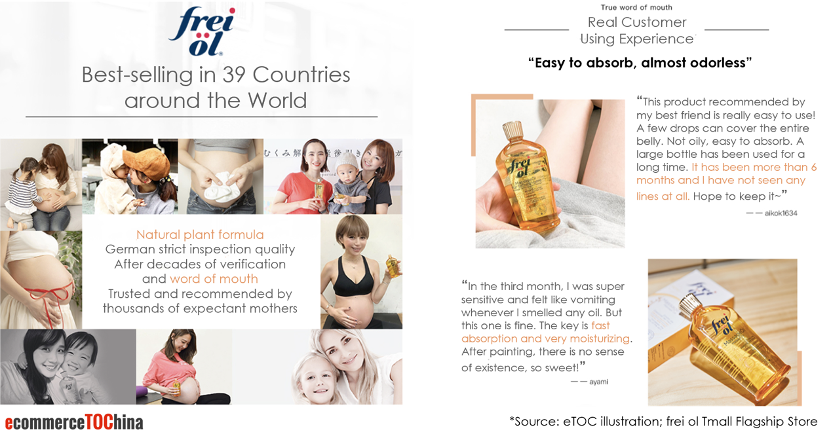

Take Frei Oil as example, Frei Oil is a German personal care & skin care brand and very well-known in Germany and other Western markets, but new to Chinese consumers. Brand collected the other markets WOM materials combined with the WOM generated from Chinese market to show the brand popularity and reliability globally.

4. Extended information

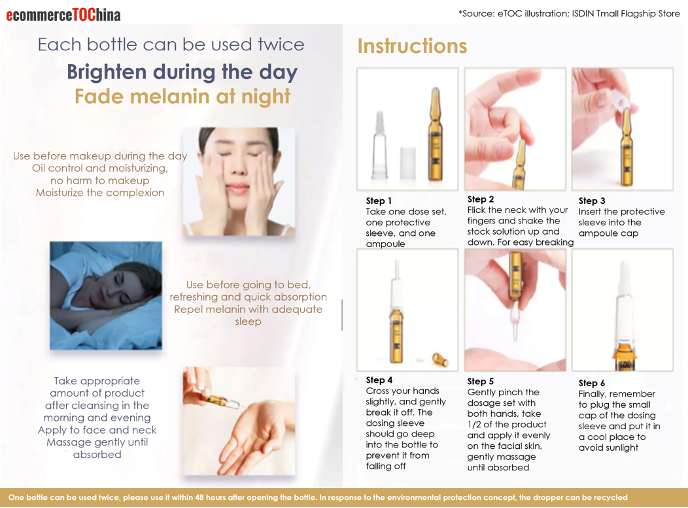

The extended information usually demonstrates product specification, usage instructions, import information to build proper product usage expectation before placing the order.

Take Isdin Ampoule as example: it considerably attached the specific instructions on how to use the ampoule products for day and night to maximize the effect. Also guide consumers how to open the Ampoule bottle safely and use the plastic cap to restore the essence for night time use step by step as Ampoule product is still very new to consumers in China.

5. Brand Credibility

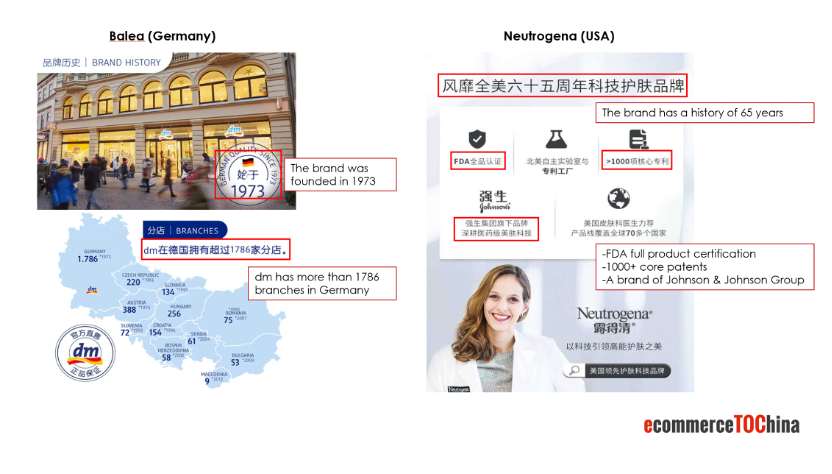

Balea introduces the history of the brand and uses a map to present the number of offline stores, highlighting the offline influence of the brand.

Neutrogena also highlights the long history of the brand and showcases authoritative certification, patented technology, and its group behind. All these can make consumers feel the long history and heritage of an international brand, thereby affirming the brand value.

Takeaways:

In summary, a competitive product story sitting in product detail page should have:

1) Complete and clear logic & structure for smooth easy understanding,

2) Convincing product USPs that differentiate from the market and memorable for consumers,

3) Various endorsement/WOMs for product or brand further empower the product credibility,

4) Detailed product usage instructions to build pre-use expectation and therefore improve the user experience,

5) Brand history serves as the base information, support the product reliability.

They have to be integrated smoothly into a logical and appealing product story and presented in an easy-to-understand way to engage with Chinese consumers who can resonate with their life experiences.

Do you need help to build your product story or improve your product detail page in China marketplaces? Contact us for a first free consultation: