All you need to know about 618 festival in 2023

China’s 618 shopping festival, the country’s mid-year online deals event, is concluding after a month-long campaign. This year’s 618 holds significance as it is the first major shopping event since China reopened in December 2022, providing insights into current consumer sentiment.

The festival gained increased activity this year, coinciding with the 20th anniversary of JD.com, Father’s Day, and the Dragon Boat Festival. Trudy Dai, CEO of Alibaba’s independent Taobao Tmall Commerce Group, emphasized their commitment to a “historical investment” in this year’s event, while JD announced their intention to undertake “industry-wide investment efforts.” Both platforms face substantial growth pressure amid intense competition.

01. The e-commerce platform reiterates the importance of low price

This year’s 618 festival exemplifies the escalating price war in China’s e-commerce industry. With the economic growth slowdown, consumers actively seek cost-effective products. In response, multiple Chinese e-commerce platforms, following Pinduoduo’s marketing strategy, offer higher discounts to attract buyers.

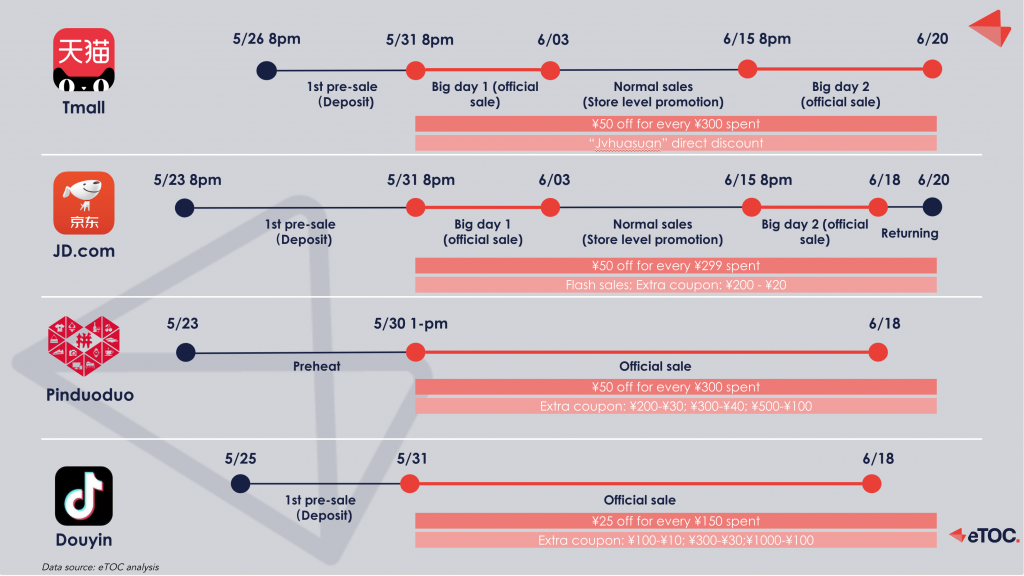

Tmall: During the month-long mega promotion, aligning with Tmall’s slogan “it’s cheaper to choose (T)mall,” Alibaba customers receive a discount of RMB 50 (about $7) for every RMB 300 spent across Tmall stores. 88VIP customers receive discount coupons worth RMB 520. Additionally, Taobao introduces the “RMB 10 billion subsidy” project, adopting a similar approach to Pinduoduo’s signature campaign. Tmall also launches the “Jvhuasuan” project, where products are directly sold at lower prices without complicated coupon applications.

JD: JD offers the most generous discounts compared to other platforms, campaigning with the slogan “even more (products), even faster (logistics speed), even better (product quality), even less (money).” Customers receive RMB 50 back for every RMB 299 spent. In addition to cross-store discounts and PLUS member subsidy coupons, there are category coupons such as RMB 30 for every RMB 400 spent on sports and outdoor products. JD also claims to have an “RMB 10 billion subsidy” like Taobao and emphasizes the “highest discount for single purchase” with the project “double indemnity for high price.”

Douyin: Douyin’s platform rhythm during the 618 festival and its discount rules follow the steps of traditional marketplace e-commerce platforms. They introduce a pre-sale period for the first time, from May 25th to May 30th. For discount rules, Douyin establishes RMB 25 coupons for every cross-store purchase of RMB 150. The platform also offers large coupons at regular intervals.

Pinduoduo: Pinduoduo, known for selling goods at ultra-low prices, prominently displays a slogan on its 618 promotion interface that roughly translates to “no need to compare with other platforms because we offer the lowest prices.” Pinduoduo also offers RMB 30 off for every RMB 200 spent.

02. Content is the new battlefield

The rise of content commerce platforms like Douyin and Kuaishou demonstrates the growing influence of digital content like live streaming and short video in the e-commerce landscape. Mainstream e-commerce platfotrms are adopting a content-driven approach as a defensive strategy to promote sales.

For the 2023 618 Shopping Festival, Taobao’s strategy revolves around turning consumers into creators. The number of content creators has increased by 200%, and the daily user base for watching short videos has grown by 113%. Moreover, the number of Taobao content creators who started livestreaming during 618 has risen by 139% compared to 2022, resulting in a doubling of consumers’ viewing time on the app.

JD Live is also leveraging top influencers to drive user transactions. Luo Yonghao, the founder of Smartisan Technology and previously an exclusive live streamer of Douyin, participated in JD’s livestream on May 31st and contributed to selling goods worth over RMB 150 million.

Douyin continues to benefit from content-based social commerce. From May 31st to June 18th, the total live streaming duration of e-commerce on Douyin reached an astonishing 42.02 million hours. Short videos with shopping cart links received an impressive 130.9 billion views. Overall sales volume increased by a remarkable 66% compared to the previous year.

03. Optimizing logistics service to win consumers‘ support

On the basis of continuously improving logistics speed, each platform further enhances logistics services to enhance the consumer experience.

JD expanded the pre-sale scale and enabled pre-sale in over 300 cities this year. Once consumers pay the balance, couriers can immediately carry out “last-kilometer” delivery. Additionally, JD.com enriched the logistics service by offering night delivery and installation services for home appliances to ensure efficiency and further improve the shopping experience for consumers.

Tmall collaborated with Cainiao to achieve “half-day” delivery in over 300 cities, covering both first-tier and fourth-tier cities. More than 70% of pre-sale orders in Cainiao warehouses were delivered in advance to the nearest express outlets, improving logistics efficiency for consumers.

Douyin focused on improving the post-purchase experience, including sales returns and refunds, to protect consumers’ interests. They ensured logistics speed and established indemnity for late delivery or lost orders. Douyin also established an exclusive consumer service team from logistics companies to provide timely responses to consumers’ requests.

04. Supporting new product launch to realize brand growth

Taobao introduced a “new species” section to attract consumers’ attention and launched the “global top goods club” on Tmall, featuring limited top-sellers in categories like digital devices and sportswear.

JD increased subsidies on Super New Products Day (June 13th) to encourage purchases of new products. They also presented a new-product calendar through open screen advertising. By searching for “613 super new products day” on the JD app, consumers could receive periodic payment discounts and coupons for new product purchases.

Douyin established the “Little Fly Box” and dedicated days for new products called “Arrival Day.” While browsing the app, consumers could receive the Little Fly Box, which distributed brand coupons, products, and other benefits to encourage engagement. The Arrival Day, leveraging Douyin’s IP, provided diverse resources to expand the influence of different brands.

618 sales recap:

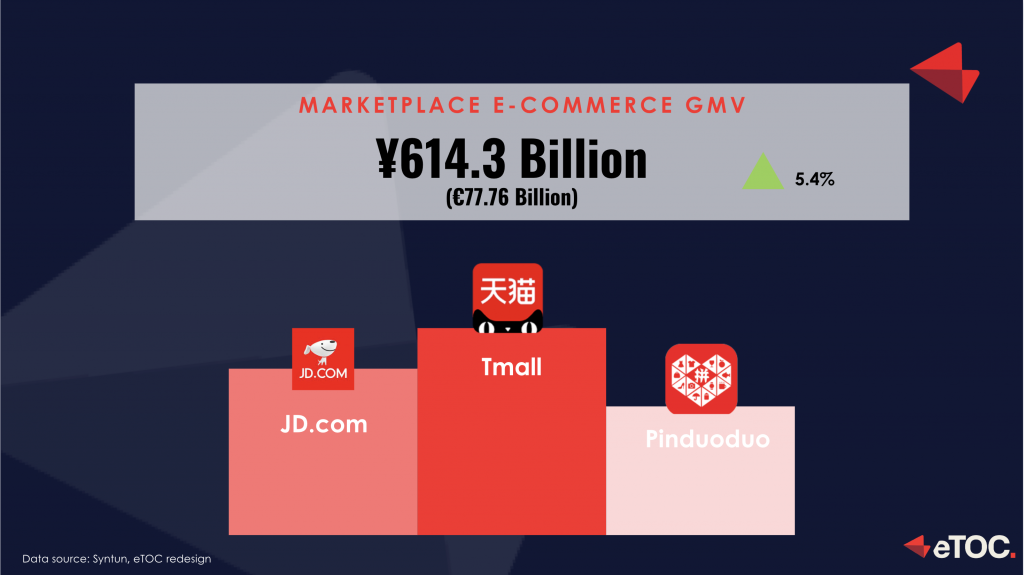

According to third-party data, during the 2023 China “618” shopping festival (from 20:00 on May 31st to 23:59 on June 18th), the GMV of the major e-commerce platforms (only including traditional e-commerce platforms and livestreaming e-commerce platforms) was 798.7 billion RMB.

The big players in the game, such as Tmall, JD.com, and Pinduoduo, continue to dominate the market share (614.3 billion RMB), showcasing their prowess and popularity among shoppers.

Occupying the top position among e-commerce platforms, Tmall published the sales performance list of popular categories without mentioning total GMV. JD claimed that the company’s sales performance during 618 exceeded expectations and set a new record.

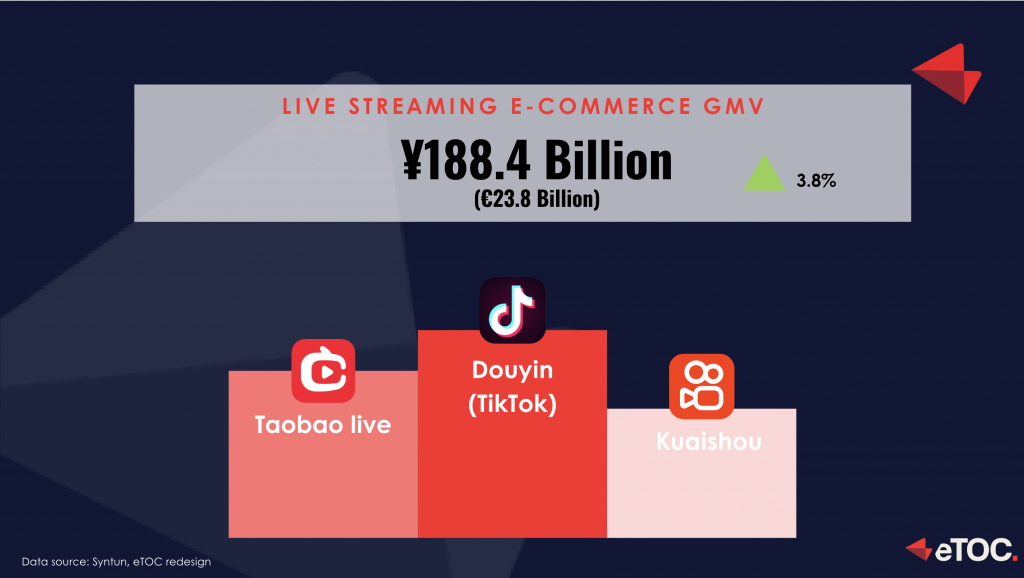

Livestreaming e-commerce platforms performed brilliantly, with a GMV of 184.4 billion, driving brands into new and exciting incremental markets.

During the 618 festival, the GMV of Douyin e-commerce increased by more than 72% YoY, and the sales volume increased by 7% YoY. Kuaishou e-commerce orders increased by nearly 40% YoY.

The fact that no specific GMV or sales data are released from any major e-commerce platforms in China, figures signals — a key indicator of e-commerce success — signals that results were not as glamorous as they once were.

The festival still shed light on new rising categories:

01. Nutrition and health care

The epidemic has accelerated the formation and development of public health awareness, promoting the concepts of “nourishing rather than treating” and “preventing instead of treating.” Nutrition and healthcare have become popular consumption categories during the 618 festival, with gross sales reaching RMB 8.8 billion.

The GMV (Gross Merchandise Volume) of the dietary health category increased by 27% YoY. Coenzyme products on Tmall experienced a turnover increase of over 91% YoY and a sales volume increase of more than 68% YoY. The sales of medical instruments on Tmall grew by 41% YoY.

JD Health set a new sales record during the opening of the 618 festival on May 31. Within an hour, the turnover of medicine, medical equipment, nutrition, and healthcare products exceeded RMB 100 million. JD Health’s product range is diverse this year, covering various health scenarios to meet the health-related needs of specific groups.

On Douyin, medicine, healthcare, and medical equipment witnessed a rapid turnover increase of 108% YoY.

02. Sports and outdoor

As a popular category in the post-epidemic era, the sales of sports and outdoor products have been growing rapidly, reaching a total GMV of RMB 25.8 billion.

Luggage and suitcases experienced an increase in both turnover and sales volume (customized luggage on Tmall surged by 115% YoY). Outdoor clothing and footwear witnessed a YoY increase of 62% and 53% respectively. Top sport brands achieved a significant increase in GMV, with a growth rate of 36%. Niche sports categories such as equestrian and climbing gained significant attention from the public, resulting in growth in turnover and sales volume.

Sportswear and outdoor products on JD realized a 28% YoY increase in GMV, with outdoor jacket clothing witnessing a growth of 76%.

Douyin witnessed a sales increase of 181% in bicycles, riding equipment, and spare parts. The growth rate of outdoor, hiking, camping, and travel supplies on Douyin reached 98%. Brands like MIEJUA and Beneunder experienced rapid growth, and top sellers were mostly related to sunscreen.

03. Pet products

The phenomenon of “empty nest youth” has led to the rapid growth of the pet economy. During the 618 period, online sales of pet food exceeded RMB 5 billion.

The pet category on Tmall has experienced significant activity, with diversified and refined subcategories. During the 618 period, the Tmall platform had 57 pet stores with sales exceeding RMB 10 million, 368 stores exceeding RMB 1 million, and 740 stores achieving a sales growth rate of 100% YoY. The turnover of 63 pet brands exceeded RMB 10 million, 405 brands exceeded RMB 1 million, and 306 brands achieved a growth rate of 500% YoY.

Pet health category sales on Douyin are growing rapidly. Domestic brands dominate this field, with brands like Puainta and Purich experiencing a remarkable 1000% increase in YoY turnover and sales volume. Traffic on the platform also increased by 15% YoY.

04. Beauty devices

As young Chinese individuals increasingly prioritize skincare and wellness, beauty devices have become highly sought after this year. Refined and advanced skincare products, particularly those targeting wrinkles and skin nourishment such as essential oils, gained significant popularity during the 618 festival.

One notable beauty tech brand, Seayeo, experienced a remarkable success on Taobao, as their LED facial beauty light sold out within 20 seconds, generating a turnover of RMB 100 million.

Similarly, on Douyin, beauty devices maintained their popularity from the previous year, witnessing a remarkable 126% year-on-year increase in sales revenue and a 42% increase in sales volume.

Despite high anticipation, the event did set a new record. We have witnessed a significant shift from the wild and chaotic early days of e-commerce. After over a decade of rapid development, the online shopping festival in China has entered a phase of stable and consistent growth. We believe that consumers are becoming more inclined to utilize the savings they accumulated during the pandemic, even though the recovery may not have been as rapid as initially anticipated.

Key takeaways:

- Low prices will continue, even beyond the 618 festival, as consumer spending power recovers slowly and young consumers downgrade their consumption.

- Short videos and live streaming-oriented content commerce will dominate e-commerce growth in the foreseeable future, influencing user purchasing habits.

- The rapid development phase of e-commerce has faded, and we have now entered a period of maturity. It is more important to manage consumers well and focus on user retention.

- The pandemic has had a significant impact on consumer purchasing preferences and category preferences. Consumers now place greater emphasis on their personal health, mental well-being, and spiritual needs.

Want to expand to the Chinese market? Contact us for a first free consultation.