Top 10 e-commerce platforms in China

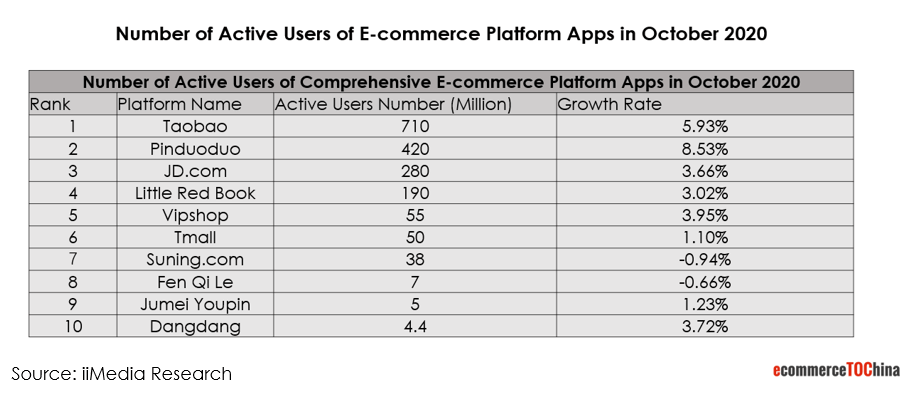

The above figures show the number of active users of corresponding e-commerce apps in China as of October 2020. It also shows the growth rate of the respective e-commerce transaction volume in the Chinese market.

This article will introduce you the top 10 Chinese e-commerce platforms based on the number of active users.

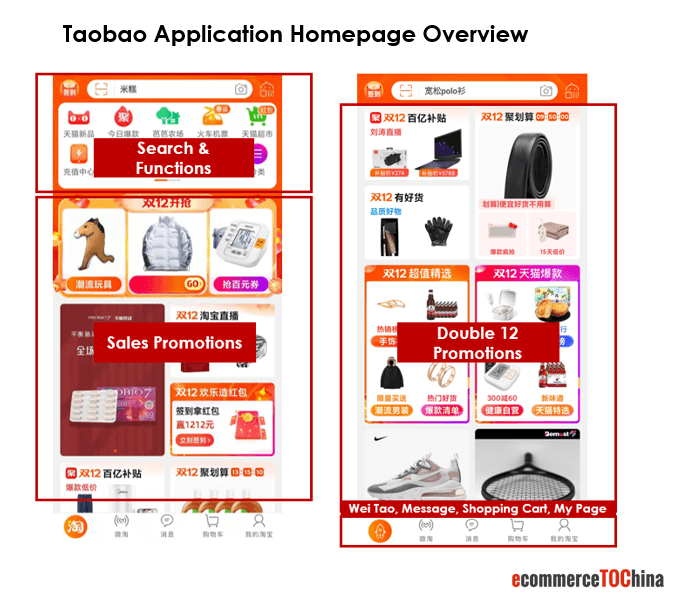

1. Taobao

Currently, Taobao is the largest e-commerce platform with the highest number of users in China. Taobao had 710 million monthly active users in October 2020. Taobao has an extremely high penetration rate of e-commerce in China’s internet user groups.

In terms of the users’ gender, Taobao’s popularity among male and female users is almost the same, with a female users’ rate of 50.72% and male users of 49.28%. Young consumers under the age of 24 make up a large proportion of users.

Purchasing behavior on Taobao is more moderate, as the process from selecting the product to making the purchase is slightly longer compared to other apps. This is due to the fact that Taobao draws its users’ attention to various products through diversified designs and promotions. With the result that consumers browse through many more products before concluding a purchase and possibly buy more.

In addition, Taobao Mall initiated the most influential e-commerce promotional event – Double Eleven shopping festival in 2009. This event was followed by other e-commerce platforms and has become the largest annual shopping festival in China and the whole world.

2. Pinduoduo

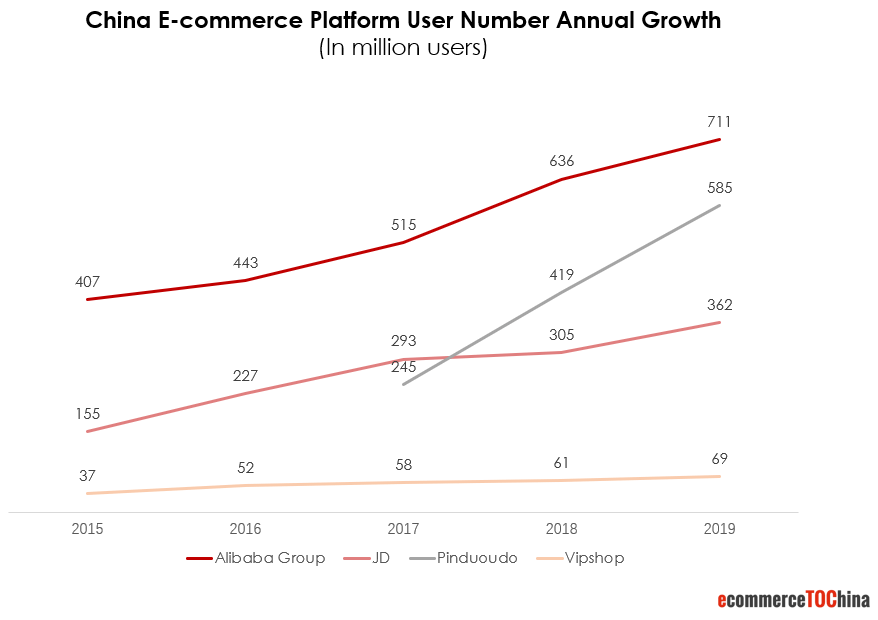

Pinduoduo was established in 2015. From 2017 to 2020, in just three years of development, Pinduoduo has become the second largest e-commerce platform in the Chinese market.

Shopping experiences on Pinduoduo and Tmall are very different from each other, Pinduoduo mainly focuses on social e-commerce. Unlike Taobao, purchase decisions are made immediately on Pinduoduo. This is due to the fact that the app does not offer a “shopping cart”, which means that purchases are completed directly.

To briefly introduce Pinduoduo’s business model: the initial stage is that users share product links with other people (usually through WeChat, China’s Super App, from which Pinduoduo get a lot of traffic). The more people click on this link, the lower the price will be for the initial sharing user. Regarding the gender distribution, the male and female user ratio is about 2:3. Users under the age of 35 account for the highest proportion, close to 70%.

If you want to know more about Pingduoduo, you can refer to eTOC another blog article: The fastest growing platform in China — Pingduoduo. You will learn the business model and success case about Pingduoduo in great detail.

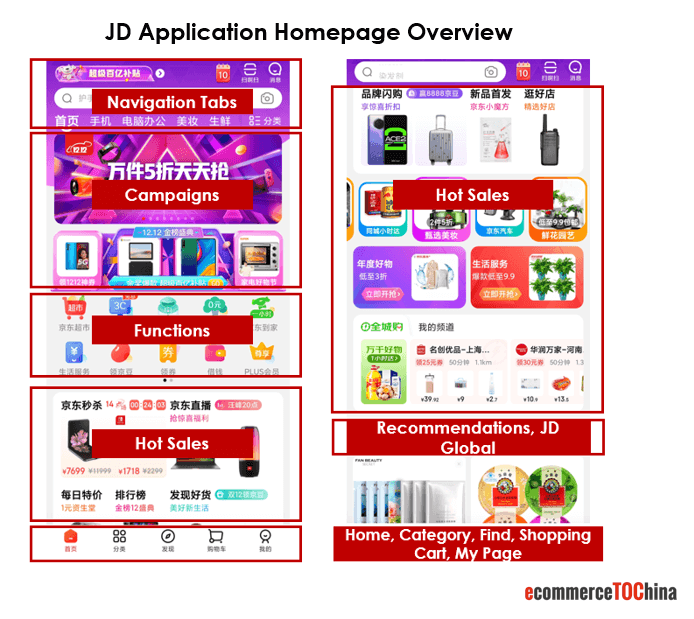

3. JD.com

JD is China’s third largest integrated e-commerce platform, with 260 million monthly active users. The biggest feature of JD.com itself is that the JD self-operated business account for more than 85% of JD.com’s annual transaction amount.

JD’s self-operated stores are under a supply agreement between JD.com and the brands. The brands are only responsible for supplying goods, the subsequent operations will be taken care of by JD.

At the same time, the most unique advantage of JD.com is that it has established its own logistics and transportation chain, which can achieve faster and controllable commodity transportation process.

JD’s overall user gender ratio is about 2:1 (men vs. women). Most users come from Tier 1 and Tier 2 cities. JD’s main consumer group spans the entire age group of 25 to 40. It can be seen that most of JD users are male, which is in line with the positioning of JD product category focuses (e.g. 3C electronics, appliances).

4. Little Red Book

Little Red Book is the most famous content sharing platform in China. It has also integrated e-commerce functions later on. Every user can browse for different kinds of products shared by other users. It mostly relies on user generated contents and has a strong “word of mouth” effect.

Little Red Book users are mainly young women. Therefore, the number of notes on categories such as beauty and personal care account for the majority. Nowadays little red book content seeding is considered as one of the must have social media marketing measures in China. The more contents are seeded, the better the sales conversion will normally be.

Little Red Book is not a traditional e-commerce platform. Along with the expansion of its scale and social influence, Little Red Book started its e-commerce business in 2017. Nowadays, brands can directly open a shop on Little Red Book. It has also built its own cross-border e-commerce platform.

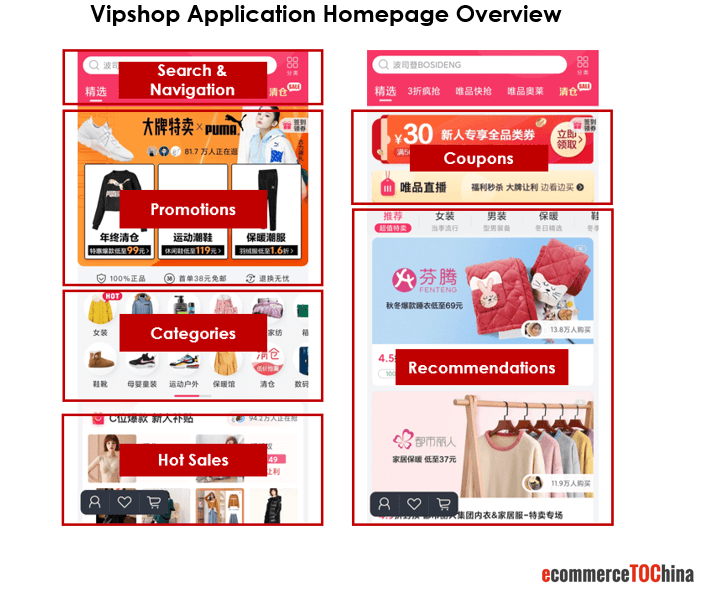

5. Vipshop

Vipshop is different from Taobao and JD in terms of operating model. The core of Vipshop’s operating model is “brand sale”. Vipshop will launch four special sales every week, each with 8-12 brands, and the sales time for each brand is generally about 3-5 days.

Therefore, for consumers, they can see a variety of special products of different brands on Vipshop every week, and enjoy much lower prices than other e-commerce platforms; at the same time, for Vipshop itself, this “zero inventory” sales model greatly reduces operating costs and can greatly increase profit margins.

The majority of Vipshop users are female, accounting for 63.84%, much higher than male users. In terms of age distribution, the largest proportion is the 26 to35 year-old group. This type of users have a higher acceptance towards new things. High quality brands and cost effective product offers are the key success factor of Vipshop’s “brand sale” business model.

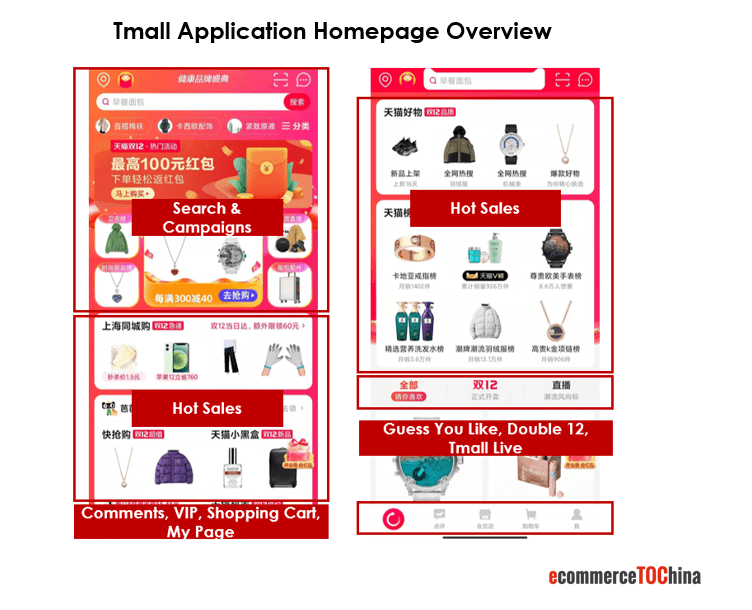

6. Tmall

Tmall is the B2C (Business-to-Consumer) platform, created by Alibaba based on Taobao (C2C). It integrates thousands of brands and manufacturers to provide a one-stop solution between merchants and consumers. Tmall provides 100% quality-guaranteed products, 7 days “no reasons needed” return policy, and many other high-quality services such as shopping points rebate.

As of 2019Q3, there are slightly more female users than male users on Tmall. Female users on Tmall accounted for 58.64% and male users accounted for 41.36%.

Because Taobao and Tmall both belong to the Alibaba Group, and users can search Tmall products on Taobao app and complete the entire online shopping process from order to delivery. Therefore, in many reports and analyses, Tmall and Taobao are regarded as the same platform.

For various brands that need to establish an authentic and credible brand image, entering Tmall will be a more reasonable choice than Taobao. This is why the brand flagship store type is only created for Tmall instead of Taobao for differentiaton.

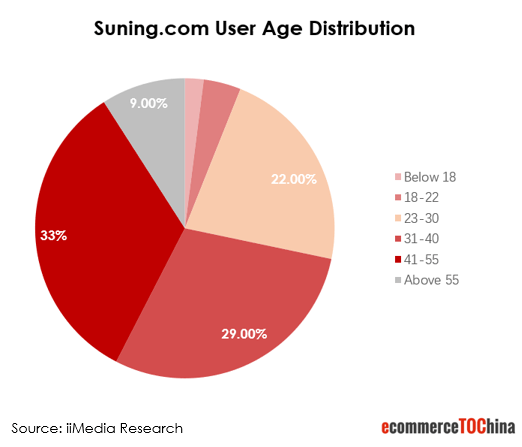

7. Suning.com

Suning.com is an O2O smart retailer under the Suning Holdings Group. Its online and offline businesses have developed simultaneously to achieve integrated online and offline (O2O) operations. It has gradually unified online and offline multi-channel, multi-format into the Internet retail “Suning.com”. Headquartered in Nanjing, Suning now covers traditional home appliances, 3C appliances, daily necessities and other categories. There are 38 million active users on the Suning app.

Suning Group is a leading retail giant with more than 13,000 offline stores of various types. With the Suning.com app, the offline business is to be expanded to gain online users as well. All products are officially operated by the Suning Group.

In addition to popular categories such as smartphones and 3C products, household appliances are also among Suning.com’s flagship products. Looking at Suning user age distribution, the group of 31- to 55-year-old group makes up more than 60%.

8. Fen Qi Le

Fen Qi Le is a domestic financial service platform that provides installment consumption for young people. The feature is that users can perform credit verification on the instalment app, and then obtain the installment loan line, so that they can purchase the products they need in the instalment store. The main user group of this installment app are young users under 30 years old.

Fen Qi Le products are less various, mainly for electronic products, sports, games, and other categories that young people like. At the same time, the platform also provides an interest-free cash instalment function of up to 2500 yuan in response to users’ urgent requirements for petty cash. This perfectly meets the shopping and cash withdrawal needs of students.

Many young people quickly gathered to shop in installments in the APP. There are 7 million monthly active users in October 2020.

9. Jumei Youpin

Jumei Youpin is China’s largest cosmetic E-Tailer, focusing on the vertical operation of the beauty category, and pioneered the “cosmetic group buying” model: a dozen popular cosmetics are recommended on the website every day and sold in limited quantities at attractive discounts and low prices; At the same time, “100% genuine” is promised. The main user group are young women, who are characterized by paying attention to cost-effectiveness, authenticity, and having strong brand awareness. The group-buying model can help consumers save money. Discounts and low-price limited sales can not only use the psychology of buyers, but also ensure the profits of websites and cosmetics sellers thanks to the increased number of buyers.

There are about 100 cooperative merchants in Jumei, including popular brands such as Xiangyi Materia Medica, as well as international well-known brands such as L’Oréal, Olay, Lancôme and Estée Lauder. From time-to-time Jumei Youpin organizes flash sales for cosmetic products and consumers are able to buy expensive top-line cosmetic products for a price up to 60% off.

10. Dangdang

Dangdang is a well-known e-tailer that has expanded from the original online book sales into other categories. Now, Dangdang offers its customers a dozen more categories such as audio-visual, beauty, home textiles, mother and child, clothing and even 3C.

But Dangdang’s main category is still books. In this category, Dangdang accounts for more than 50% of the online market share. Dangdang’s online children’s book market is also very competitive. However, the sales performance of other categories is rather at an average level. The number of monthly active users of Dangdang is about 4 million.

Discover the Future of Shopping with "Shopatainment – The Future of Shopping"

Our new book “Shopatainment – The Future of Shopping” explores how the innovative fusion of shopping and entertainment is revolutionizing the way we shop. Learn about the origins of this trend in China, the technologies and formats being used, and the opportunities and challenges it presents for the West.

Want to have a first free consultation session about China e-commerce and digital marketing? Contact us.