In the digital age, e-commerce has not only revolutionized the way we shop but also transformed global marketplaces. This shift is particularly pronounced in Southeast Asia, a vibrant and diverse region nestled between the Indian subcontinent and China. Emerging as a significant player in the global e-commerce landscape, Southeast Asia spans approximately 4.5 million square kilometers, representing a dynamic hub of economic and demographic activity. Home to 11 countries, including economic powerhouses like Singapore, Thailand, Vietnam, Indonesia, Philippines, and Malaysia, this region accounts for a substantial portion of Asia’s landmass and the world’s population.

With over 650 million residents, roughly half the size of China’s population, the ‘big 6’ of Southeast Asia — Singapore, Thailand, Vietnam, Indonesia, Philippines, and Malaysia — dominate in both demographic and economic terms. This article delves into the burgeoning e-commerce landscape of Southeast Asia, exploring its unique demographic characteristics, evolving market trends, key players, and the diverse challenges that are shaping this dynamic sector. From the bustling streets of Jakarta to the advanced digital storefronts in Singapore, we uncover the forces driving one of the world’s most vibrant online marketplaces, highlighting the region’s growing influence in the digital commerce arena.

Population Benefits

The region’s demographic landscape is particularly favorable for e-commerce growth. Over 650 million people, many of whom are young and part of an expanding middle class, present a vast consumer market with growing purchasing power. Two key factors underscore this potential:

- The Large and Rising Working-Age Population: Southeast Asia boasts a working-age (15-64 years) population exceeding 60%, surpassing Europe’s 45%. Notably, countries like Vietnam, Indonesia, Philippines, and Malaysia are ahead of this curve. The region is expected to add 23 million people to its working populace by 2030, contrasting with shrinking workforces in areas like Europe.

- Middle-Class Expansion and Urbanization: The middle class, almost doubling since 2012, is projected to reach 350 million by 2022. This surge, coupled with rapid urbanization – a projected increase from 49% to 56% urban population by 2030 – spells a significant shift in consumption patterns. This burgeoning middle class, increasingly affluent and lifestyle-conscious, is likely to drive demand for quality foreign brands and sustainable products.

The E-Commerce Boom: Accelerated by COVID-19

The COVID-19 pandemic has been a critical accelerator for the region’s e-commerce sector. Lockdowns and social distancing measures turned online shopping from a convenience into a necessity, propelling an already upward trend. From 2019 to 2022, the digital economy doubled, with e-commerce claiming a 63% market share across industries.

Market Variations and Future Growth

This growth, however, is not uniform across the region. According to Meta & Bain & Company, the Southeast Asian e-commerce market hit a remarkable $129 billion in Gross Merchandise Value (GMV) in 2022, with a strong outlook for sustained double-digit growth until 2027. Indonesia leads, comprising nearly half the region’s total e-commerce market. Thailand and Vietnam are also key players, with Thailand poised to become the second-largest market by 2025, expecting a 14% compound annual growth rate (CAGR), closely followed by Vietnam.

Even Singapore, the region’s wealthiest country, continues to enjoy robust e-commerce growth. This varied landscape highlights the unique opportunities and challenges within Southeast Asian e-commerce, underscoring the need for tailored approaches to tap into this burgeoning market.

Dynamic e-commerce landscape

In the rapidly evolving world of e-commerce, Southeast Asia stands out with its dynamic and diverse market. This region, already brimming with economic potential, is home to several key players that are reshaping the way consumers shop online. Let’s delve into the major forces driving this transformation.

- Dominance of Local Marketplaces

In Southeast Asia, local e-commerce companies like Shopee, Lazada, and Tokopedia are leading the online retail revolution. These platforms, similar to Amazon’s model, offer an array of products and have captured a significant portion of the market. In 2021, online retail sales in this region are forecast to reach $71 billion, a testament to their burgeoning presence.

- Shopee: The Reigning Champion

Shopee, the largest online marketplace in Southeast Asia, records a staggering 342 million monthly visits. Its extensive reach across the region and recent expansion into South America highlight its growing influence. With 27% of its traffic coming from Indonesia, Shopee’s success is built on:

- Leveraging resources from sister businesses in gaming (Garena) and online payments (Seamoney).

- A localized approach with seven independent apps catering to the nuances of different Southeast Asian countries.

- A mobile-first strategy, with 95% of orders placed via mobile devices.

- Strong branding strategies, utilizing celebrities and social media for user acquisition.

- Lazada: The B2C Giant

Backed by China’s Alibaba, Lazada mirrors the Tmall experience in Southeast Asia. Its 12-year history in the region and presence in six countries make it a formidable force. Lazada’s focus on B2C transactions, offering a one-stop-shop for over 32,000 brands, and leveraging Alibaba’s logistics and payment solutions, mark it as a key player in the region’s e-commerce scene.

- Tokopedia: Indonesia’s Top Platform

Tokopedia has risen to become Indonesia’s leading e-commerce platform in terms of Monthly Active Users (MAU). Its merger with Gojek has created a digital behemoth encompassing e-commerce, ride-hailing, and financial services. Tokopedia’s commitment to empowering local entrepreneurs and its “Smart logistic” system, covering 98% of Indonesia’s districts, underscore its market dominance.

- The Rise of Social Commerce

Social commerce is emerging as a significant trend in Southeast Asia. Countries like Thailand, Vietnam, and Indonesia are leading this charge, harnessing the power of social platforms to drive online sales.

Post-COVID E-Commerce Trends in Southeast Asia

The COVID-19 pandemic has irrevocably changed consumer behaviors and preferences. Key trends include:

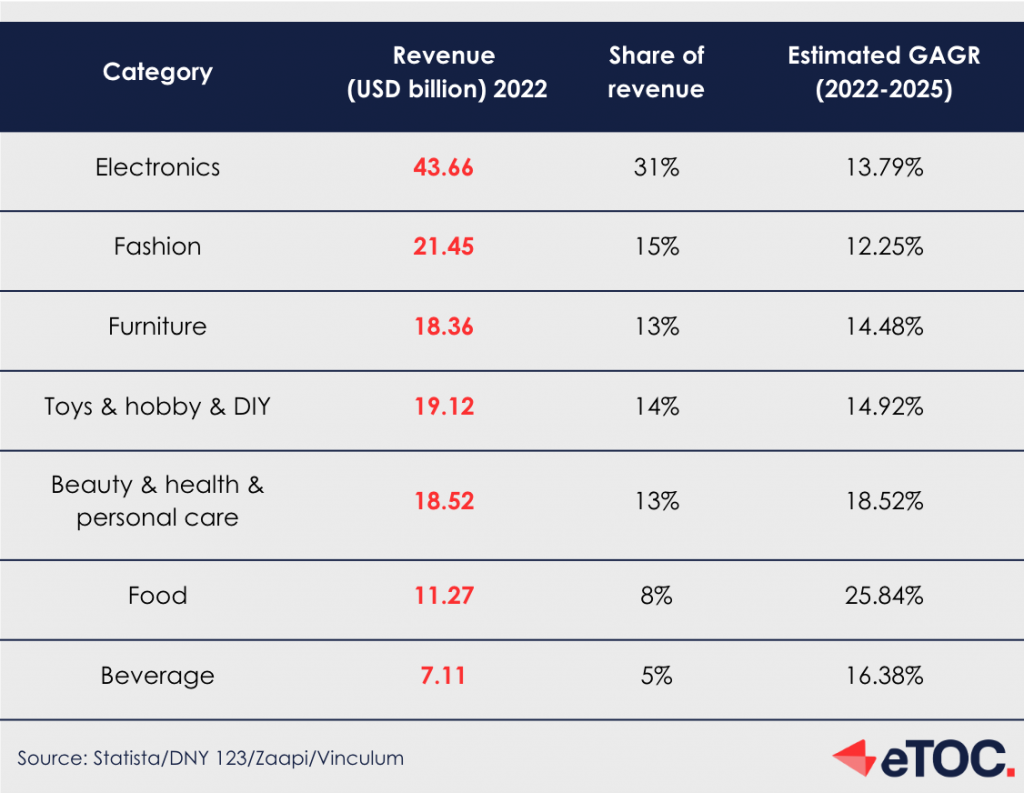

- Electronics: A prime category in e-commerce, with high demand for TVs, smartphones, laptops, and other digital devices.

- Fashion & Clothing: A highly competitive sector, especially among Southeast Asian women, with fashion and clothing purchases dominating online sales.

- Baby Care Products: Driven by a high birth rate, baby care items from diapers to toys are in high demand.

- Groceries (Food & Beverage): The pandemic has led to a surge in online grocery shopping, with significant growth potential for packaged and fresh groceries, as well as non-alcoholic drinks.

Challenges of Southeast Asia's E-Commerce Landscape

While Southeast Asia’s e-commerce sector is burgeoning, it’s not without its complexities. The region’s unique geographical, cultural, and economic characteristics present distinct challenges that need to be addressed for sustained growth. Here, we explore the primary obstacles and how businesses are adapting to these conditions.

- Geographical Challenges

Southeast Asia’s intricate geography, marked by islands, mountain ranges, and diverse terrains, poses significant logistical hurdles. Countries like Indonesia and the Philippines, with their numerous islands, face particularly daunting challenges in ensuring efficient last-mile delivery. To combat these issues, major e-commerce platforms are investing in building their own warehouses and developing logistics arms. Innovative distribution methods, such as click-and-collect, are increasingly popular to circumvent these geographical barriers.

- Varied Payment Landscapes

The region’s payment landscape is as diverse as its geography. While Singapore and Indonesia show a preference for credit/debit cards, Malaysia and Thailand lean towards bank transfers. Cash-on-delivery (COD) remains prevalent in Vietnam, Thailand, and Indonesia. This diversity in payment preferences, combined with the additional costs associated with COD, presents a unique challenge. However, mobile payments are on the rise, with local providers like Grab, Airpay, and Bukalapak leading the charge. Digital wallets are also gaining popularity, though in Singapore, credit cards still dominate the market.

- Cultural and Economic Diversity

Southeast Asia is a mosaic of cultures, languages, and religions. For instance, Indonesia alone has over 800 languages, while the Philippines and Malaysia have 187 and 137, respectively. The region is also home to over 350 ethnic minorities, each with its own traditions. In terms of religion, Buddhism is predominant in Thailand and Vietnam, Islam in Indonesia and Malaysia, and Catholicism in the Philippines.

This cultural diversity is mirrored in the region’s economic landscape. Singapore stands as a high-income developed country, while Malaysia and Thailand are in the middle-to-high income bracket. Indonesia, Vietnam, and the Philippines are comparatively lower-income areas. This variance not only affects consumer behavior but also demands a highly localized approach in terms of product assortment and customer service. A one-size-fits-all strategy is ineffective in this region, necessitating tailored approaches to cater to the diverse needs of each market.

Conclusion

In conclusion, Southeast Asia’s e-commerce sector is a vibrant tapestry of opportunities and challenges, reflecting the region’s diverse cultural, economic, and geographical landscape. As we have seen, this dynamic market is not just thriving but evolving, adapting to the needs of a growing middle class, navigating logistical complexities, and embracing technological advancements. The resilience and innovation shown by key players like Shopee, Lazada, and Tokopedia, coupled with the region’s robust digital infrastructure and changing consumer behaviors, paint a promising picture for the future of e-commerce in Southeast Asia. As the world becomes increasingly connected, the lessons and successes from this region offer valuable insights for the global e-commerce community. Southeast Asia is not just following global e-commerce trends; it is setting them, making it a region to watch in the coming years.

Download Our Comprehensive Southeast Asia E-Commerce Whitepaper

Dive deeper into the vibrant world of e-commerce in Southeast Asia with our detailed whitepaper.

This essential guide provides an in-depth overview of the e-commerce market, highlighting growth drivers, key landscape features, and effective market entry tactics. Uncover the unique challenges and opportunities in the region and gain valuable insights with our expert analysis. This whitepaper is an indispensable resource for businesses looking to thrive in Southeast Asia’s dynamic e-commerce environment. Download your free copy now and arm yourself with the knowledge to succeed in this exciting market.

Want to expand to the Southeast Asian market? Contact us for a first free consultation.