Coronavirus Industry Impact in China

Currently, we are experiencing a progressing shutdown in most European countries. At first the events and public activities, then sport facilities and companies encouraging home office, now most of offline retail stores and even restaurants.

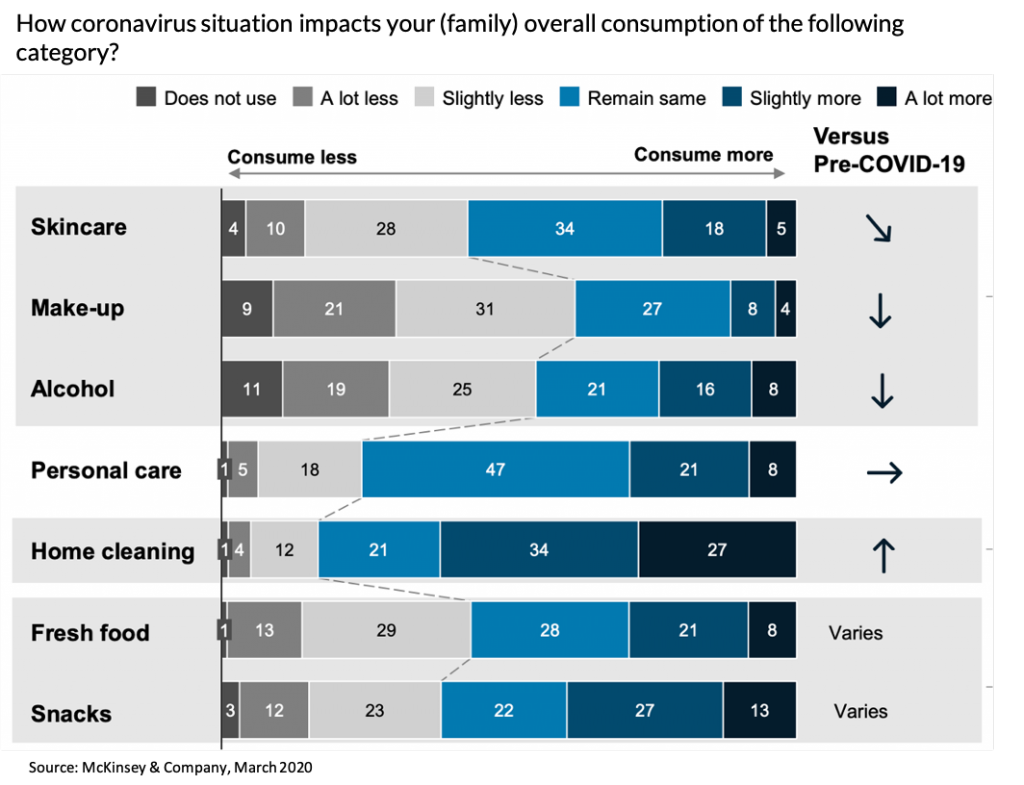

In the supermarkets, fresh food such as fruits and vegetables are quickly sold out. Disinfectants and hygiene products are becoming hot buzz everywhere. The videos go mostly viral are people fighting against each other for toilet papers.

Goldman Sachs revised the 2020 global GDP growth forecast to 1.25%—implying a recession less severe than in 1981-82 & 2008-09, but worse than in 1991 & 2001.

Since China has been going through this crisis since Nov. 2019 and seems to slowly recover from it. There are some interesting data we have gathered from credible sources such as McKinsey & Company and Alibaba Group to share with interested industry fellows in Europe.

1. The corona virus forced industry player to explore more potential online

2. Coronavirus industry impact varies

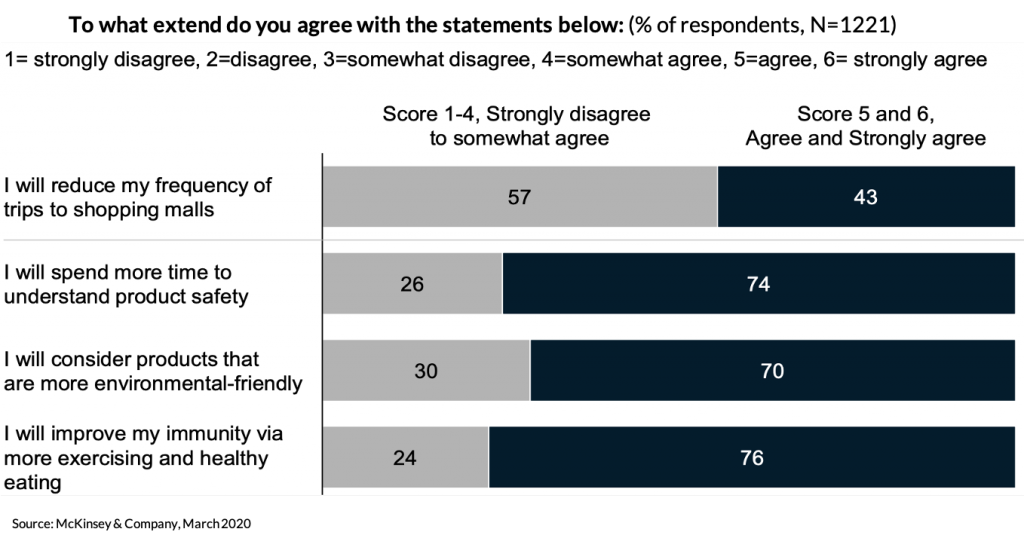

3. Chinese consumers are paying even more attention on product safety

4. Under quarantine, people in China turn to livestreams and brands shift marketing more to digital

Traffic to Alibaba’s Taobao Live streaming platform has been more than doubled in comparison to the same time in 2019.Among others, pets have become an obvious hit online, especially pet pigs, as “pig livestream” was one of the most popular search keywords in February 2020. JD also noticed a sales jump of pet products.

Both confirmed by McKinsey & Company and Alibaba Group, brands and retailers have shifted resources more to digital.

Nike launched livestreaming initiatives to provide exercising classes and created “at home sports” themes to engage with consumers.

Loreal Increased overall social spending and digital sales.

Mead Johnson created COVID-19 relevant branded assets to build emotional bonding (e.g. video of Mead Johnson CEO to customers).

Reported by Alibaba Group News Alizila, local cosmetics brand Forest Cabin temporarily closed about half of its 337 stores across China due to the virus. Sales had dropped 90% during the Spring Festival holiday, traditionally a peak season for shopping, confirmed by the brand founder. He also estimated a loss of up to RMB30 million ($4.26 million) a month and possible bankruptcy in under two months. But the brand embarked on a turnaround strategy with livestreaming. In just 15 days, Forest Cabin’s sales surpassed the same day last year by 45%.

5. Industry impact in Europe

Want to have a first free consultation session about selling and growing in China via e-commerce and digital marketing? Contact us.