China Market Entry Guide 2020: how to speed test your product potential in China

Today, internet has been well established and developed, no business is limited to its geographic regions. Information about your brand can be easily accessed by any consumer at the click of a mouse.

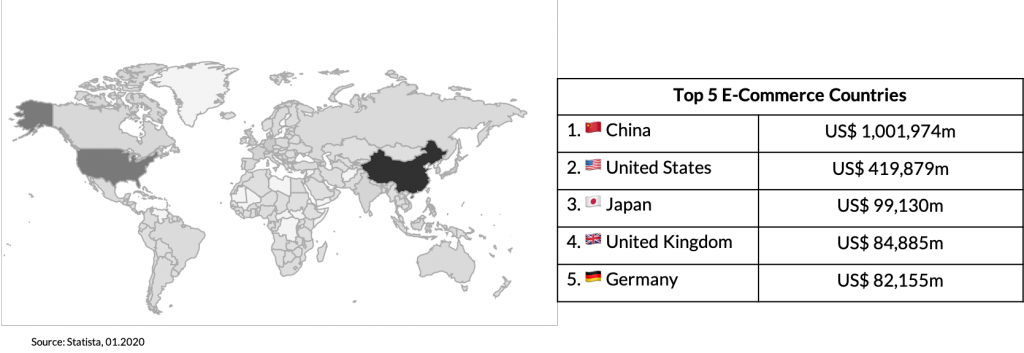

1. China is the biggest e-commerce country in the world

According to Statista latest figure about the global e-commerce market, China is the biggest e-commerce country and contributes to almost 45% of global e-commerce revenue.

With its sophisticated shoppers, massive volume of transactions, rapid rate of innovation, and integration of social media, multimedia, and other channels, China’s online environment offers a glimpse into the future.

Jack Ma, founder of Alibaba, once said: “In other countries e-commerce is a way to shop, in China it is a lifestyle.” E-commerce is indeed deeply involved in the Chinese people’s life. Alibaba Tmall alone has over 800 million active users.

2. What is cross border e-commerce?

One of the fastest growing subsectors of China’s e-commerce market is Cross Border E-Commerce.

Cross border e-commerce is a newly regulated business model from Chinese government that allows international companies to sell products directly to the Chinese consumers online, through authorized platforms at preferential duty rates and without a license to operate a business in China.

No Chinese legal entity, no product registration, no Chinese labeling needed. Overseas brands can also benefit from favorable policies such as fast lane customs clearances, lower tax rates and clustering of e-commerce logistics services.

The Chinese government has been promoting cross border e-commerce since 2012 by issuing favorable policies. There are some latest policies issued:

In August 2018, the 13th National People’s Congress passed three important bills about cross border e-commerce which were valid from 01.01.2019 on:

The state promotes the development of e-commerce, establishes and improves management systems for customs, taxation, import and export inspection and quarantine, payment and settlement.

On 17th of January 2020, the Chinese government announced that further 50 cities were newly opened for Cross Border E-Commerce.

3. How to sell to China via cross border e-commerce?

Cross border e-commerce sounds like a great opportunity to enter into the Chinese market, right? Well, it indeed is. So how exactly can overseas brands and retailers sell to China through cross border e-commerce?

First of all, of course you need to make your products accessible to Chinese consumers. There are several e-commerce marketplaces which were acknowledged as authorized platforms with already hundreds of millions of users. Therefore, get listed on those cross border e-commerce platforms is the first step to make the products available for the Chinese consumers.

The products can be imported on a per-order basis and shipped from overseas directly to the Chinese consumers. If the products are already stored in the connected bonded warehouse, the product delivery will be even easier and the consumers can receive the products within just 1 day. The payment will be received by overseas brands and retailers to their home country bank account and in local currency.

4. Why do Chinese consumers buy from cross border e-commerce?

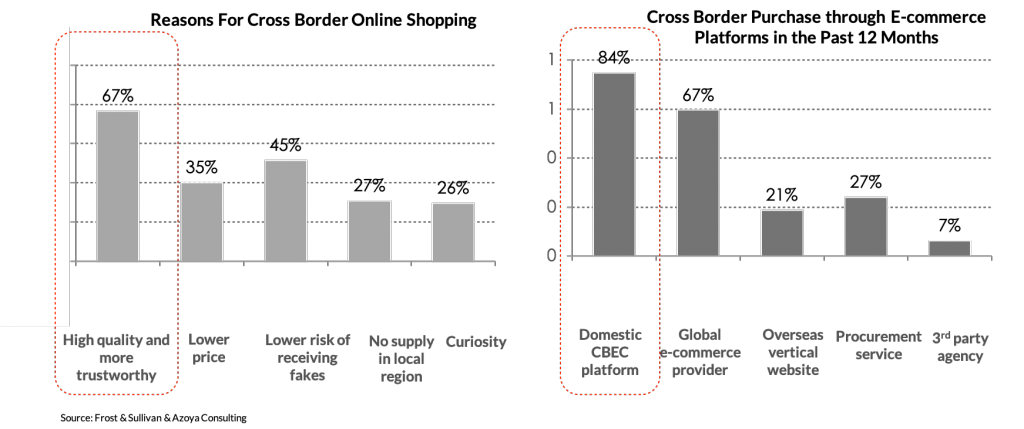

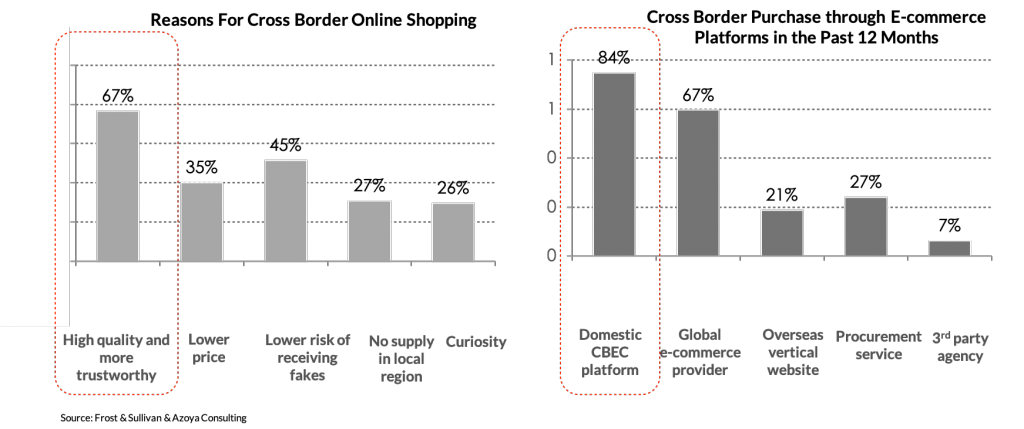

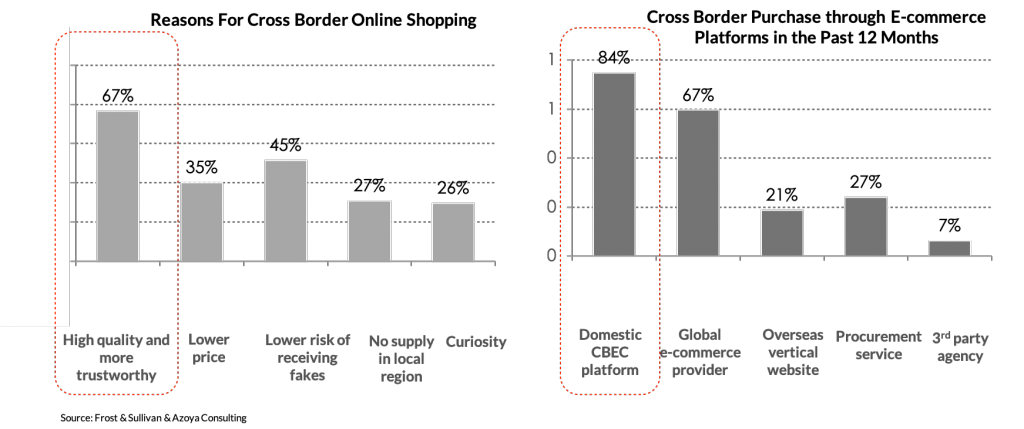

The pursuit of high-quality, reliable products is the main reason. 84% of respondents have in the past 12 months bought imports through cross border e-commerce platforms.

5. The major differences between traditional import export and cross border e-commerce

Cross border e-commerce is an attractive channel for foreign businesses to sell to China, as it allows them to access the world’s largest e-commerce market without the costs and commitment of establishing a formal presence there. This means overseas brands and retailers can access millions of Chinese consumers at a relatively low cost.

The traditional import export requires brands and retailers to have their products registered in China before. Depending on the categories, it takes from 6 to 36 months to go through the registration process. The costs are sometimes enormous too and can cost up to 250,000 RMB (>35,000 US$) pro product. This is one of the major reasons why small and middle-sized companies (SMEs) hesitating about selling their products to China. If the SMEs are not sure about the product popularity and if the investment can be paid back in a reasonable time, they are of course scared of investing the time and money for the product registration.

With cross border e-commerce, sell to China is becoming much cheaper and easier. Overseas products do not need to go through the expansive and long registration process anymore, they only need to be registered at the China customs, which takes about one week and cost nothing. The products don’t even need to be translated or labeled in Chinese. Furthermore, the taxes are much lower than the traditional import export too.

Cross Border E-Commerce therefore allows overseas brands and retailers to test the Chinese market while potentially making significant profits at the same time.

6. Top China cross border e-commerce channels

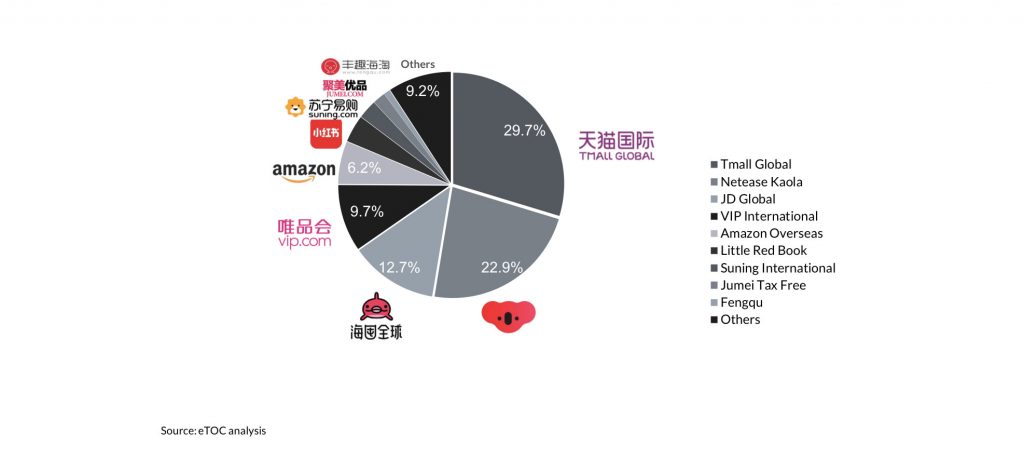

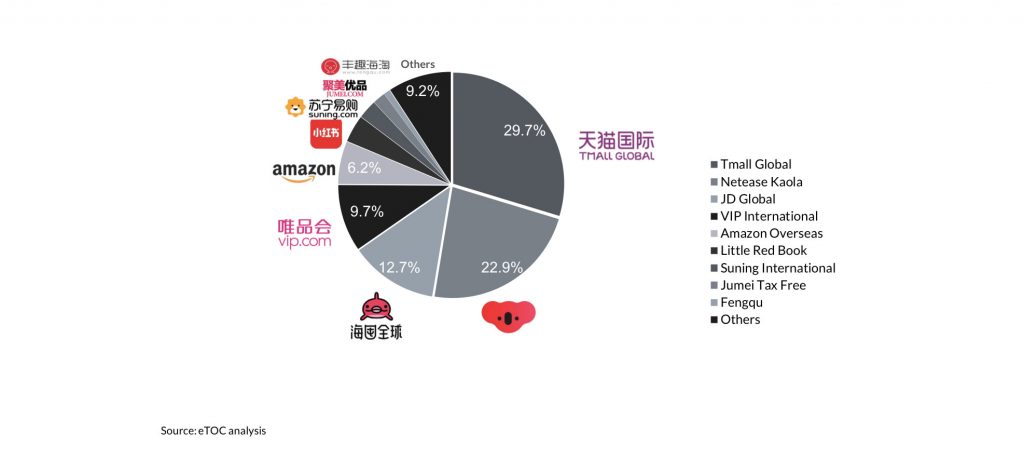

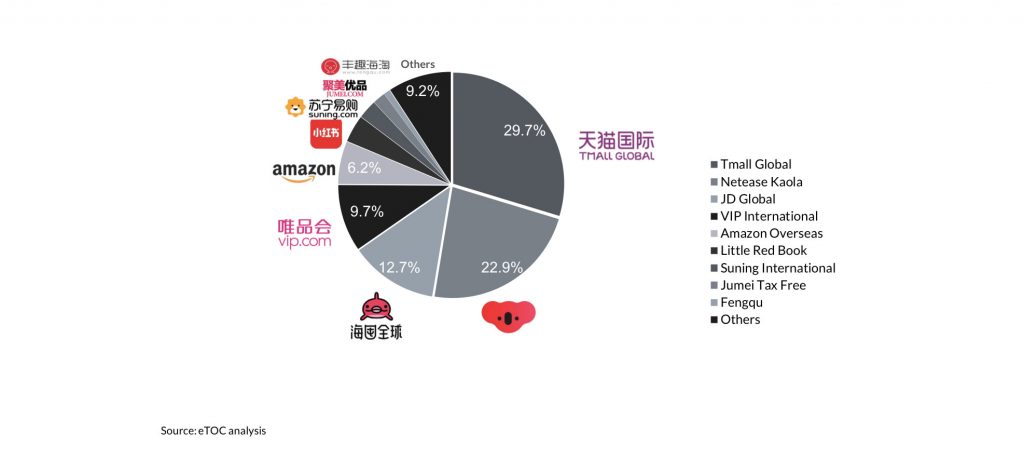

As mentioned before, overseas products need to be sold through authorized e-commerce platforms. There are several major cross border e-commerce platforms in China. Tmall Global and Kaola are the biggest domestic Cross Border E-Commerce platforms, contributing over 52.6% of market share by the end of 2018, followed by JD Global and VIP International. As we can tell from the pie graph below, Amazons Overseas is not as successful in China as in the western world, surrounded by the local competitors.

Certainly, companies do not have to limit to one platform. In fact, most companies pursue a multi-channel strategy. In this case, companies should consider how the different platforms fit into their overall e-commerce roadmaps along with the market entry strategy.

7. China market entry challenges for SMEs

Apart from the obvious language and cultural barriers, there are some other challenges overseas brands and retailers have to confront with. Swimming in the deep ocean of tremendous amount of unfiltered information about the Chinese market, SMEs with limited market knowledge often feel very lost.

Unlike Amazon where single products can be uploaded to the marketplace for sell, brands and retailers need to either open a flagship store on e-commerce marketplaces to list their own products or sell through other distributor retail shops. The preparation time to open a flagship store usually takes 6 to 12 months. The investment is not as small as one might think, since you normally have to assign a shop operation partner, known as TP, to run your store. They often charge a fix fee (about 100,000 -150,000 US$ per year) in addition to a sales commission (5%-10%).

The same cost challenge also applies for distributors, who often ask for lower than 30% of the retail price as their buy-in price. A large percentage of profit margin is cut.

Some overseas brands and retailers are successful with their web shops. However, the situation is quite different in China. A standalone web shop might be appealing for many international businesses at first glance, since it appears to be the most convenient and cost-effective way. However, these web shops often suffer from low traffic and cannot reach high awareness and popularity without enormous marketing investment.

As a new brand in China with a low brand awareness and no product expose, it’s also difficult to achieve an equal partnership with the distributors and marketplaces, not to mentioned to gain enough priority from them.

If the brand only provides a small assortment, it might be difficult to fill a flagship store and the cost effectiveness of their investment is even lower.

Nevertheless, there are a lot of SMEs which are industry experts specialized in certain areas and produce excellent products. Even if they only provide a small portfolio of products, the single products can be very attractive for the Chinese consumers and yield great sales results in the market. There are many of those success cases. The water filter brand Brita is becoming almost as popular in China as in their home market Germany. Even the biggest German drug store chain dm has achieved enormous success with their private label brand balea.

Naturally, here comes the interesting question from SMEs: how can I find out if my products have potential in the Chinese market?

8. How to find out if your products have potential in the Chinese market?

In the age of big data, facing and servicing the consumer upfront means getting direct feedbacks from consumers. Overseas brands and retailers need to test their products in the Chinese market and get real market feedback if they want to find out if the products really have good sales potential. With the real sales data, marketing data and consumers feedback, brands can accurately estimate their future sales potentials, adapt their product choices and corresponding positioning, as well as make safer decision for the next bigger market expansion move.

9. How to test the product potential in the Chinese market at an affordable price?

Market test with real market and consumer feedback sounds great. However,

as explained before, SMEs often complain about the high market entry costs, long “go to market” time and missing knowhow of how this whole process works.

One very good solution is having the products listed in an existing retail shop on those e-commerce platforms. There are a lot of retail shops opened on the platform such as Tmall Global and allowed to sell different brands and products. Find one of these retailer shop owners who are willing to list and sell your products.

For example, eTOC (that´s us!) offers overseas brands and retailers a “one stop market test” solution to list their products on eTOC Tmall global retail shops. Except a small handling fee, the major costs of shop opening and operation, sales commissions as well as margin loss, are saved.

With the listing done, the products are directly accessible by over 800 million Chinese consumers.

The second step is of course to carry out some marketing activities to promote your product sales.

10. How to promote your products and push the sales?

Marketing and sales work hand in hand. Without effective marketing measures, products can hardly be found by the consumers.

Content seeding is a popular and effective marketing measure worldwide, especially in China. It becomes one of the musts in brands´ todo list to seed brand relevant content on China´s largest “word of mouth” platform Little Red Book (known in Chinese as “Xiaohongshu”). Consumers love to search for relevant information about the brands and products, share their user experiences and look for recommendations on Little Red Book.

TikTok (in Chinese known as Douyin) is getting more and more popular all over the world. It can help brands or products go viral in a short period of time. If you can produce interesting and engaging content for your products, TikTok is also a good marketing tool to use.

Taobao Live Streaming is positioned as the e-commerce live-streaming shopping platform leveraging Key Opinion Leaders (KOLs) product recommendations. Similar to TV shopping, consumers can watch the anchor’s presentation and buy products at the same time.

In recent years, Taobao Live Streaming is becoming one of the most effective sales driven brand activation tools. In 2018, Taobao Live Streaming achieved over 100 billion RMB sales. The store visit conversion is extremely high with over 65% consumers visiting the corresponding stores after watching the live streaming.

During the Covid-19 outbreak in China, traffic to Alibaba’s Taobao Live streaming platform has been more than doubled in comparison to the same time in 2019.

The above mentioned are the most effective must-have brand marketing measures in China, but the list goes on and on. Additionally, not only brand marketing needs to be conducted, performance marketing is sometimes even more effective in terms of sales conversion. A good marketing strategy needs to cover both.

To facilitate overseas brands and retailers to fully carry out their product marketing test, eTOC has designed a corresponding marketing package, covering both the necessary and most effective brand marketing and performance marketing measures.

11. Conclusion

With the right marketing measures, the market test is ready to be started. It recommended to carry out the market test for 6-12 months to gather enough sales and marketing data and generate useful results.

It´s also very important for the overseas brands and retailers to continuously track the data and make good use of those valuable data. To actively grow and develop a healthy business in China, you need abundant statistics and figures to closely monitor and control your business, understand your competitors and target consumers, adjust your strategies accordingly as well as make accurate decision for the next bigger steps.

Want to have a first free consultation session about sell to China via e-commerce? Contact us.