Because of the decline in marriage rates and the increase in the aging trend, the companionship of pets is becoming more important for many people living alone nowadays in cities.

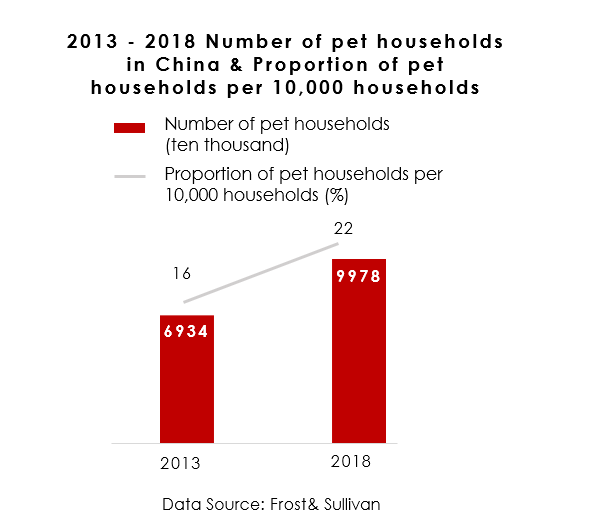

Following this psychological demand, keeping pets has increasingly evolve into a mainstream life choice in cities. According to the 2018 China Pet Industry Report, from 2013 to 2018, the number of pet households increased from 69 million to 99 million, in five year-on-year growth of 43.9%. And because of the popularity of pet videos on short video platforms e.g. Douyin (also known as Tiktok), potential pet users are also expanding.

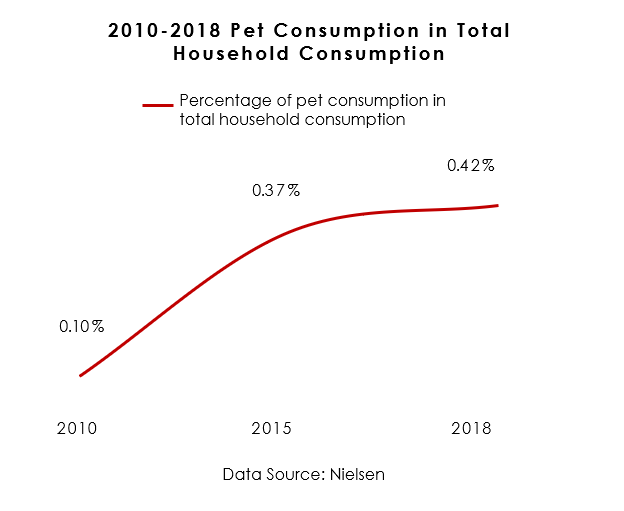

At the same time, due to the rapid development of the national economy and urbanization, the income of urban residents has thereby increased rapidly, so, pet owners are willing and is possible to spend more and more on their pets.

Following this psychological demand, keeping pets has increasingly evolve into a mainstream life choice in cities. According to the 2018 China Pet Industry Report, from 2013 to 2018, the number of pet households increased from 69 million to 99 million, in five year-on-year growth of 43.9%. And because of the popularity of pet videos on short video platforms e.g. Douyin (also known as Tiktok), potential pet users are also expanding.

At the same time, due to the rapid development of the national economy and urbanization, the income of urban residents has thereby increased rapidly, so, pet owners are willing and is possible to spend more and more on their pets.

1. Petcare Market Preview

1.1 Petcare Market Development History in China

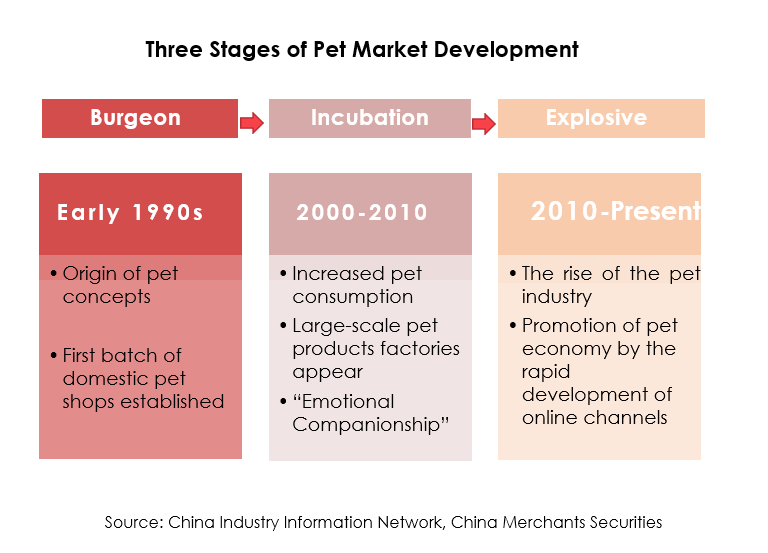

Keeping a pet has been a long tradition in Chinese history, but modernized market didn’t thrive until 1990s. And since then, Chinese pet-related product market has endured three phrases of development.

From the beginning of 1990s, the thought of keeping a pet has been introduced into many people’s life, and followed by this trend, the first batch of offline pet product stores began to appear and drove the growth of pet-related economy. In this decade, China’s pet economy has therefore entered a period of burgeoning, while the pet product market has begun its development.

Coming into the next decade, the 2000s, pet market has entered its incubation period. Pets has turned into “emotional companionship” and have begun to be regarded as members of the family for the pet owners. The increase in consumption of pet products caused by this mental shift has promoted the expansion of domestic pet commodity production in large-scale factories in China as well.

With the advent of the 2010s, China’s pet industry has entered an explosive period, with the pet-related product market also entered a period of rapid development. People who choose to keep pets are no longer a minority in the city, and the consumption scale of the pet-related product market has also grown tremendously along with the number of pet-keeping households.

From the beginning of 1990s, the thought of keeping a pet has been introduced into many people’s life, and followed by this trend, the first batch of offline pet product stores began to appear and drove the growth of pet-related economy. In this decade, China’s pet economy has therefore entered a period of burgeoning, while the pet product market has begun its development.

Coming into the next decade, the 2000s, pet market has entered its incubation period. Pets has turned into “emotional companionship” and have begun to be regarded as members of the family for the pet owners. The increase in consumption of pet products caused by this mental shift has promoted the expansion of domestic pet commodity production in large-scale factories in China as well.

With the advent of the 2010s, China’s pet industry has entered an explosive period, with the pet-related product market also entered a period of rapid development. People who choose to keep pets are no longer a minority in the city, and the consumption scale of the pet-related product market has also grown tremendously along with the number of pet-keeping households.

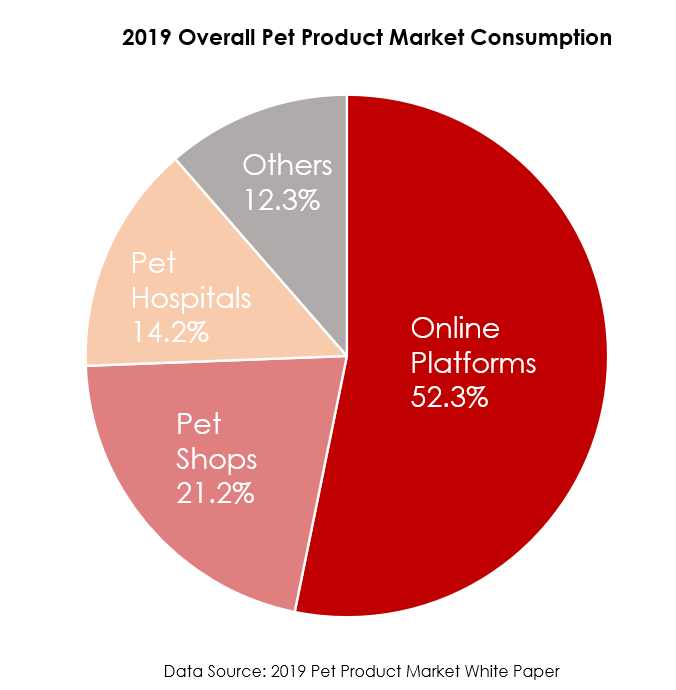

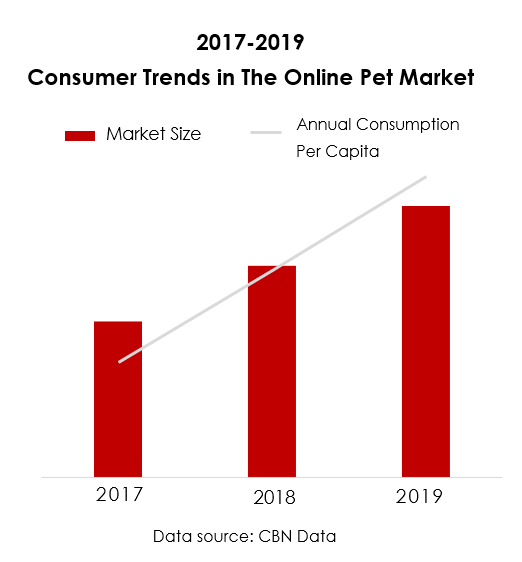

The most obvious feature of this stage is the explosion of online pet products consumption, with today’s online pet product consumer market has far exceeded the scale of offline consumption.

1.2 Online Pet Products Consumer Market in China

According to the 2018 Pet White Paper report, 89% of pet owners have purchased pet products online before, e-commerce platforms provide Chinese pet owners with more convenient purchase channels and more diverse choices than offline stores. Therefore, the consumption amount of online pet market is increasing rapidly.

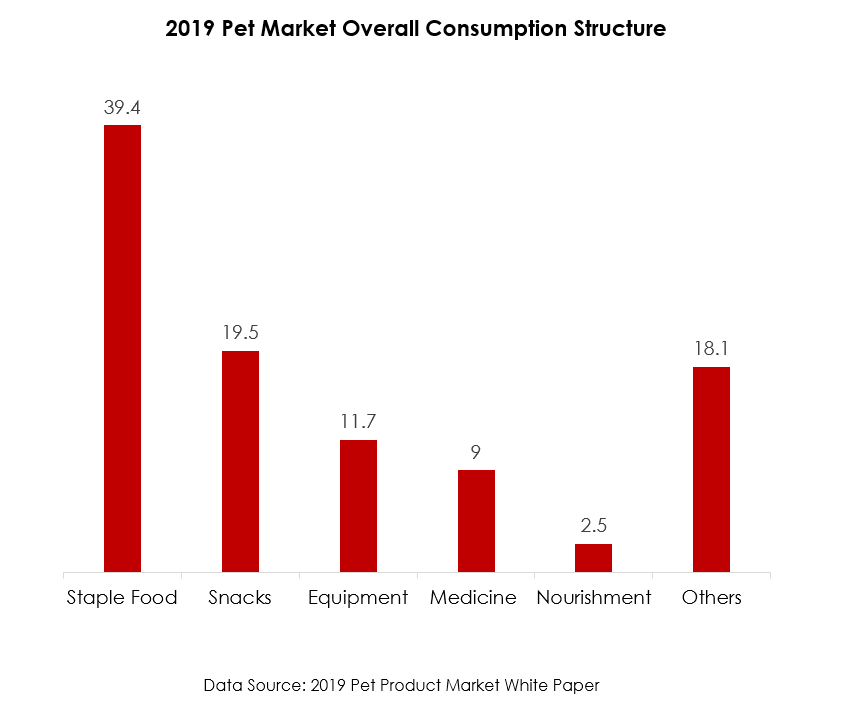

The main categories occupying the pet product consumer market are staple food, snacks, and pet-related equipment, taking over the market share over 70% in combination. These products are suitable for transportation, convenient for storage management, and easy to purchase online.

1.3 Portraits of Major Patcare Product Chinese Consumers

To gain a deeper understanding for online pet-product market, an introduction to the portraits for major consumers can be helpful.

From the perspective of online shopping consumers by region, because the amount of online consumption of pet-raising people living in rural areas is too small, almost all online consumption is from urban pet-raising people. Among them, first-tier cities have the strongest consumption amount.

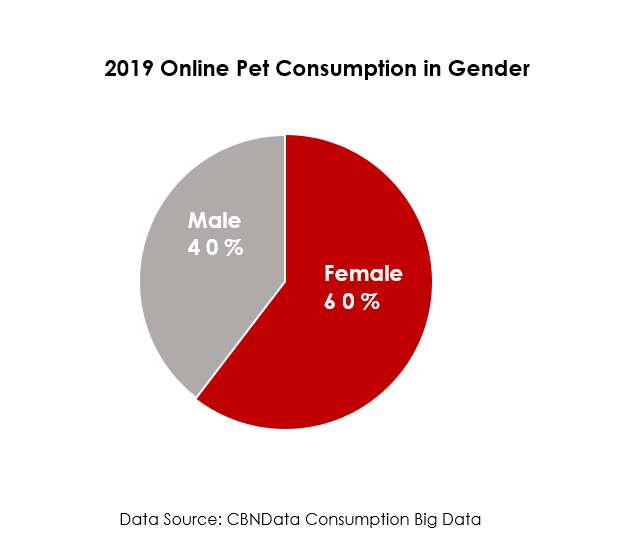

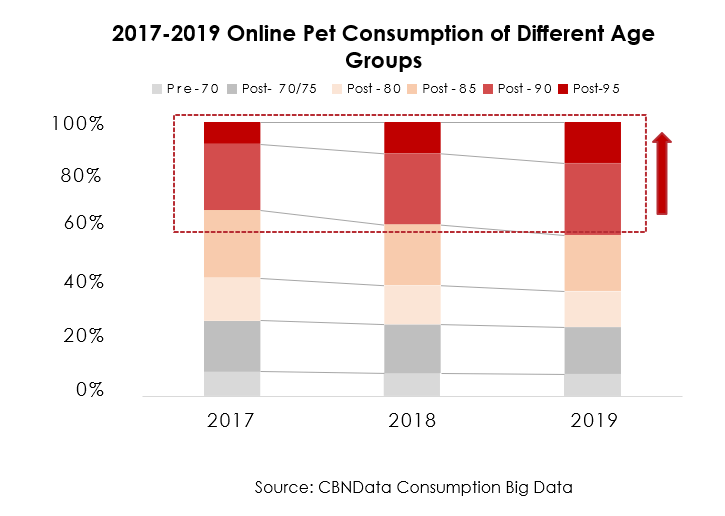

For consumers buying pet products online in gender differences, female costumers contribute up to 60% consumption amount, while male costumers contribute the rest 40%. At the same time, in terms of age, young consumers (post-90s/95s) have the largest consumption share of all age groups, which also exceeds 40%. This proportional distribution synchronizes with the distribution of online shopping consumers, in which female consumers and the younger 90/95 generation is also the majority. It is worth noting that the population of pet owners who shop online can also represent the gender and age ratio of the pet population. This may be related to the rapid development of online e-commerce, while offline stores have yet to mature and improve themselves.

From the perspective of online shopping consumers by region, because the amount of online consumption of pet-raising people living in rural areas is too small, almost all online consumption is from urban pet-raising people. Among them, first-tier cities have the strongest consumption amount.

For consumers buying pet products online in gender differences, female costumers contribute up to 60% consumption amount, while male costumers contribute the rest 40%. At the same time, in terms of age, young consumers (post-90s/95s) have the largest consumption share of all age groups, which also exceeds 40%. This proportional distribution synchronizes with the distribution of online shopping consumers, in which female consumers and the younger 90/95 generation is also the majority. It is worth noting that the population of pet owners who shop online can also represent the gender and age ratio of the pet population. This may be related to the rapid development of online e-commerce, while offline stores have yet to mature and improve themselves.

2. Food-related Petcare Product Consumption in China

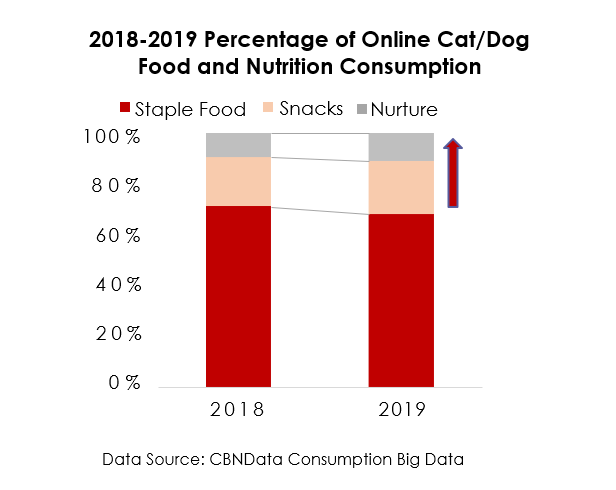

According to the 2019 pet industry white paper report, pet food is the category with the largest share in the entire pet supplies market, among which staple foods, snacks, and nutritional products are the three categories with the largest consumption share. As urban residents are willing to invest more of their consumption share in pet food, young consumers’ requirements for pet health, and their willingness to adopt new products, the demand for pet food is also undergoing consumption upgrades, and the market has some new trends.

2.1 Refined Demand for Pet Staple Food in China

As pet owners pay more attention to the nutrition of pet food, the selection and purchase of pet staple food has also become refined.

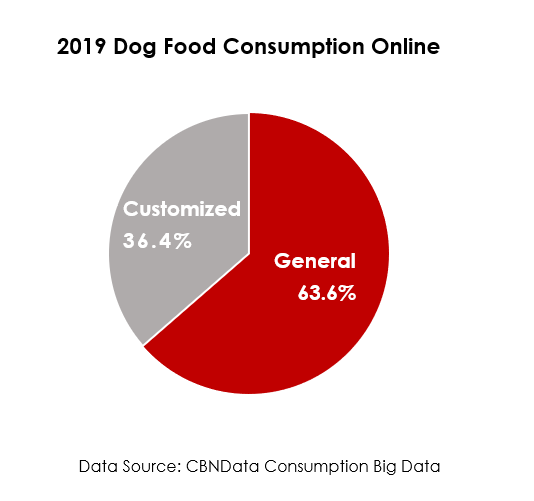

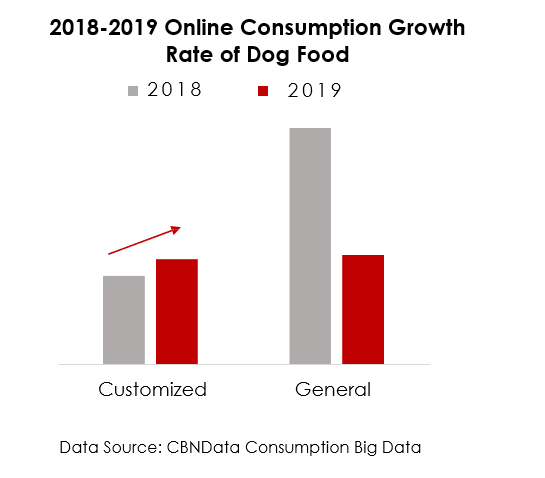

Taking dog food as an example, according to the data in 2019, the consumption of customized dog food in the staple food market has reached 36.4%, and compared with 2018, the consumption growth rate of customized dog food in 2019 also improved a lot. In contrast, the consumption growth rate of general-purpose dog food in 2019 was much lower than in 2018. This shows that pet owners are more inclined to choose staple foods with more flavors and a more suitable nutritional ratio for their pets.

2.2 The Consumption Overview of Pet Nutrition Products

Compared with the staple pet food, the trend of pet consumption upgrade is more obvious in the pet nutrition category. From 2017 to 2019, the growth rate of online cat and dog nutrition products is very impressive. Within three years, its market size and number of consumers have at least doubled. In addition, the consumption of pet nutrition relative to the staple food of cats and dogs has gradually expanded also, indicating the huge potential of the pet nutrition market.

In addition to commonly used and very popular pet nutrition products such as vitamins, probiotics, and calcium tablets, customized pet nutrition products are also becoming trendy.

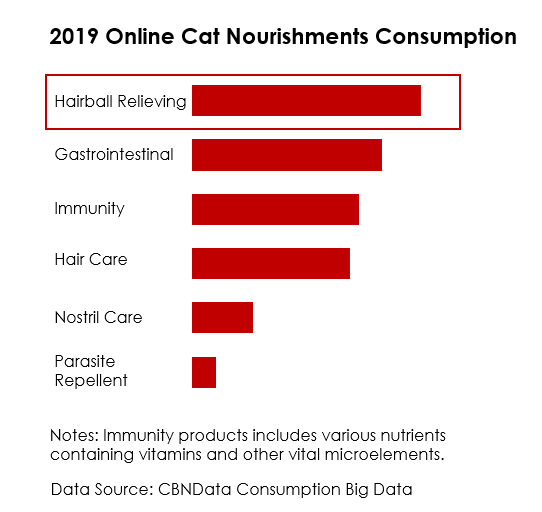

Varied by the type of pets, the efficacy of the top products that account for a relatively high consumption of cat and dog nutritional products is not consistent. Regarding cat nutrition, the product with the highest consumption ratio is the hairball relieving products, which is related to the licking habit of cats. In addition, because most cat pets have a weaker gastrointestinal condition, gastrointestinal conditioning nutrients account for the second place in the consumption of cat functional nutrients.

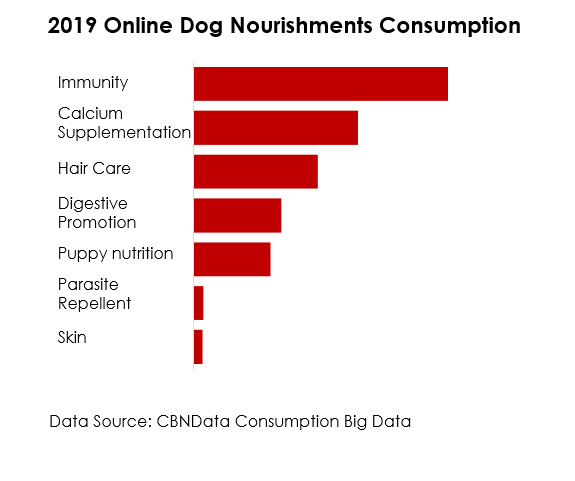

From the perspective of dog nutrition, pet owners prefer basic immunity and calcium supplements in product selection. In addition, hair care nutrition is used in the consumption of both cats and dogs. Their proportions are relatively high, also indicating that pet owners are very concerned about the appearance of their pets.

Varied by the type of pets, the efficacy of the top products that account for a relatively high consumption of cat and dog nutritional products is not consistent. Regarding cat nutrition, the product with the highest consumption ratio is the hairball relieving products, which is related to the licking habit of cats. In addition, because most cat pets have a weaker gastrointestinal condition, gastrointestinal conditioning nutrients account for the second place in the consumption of cat functional nutrients.

From the perspective of dog nutrition, pet owners prefer basic immunity and calcium supplements in product selection. In addition, hair care nutrition is used in the consumption of both cats and dogs. Their proportions are relatively high, also indicating that pet owners are very concerned about the appearance of their pets.

3. Conclusion

After more than ten years of development, pet related markets, which are still expected to grow rapidly in the future, will also have many changes within the market: the most noticeable one is the upgrading trend of pet products market consumption.

Stimulated by new e-commerce promotions, such as live streaming, short videos, and the attitude change of pet owners to see pets as companionship, new demands and new consumption methods are constantly generated.

The customization and categorization of the staple food market; the refinement and functionalization of the nutritional product market have brought many challenges to various brands in the market. Brands need to seize the new market trends, capture to the new preferences of consumers, and mature its own product operations, scientific products, etc., in order to obtain the expansion of its own sales performance and earn brand benefits.

Stimulated by new e-commerce promotions, such as live streaming, short videos, and the attitude change of pet owners to see pets as companionship, new demands and new consumption methods are constantly generated.

The customization and categorization of the staple food market; the refinement and functionalization of the nutritional product market have brought many challenges to various brands in the market. Brands need to seize the new market trends, capture to the new preferences of consumers, and mature its own product operations, scientific products, etc., in order to obtain the expansion of its own sales performance and earn brand benefits.

Want to have a first free consultation session about selling and growing in China via e-commerce? Contact us.