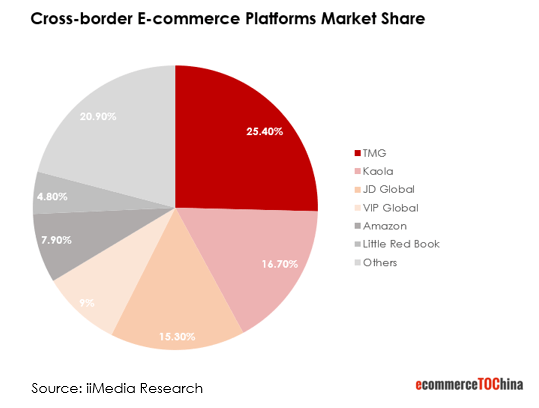

Top 5 cross-border E-Commerce platforms in China

China’s cross-border e-commerce market has achieved great development in recent years. According to iiMedia Research, China’s cross-border e-commerce users have reached 150 million. This article will introduce China’s top five cross-border e-commerce platforms measured by sales.

The top 5 platforms are: Tmall Global, Kaola, JD Global, Vipshop Global, and Amazon

1. Tmall Global

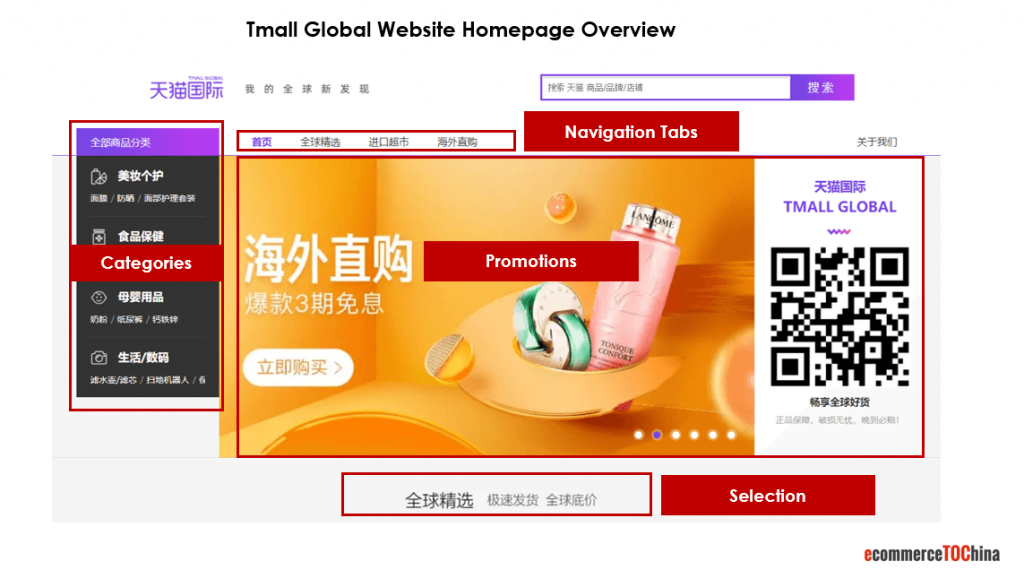

Tmall Global is currently China’s largest cross-border e-commerce platform owned by the Alibaba Group. Same as Tmall, Tmall Global acts as a marketplace model that supplies domestic consumers with imported products from overseas. At the same time, it also helps overseas brands to reach Chinese consumers directly through their own online stores. Tmall Global is the platform of choice for building brand awareness and gathering consumer insights.

Tmall Global was officially launched in 2014. Merchants stationed in Tmall Global are all corporate entities outside of mainland China and have overseas retail qualifications. All the goods sold are officially entered the international logistics through the Chinese customs.

All merchants stationed in Tmall Global will be equipped with Chinese-language shopping experience for their stores and provide domestic after-sales service. Consumers can use Alipay to pay for their purchases. In terms of logistics, Tmall Global requires merchants to complete delivery within 120 hours and arrive within 14 working days and to ensure that logistics information can be tracked throughout the process.

Young consumers aged 20-30 are the main consumers of Tmall Global. They appreciate the diverse range of categories and value high quality products.

(If you’re interested in opening a Tmall flagship store, check out our full guide on how to open a Tmall flagship store).

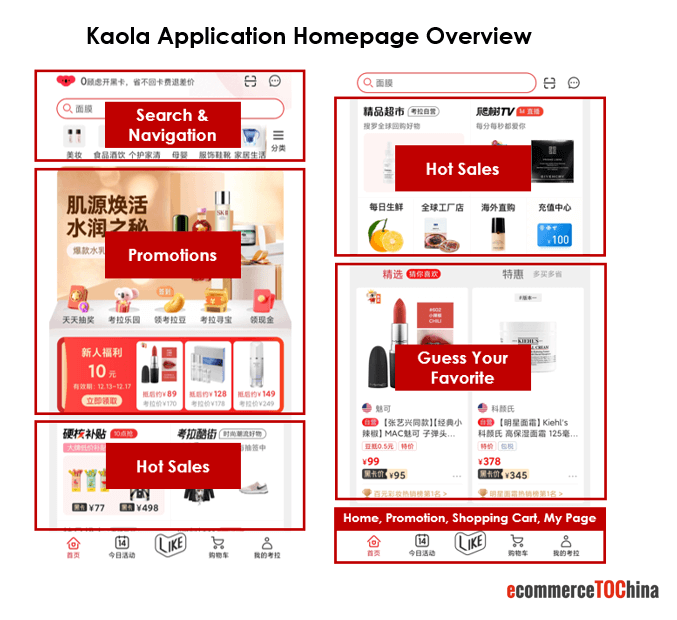

2. Kaola

Kaola is the 2nd largest cross-border e-commerce platform in China. Alibaba acquired Kaola from NetEase Group in 2019 and included it into its own cross border business territory.

Kaola users are mainly women aged 20-40 white-collar workers and urban mothers. Therefore, Kaola is very competitive in categories such as beauty, personal care, and mothers and babies.

Kaola uses a “self-operating + self-sourcing” method to sell products on the platform as the main business model. This means that the products on the Kaola platform are mostly under Kaola’s own operation. Brands do not participate in the specific operation in the Kaola self-operated stores. However, to meet the need of brand owners to have their own stores on the platform, Kaola has extended its business model to the marketplace. But the business scale is still small.

All products in the stores are directly supplied from the brand, which has signed a wholesale or consignment contract with Kaola.

3. JD Global

JD Global started its business in 2015. It sells multiple categories of imported products. Wholesale & self-operation models are the main business model of JD Global. The platform promises to sell 100% overseas original authentic products and provide “genuine guarantee service”. Once global providers are found to sell fake and non-original products, JD Global has the right to immediately terminate the agreement with the merchant and compensate the buyers. Its products are shipped from overseas or bonded warehouses as the standard cross border logistic solutions, similar to other platforms.

At the same time, to provide more shopping choices, JD global acts as marketplace to embrace brands and retailers setting up their own cross border shops in the platform. This has already been benefiting world-renowned brands such as Walmart and Rakuten.

JD’s guarantee for logistics is also reflected in JD’s Global shopping experience. JD.com cooperates with DHL Group to hand over the cross-border transportation part to DHL express. JD Global themself is responsible for the direct-to-consumer delivery process to ensure that consumers won’t have any bad experience due to logistics, as logistics has always been a unique advantage of JD.com.

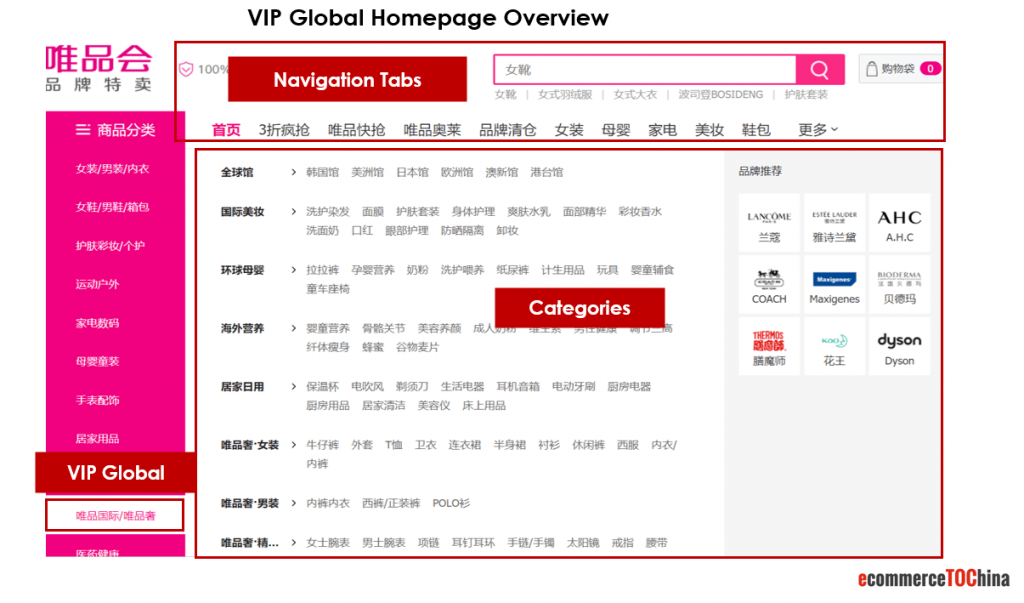

4. Vipshop Global

Vipshop Global is a cross border shopping business under Vipshop. Vipshop known as an online discount & flash sale retailer for brands started from 2008. Fashion and cosmetics are the major business focus. Vipshop Global works with the same business model as Vipshop.com, which is famous for its discount and flash sale model. Platform directly sign contracts with foreign suppliers under wholesale or consignment.

Vipshop Global business is been depriotized recently as no independent entrance from the Vipshop platform homepage anymore.

5. Amazon

Amazon, as one of the world’s largest e-commerce platforms, has not achieved corresponding success in the Chinese market. However, the newly opened overseas business, which relies on Amazon’s global supply chain is accounted for 7.9% of China’s cross-border e-commerce market.

Most of the purchased products are sold by Amazon in the United States. Compared with other cross-border e-commerce platforms, Amazon do not have enough differentiated operations. Most products are not stored in Chinese warehouses. So, when consumers order from Amazon, the products are shipped from overseas, which causes expensive overseas delivery cost and longer time to receive the parcel. Since the average delivery time for parcels in China is only 1-3 days, it is difficult to offer longer delivery time and gain customer satisfaction at the same time.

Want to have a first free consultation session about e-commerce and digital marketing in China? Contact us.