Content Seeding Platform Comparison: Weibo, RED & Bilibili

1. What is Content Seeding in China?

Content seeding describes an online behavior: through relevant content seeded about a certain product or brand to plant thoughts in consumers´ minds of buying this item.

Content seeding is one of the most essential approaches to increase brand awareness, communicate brand messages and marketing products to target audiences, in order to influence their purchase consideration and drive sales. This approach has become an important part of China’s e-commerce shopping drivers.

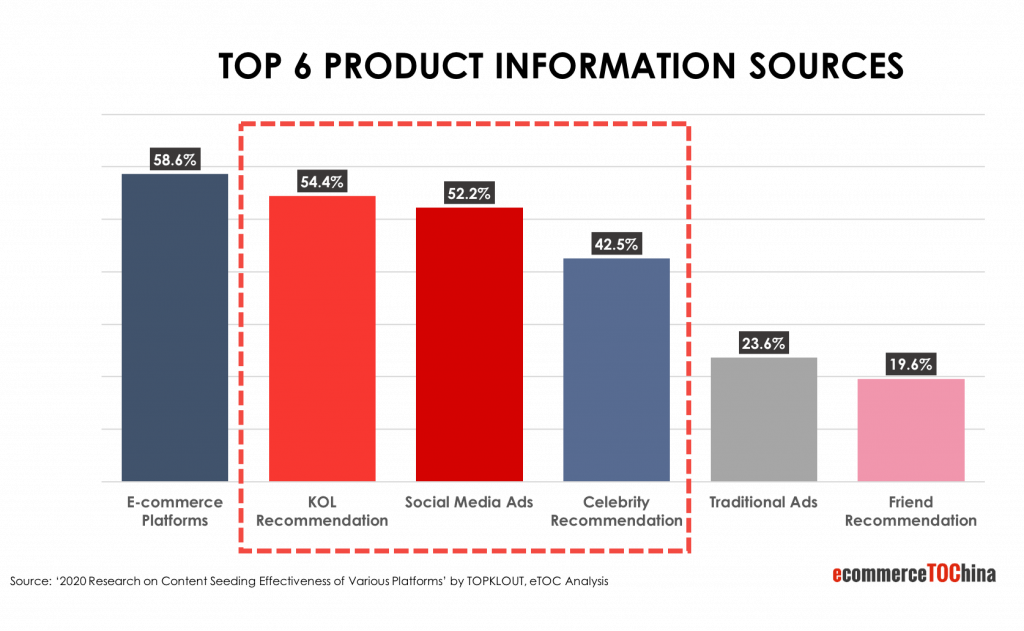

3 out of top 6 online product information sources are related to content seeding: 54.4% consumers get product information from KOL recommendations, 52.2% are from social media ads and 42.5% are from celebrity recommendations.

According to a survey carried out by TOPKLOUT, 67.8% of online users mentioned that online content seeding has a great impact on their shopping considerations and final purchasing decisions.

74.0% of the interviewees were influenced by content seeding content on social media platforms and 80.7% of them make the purchase within one week. Content seeding has already become a powerful “catalyst” to build brand influence and drive sales.

58.8% of the respondents asked for relevant information in the comment after reading the seeded content; 61.5% of the respondents said that the cost efficiency is still the main factor in the final purchase decision.

Content seeding is a journey with 5 steps:

2. Major Content Seeding Platforms

Weibo, RED, and Bilibili are all frequently used content seeding platforms in China.

Similar to Twitter, Weibo is a microblogging platform with 511 million monthly active users (source: Weibo 2020 user development annual report).

Weibo has a 140-character word limit which requires content to be short and sound.

Weibo is rich in content and diverse in functions. It unifies multiple functions such as media, search, news acquiring and self-media content creation in one eco-system. Therefore, Weibo has become a high-frequency use platform for users.

66.3% Weibo users frequently use Weibo and 72.4% users use once to twice a day.

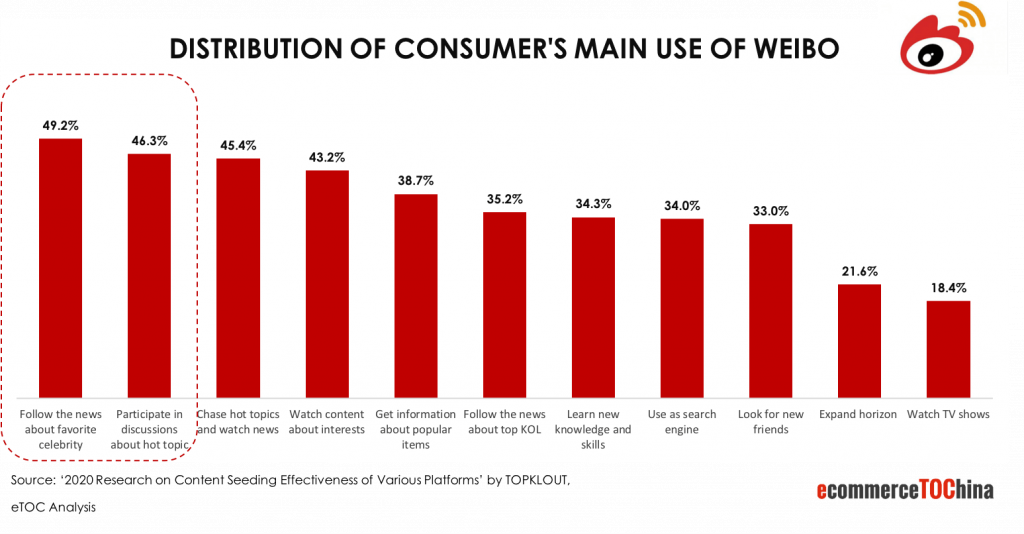

Main purposes of using Weibo:

1) Follow the news about favorite celebrities (49.2%);

2) Participate in discussions about hot topics (46.3%).

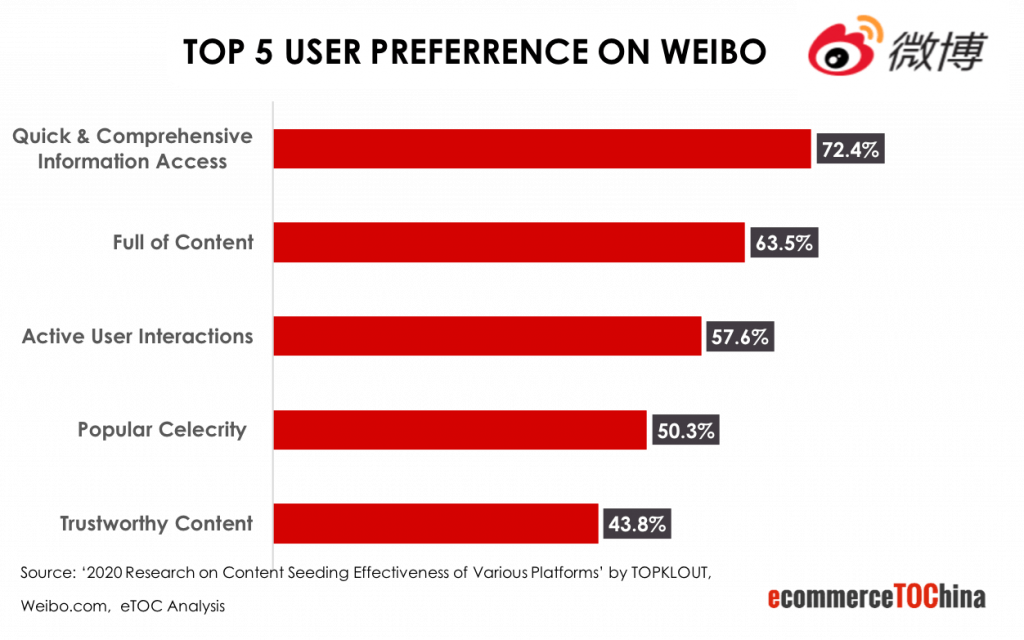

User preferences on Weibo:

- Rich content and the format (140 words limit) meet the needs of users for fast and one-stop access to information (72.4%).

- Huge celebrity exposure makes Weibo the main portal for fans to follow their favorite celebrities and hot topics attract consumers make timely comments and active interaction (57.6%).

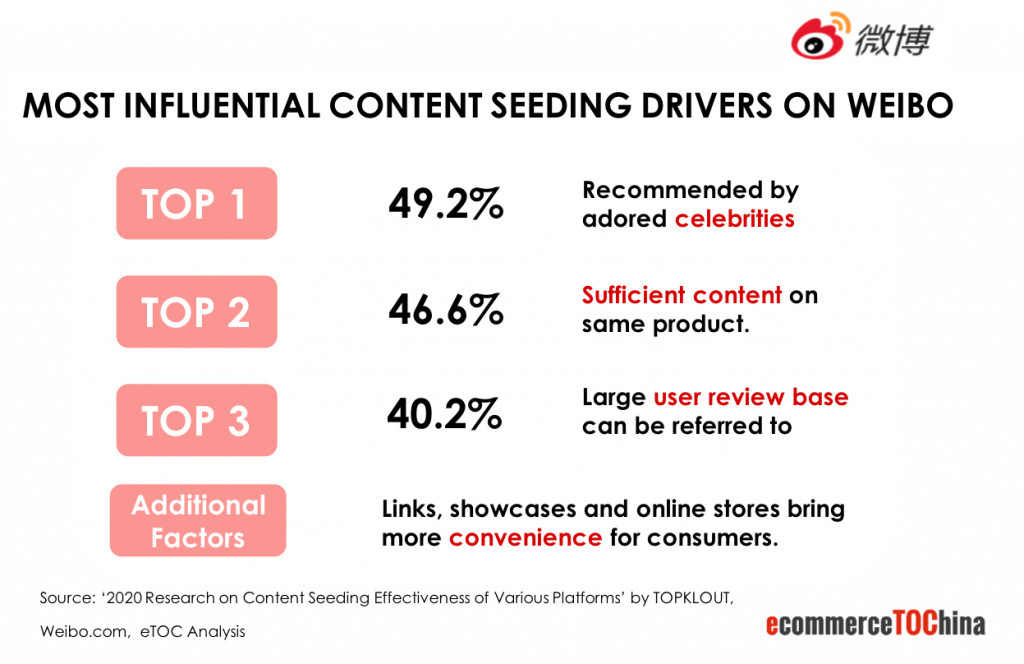

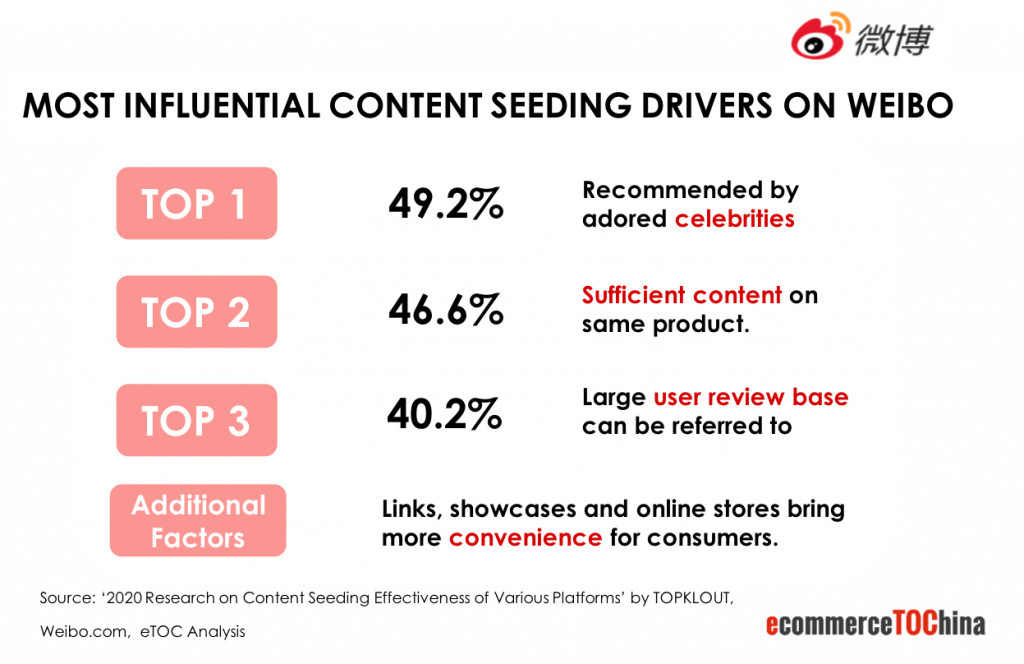

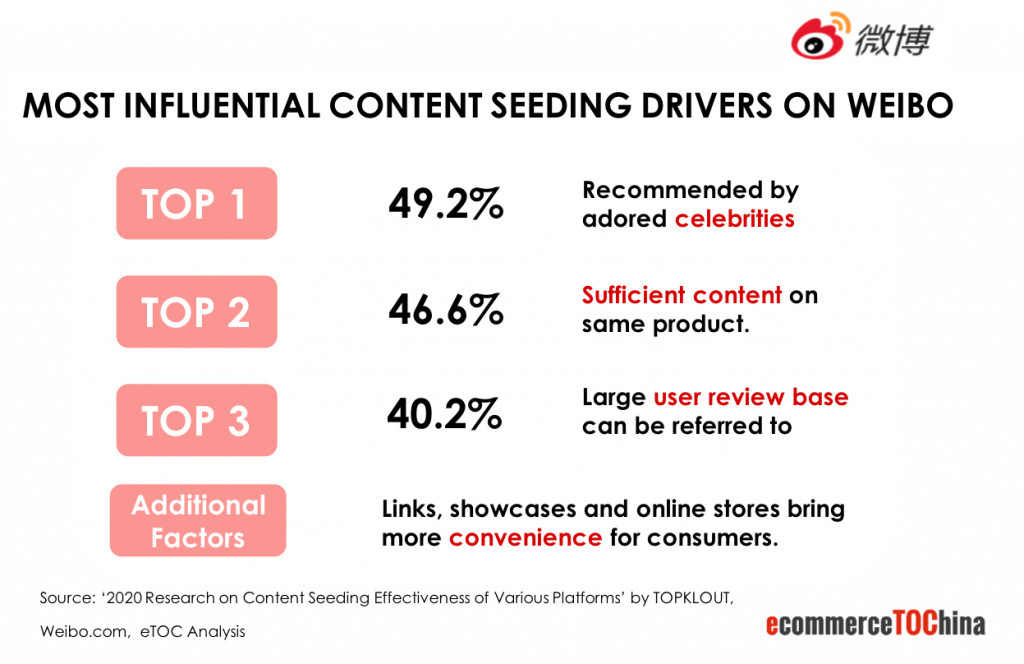

In terms of major content seeding drivers, “celebrity recommendation” is the No.1 most influential content seeding drivers on Weibo. 49.2% of users were influenced by celebrities’ recommendations, according to Topklout’s analysis.

Key insights about Weibo content seeding:

The entertaining type of contents and topics related to celebrity, easily became hot topics that drive massive attentions and discussions in a short period of time.

Content seeding in Weibo need to fully capture halo effect of celebrities: leveraging celebrities to quickly build up social impact and discussions. However, it usually requires big marketing investment.

To play smartly: pay attention to every hot topic on the platform that are not related to celebrities, leverage them to build the brand or product relevance, borrow the attention and popularity for own brand exposure and discussion.

RED (Little Red Book)

RED has evolved from an online social community for overseas shopping advices to a user-generated lifestyle content sharing community integrated with amazing e-commerce shopping features. The MAU has achieved 200 million as of 2019.

RED is the biggest “word of mouth” content platform in China. Based on TOPKLOUT report, 62.2% RED users frequently use RED and 41.1% users use once to twice a day.

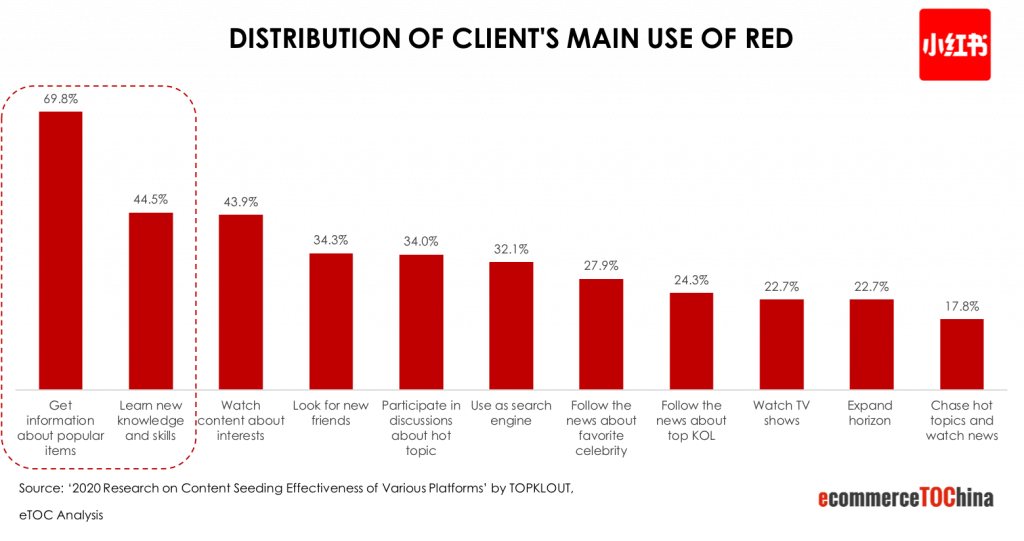

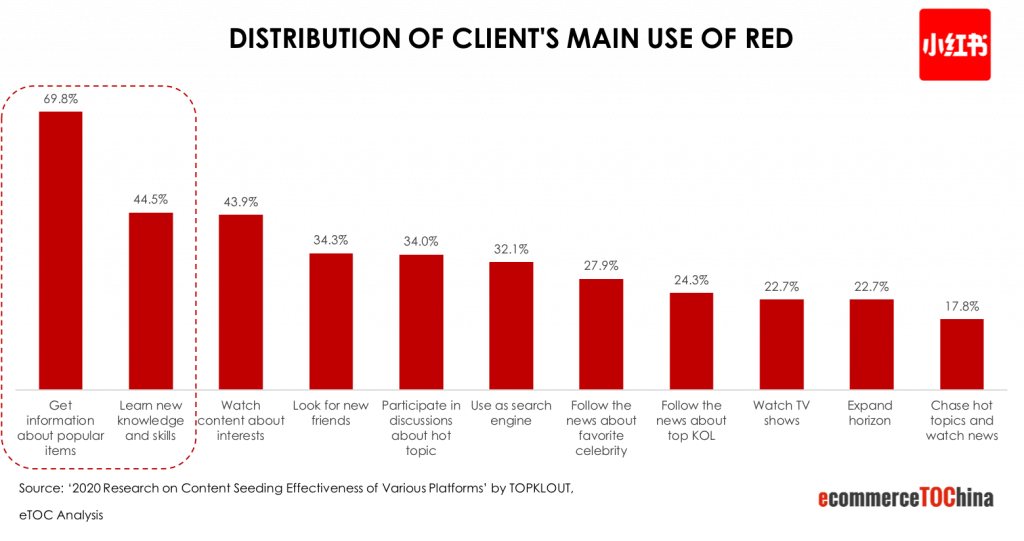

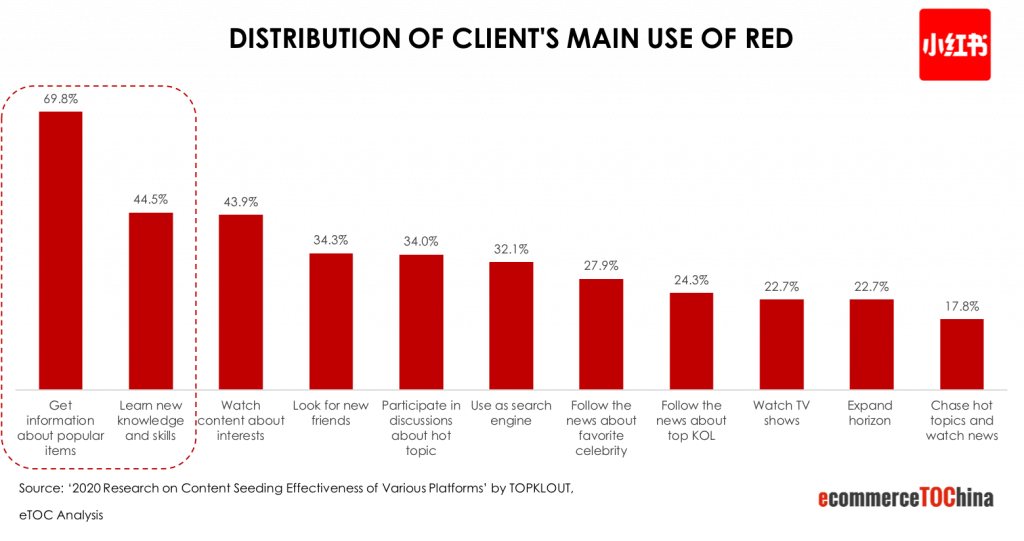

Main purpose of using RED:

1) Rich content and a large number of KOCs (Key Opinion Consumer) have made RED a destination for users to discover new things and experiences (69.8%).

2) Beauty (skin care & make up) and foodie (cooking) are the most popular content categories of RED. The educational type of content and detailed explanations in steps have attracted many users to learn the skills on RED (44.5%).

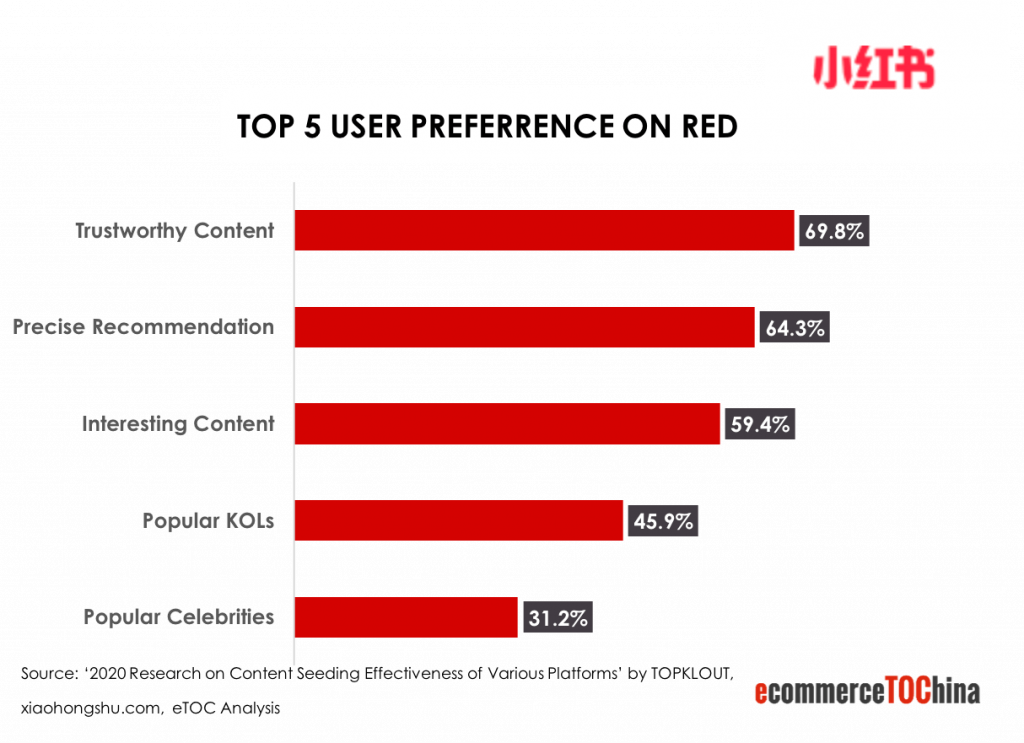

User preferences on RED:

Trustworthy Content: A large amount of content about discovering new products and life experience from KOCs, and the lifelike manner makes the content real and trustworthy to users (69.8%).

Precise Recommendation: based on user behaviors, RED will display the personalized content recommendation matching with user´s interests. This makes the content exploration easier and more efficient (64.3%).

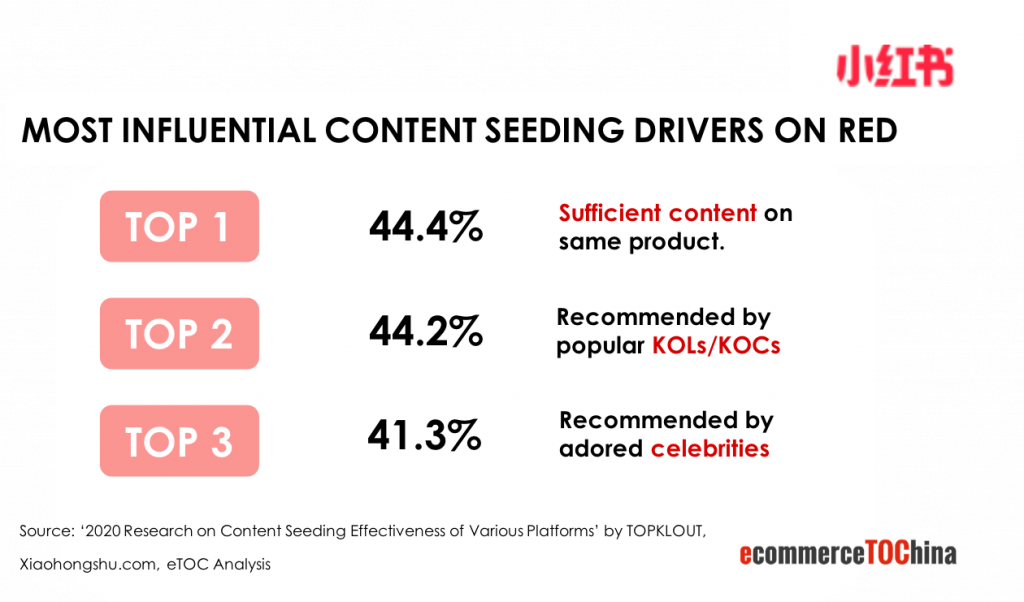

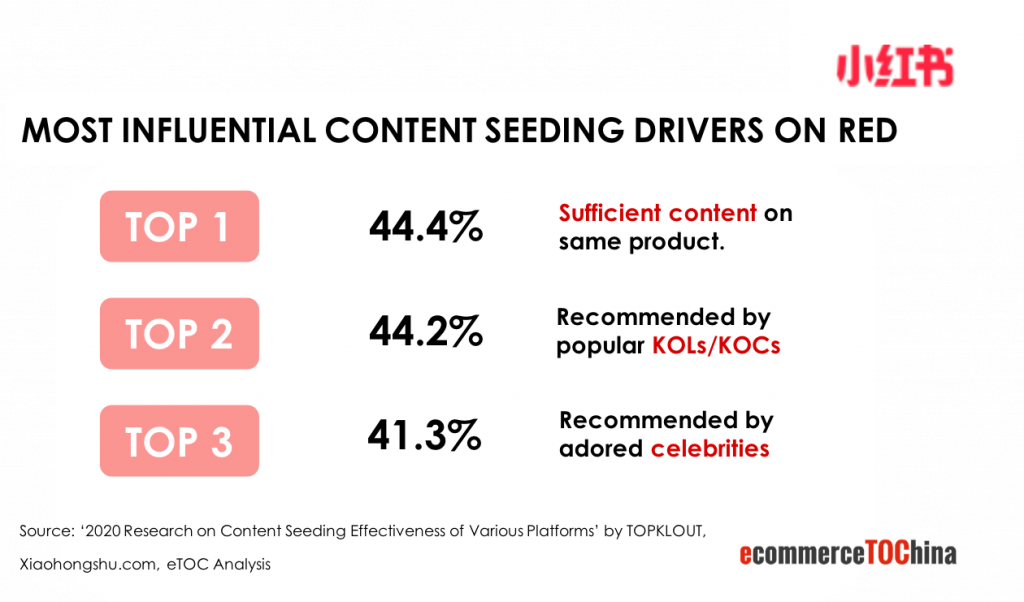

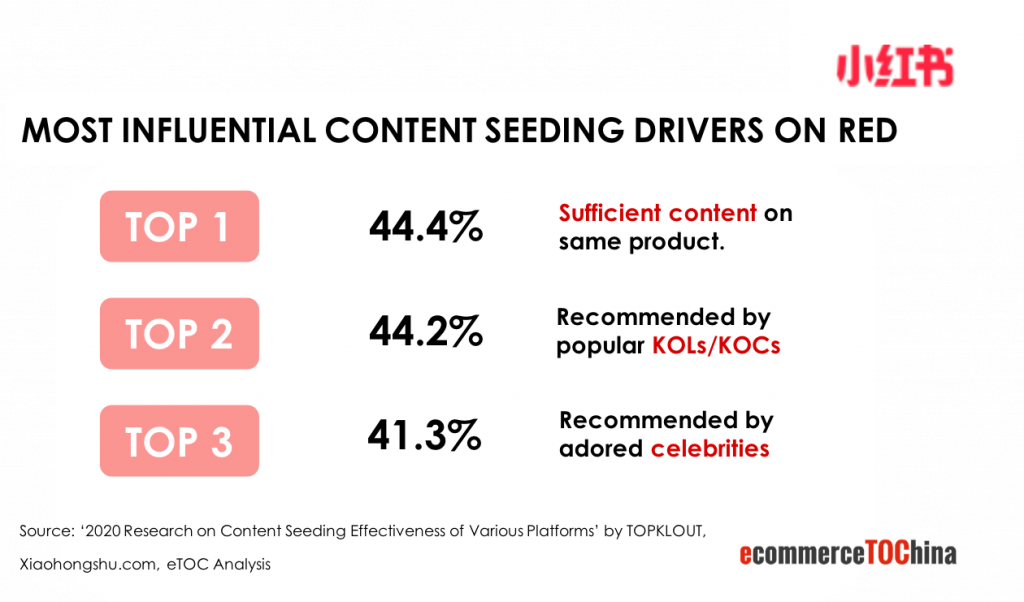

The most influential content seeding drivers are: “Sufficient content on the same product” refers to the massive product content posted by KOLs and consumers (44.4%) , as well as “Recommended by KOLs/KOCs” (44.2%)“ and “Recommended by celebrities” (41.3%).

Key insights about RED content seeding:

Traveling, foodie, skin care, fashion are the main content categories in RED. Authentic and high-quality content are essential features of content in RED. Key opinion consumers (KOCs) play a key role on RED as they are considered as more trustworthy.

Consumers will refer to a larger range of KOCs´ opinion to evaluate the brand or product in addition to celebrities and top KOLs recommendations.

For a new brand, RED is an important platform to progressively build brand awareness and reputation.

Bilibili

Bilibili was established on 2009 as a video content community for anime, comics, and games (ACG), engaging with young users. Professional User Generated Video (PUGV) was the core and root of Bilibili. Now it has expanded to a full-category online entertainment platform serving young generations’ diverse interests, such as videos, live-streaming and gaming. The monthly active users have reached 202 million (2020Q4 bilibili financial report).

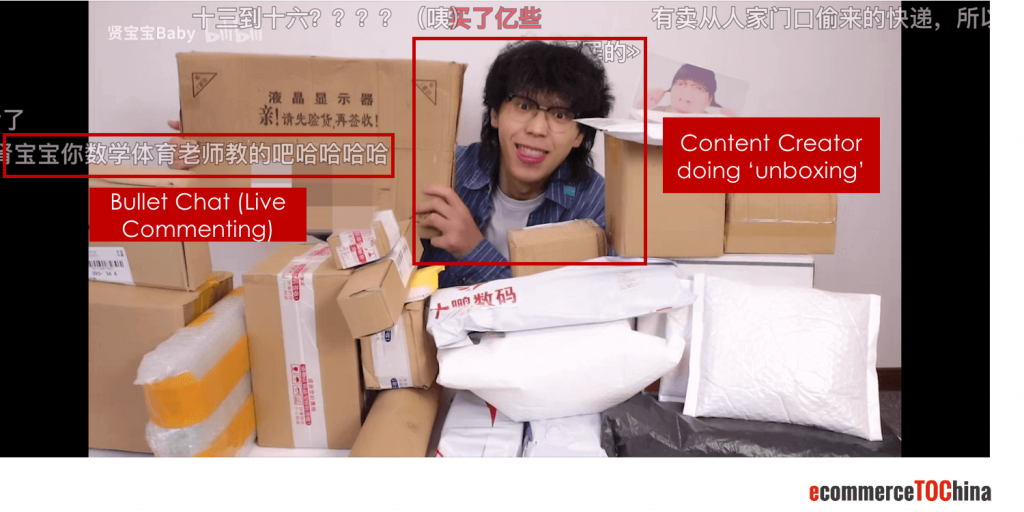

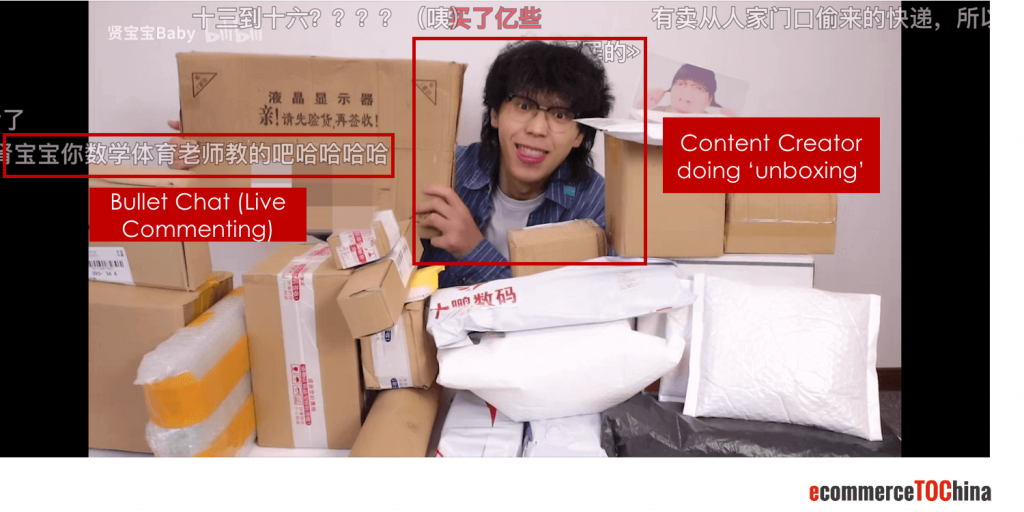

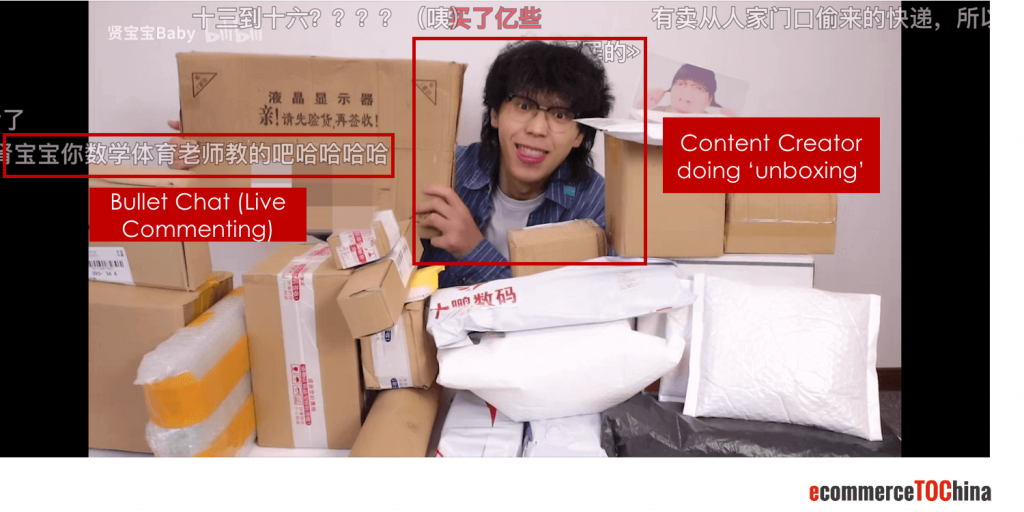

Bullet chat (in Chinese Danmu 弹幕) is another unique feature on Bilibili: the audiences can place live comments which will appear on the screen while watching videos. This function is very engaging and generates a strong emotional bonding which perfectly meets the Gen-Z’s demand for self-expression.

Based on TOPKLOUT report, 51.2% Bilibili users frequently use Bilibili and 45.3% users use it once to twice a day.

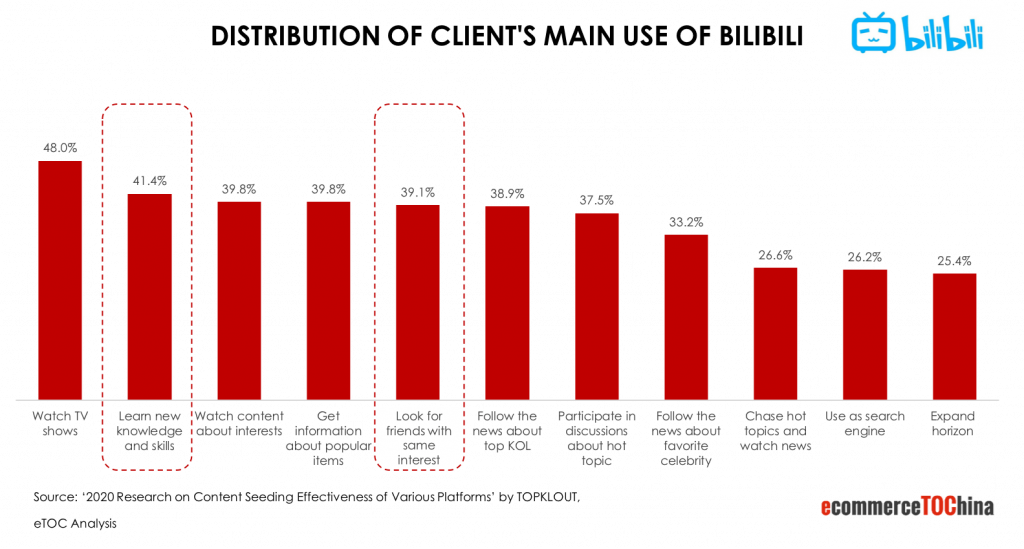

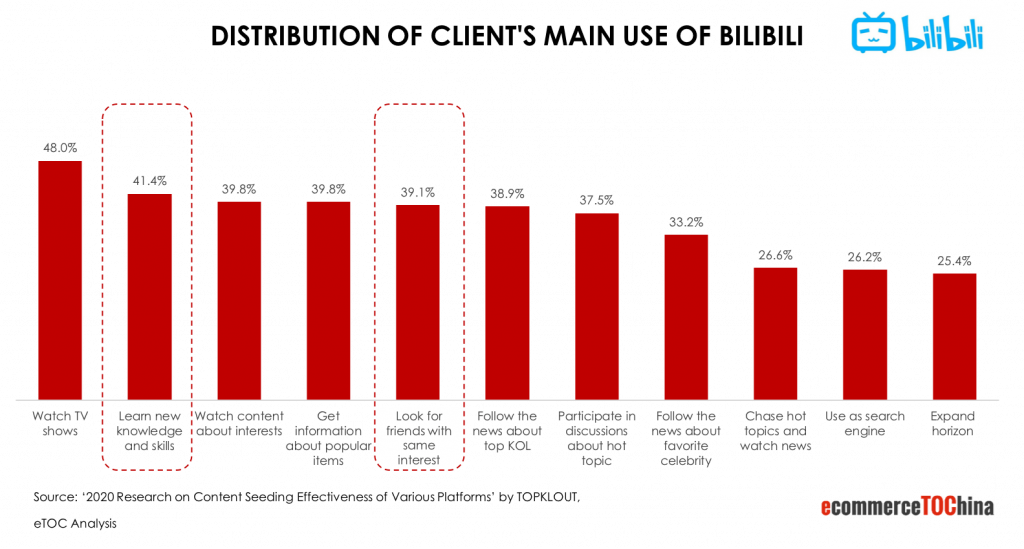

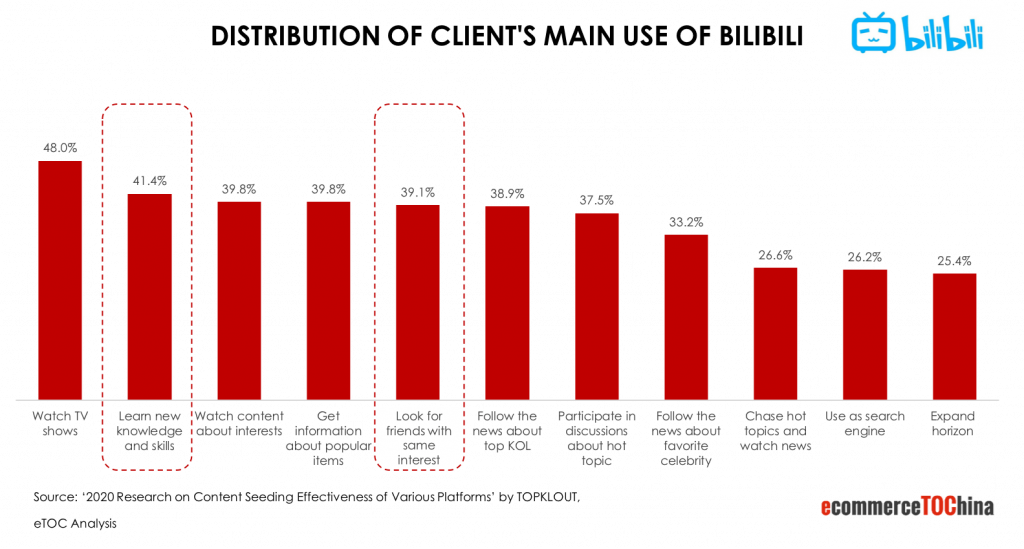

Main purposes of using Bilibili:

Similar to other video platforms, watching videos and entertaining shows is the biggest purpose of using Bilibili (48%).

New knowledge and skills instructions are he main PUGVs in Bilibili, which make Bilibili a “new knowledge learning platform” for many users (41.4%).

Bilibili hosts lots of unique content categories and PUGVs. It has become one of the main communities for young people to find “friends with the same interests” (39.1%).

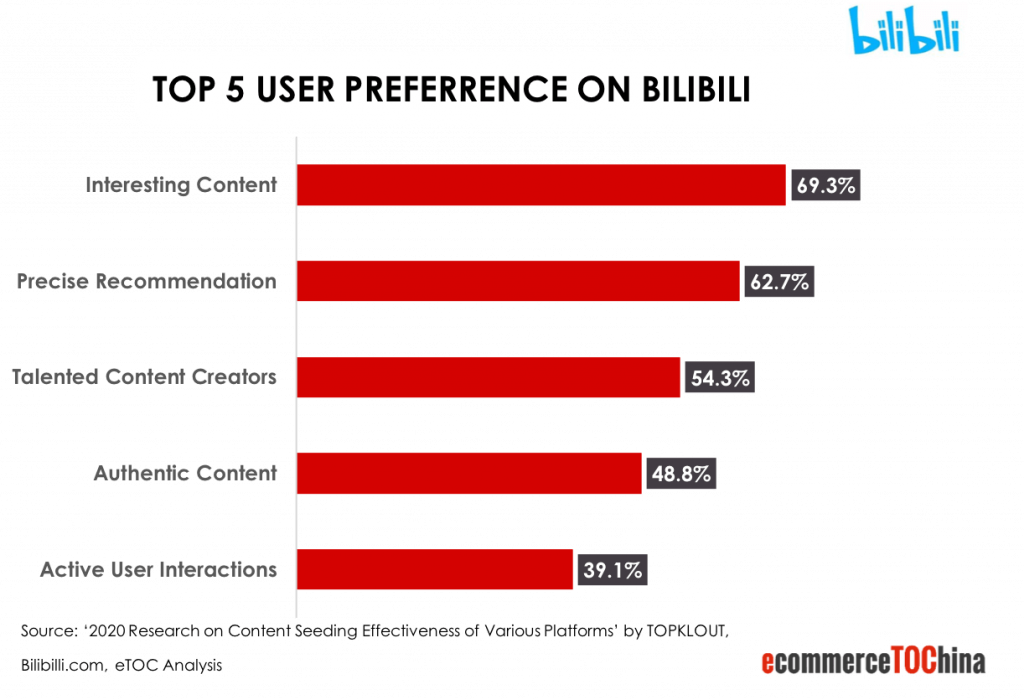

User preferences on Bilibili:

Interesting Content: Many talented professional content creators on Bilibili make creative and interesting contents, which makes the platform very attractive (69.3%).

Precise Recommendation: Similar to RED, Bilibili delivers highly relevant content based on user behavior and content preference algorithm (62.7%).

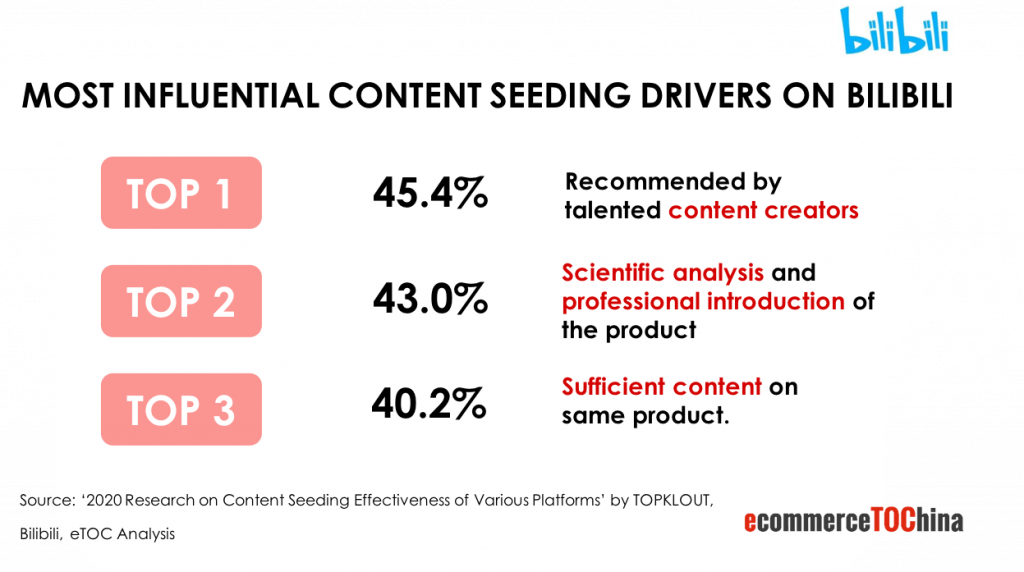

Celebrities and KOC’s influence on Bilibili are less influential compared to PUGV content creators. “Recommended by talented content creators” is the No.1 influential content seeding drivers on Bilibili (45.4%), followed by “Scientific analysis and professional introduction of the product” (43%).

Key insights about Bilibili content seeding:

Bilibili is a video community providing diverse content especially for the young generation. The key influencers on this platform are creators of PUGV. The major features of their videos are professional and creative.

The content seeding approach on Bilibili is different from RED and Weibo:

Consumers follow professional content creators based on the interests and they are usually specialized in one category or specific fields.

To connect with the precise target audience, it is essential to find the content creators in the specific area which is relevant for the brand.

3. Three Platforms Content Seeding Effectiveness Comparison:

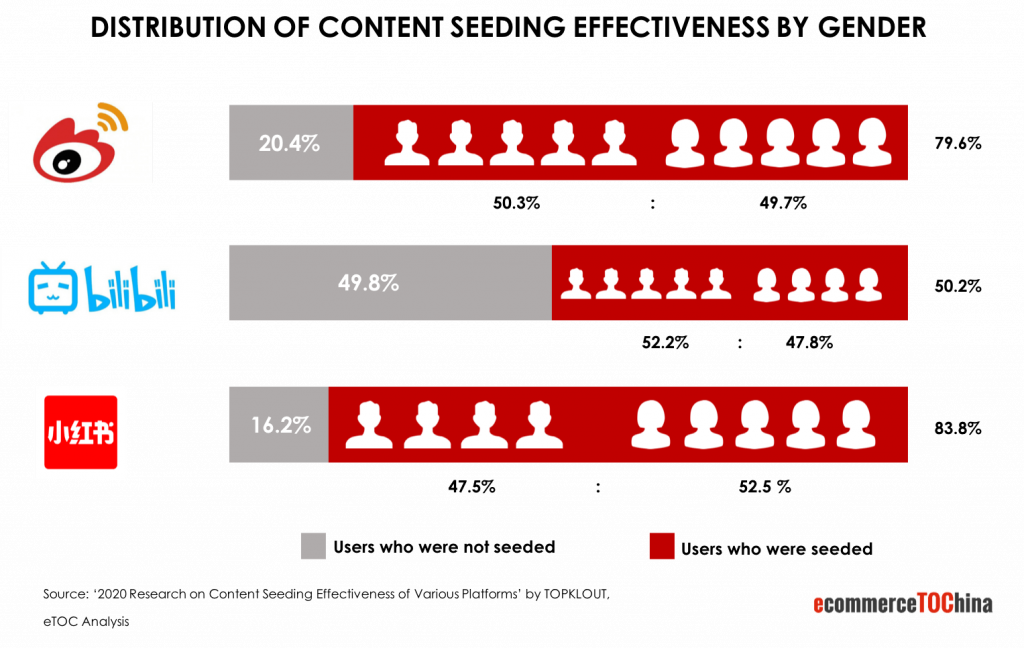

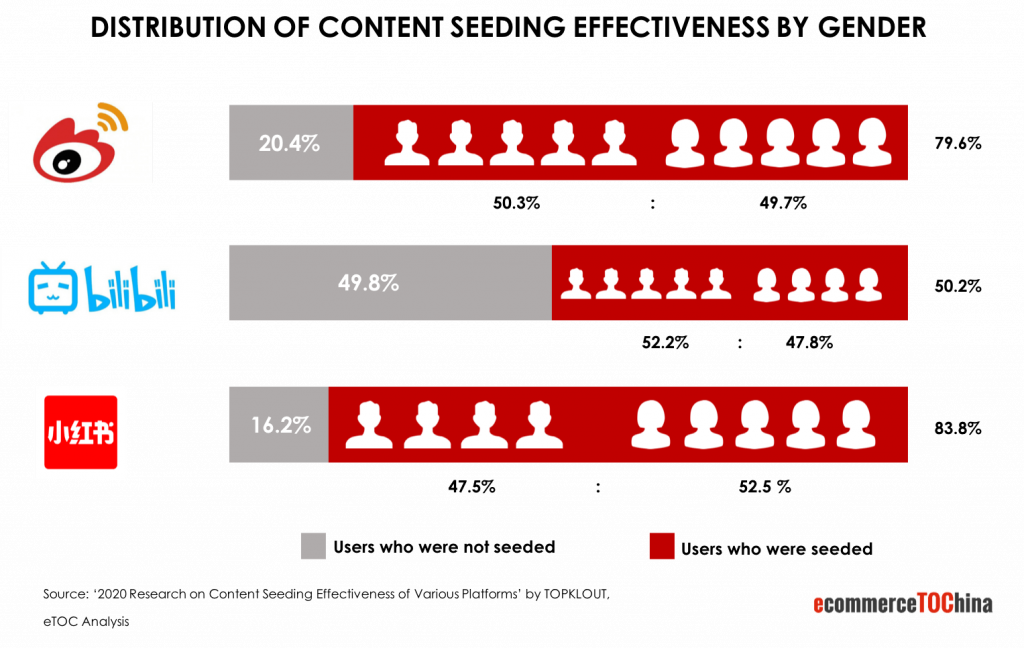

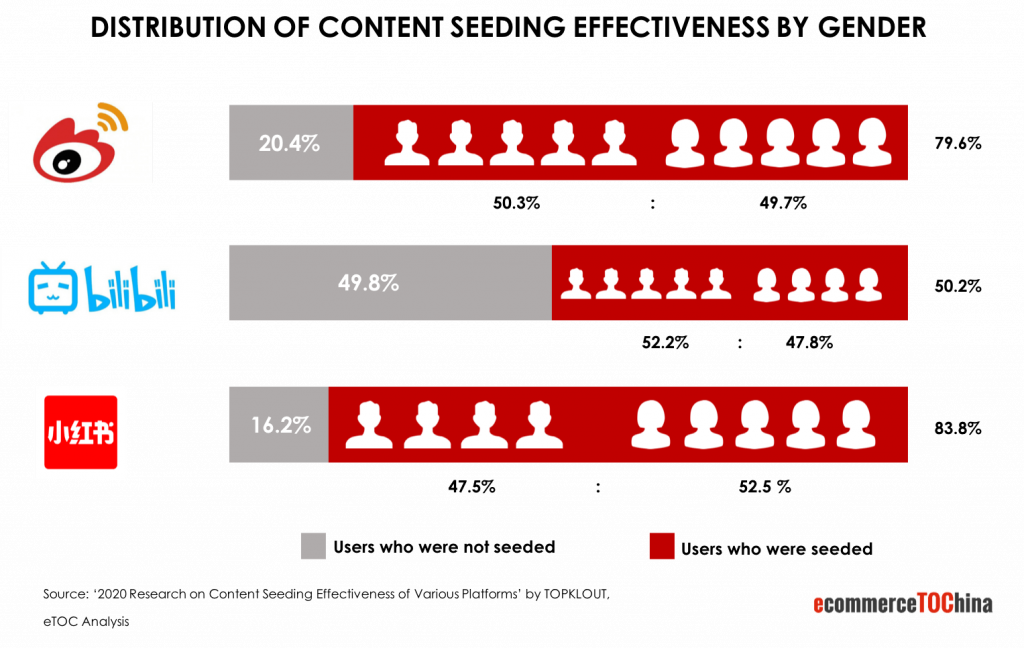

3.1 Content seeding influence and its user gender distribution on 3 platforms:

Weibo and RED have better content seeding coverage compared to Bilibili based on TOPKLOUT research.

83.8% of RED users were once influenced by seeded content which ranks the highest of content seeding effectiveness among all 3 platforms. Most of these users are female (52.5%).

79.6% Weibo users were influenced by seeded content, with relatively even ratio of male and female.

Bilibili’s unique environment of ACG attracts more male users (52.2%). But in general, only 50.2% Bilibili users were influenced by content on the platform.

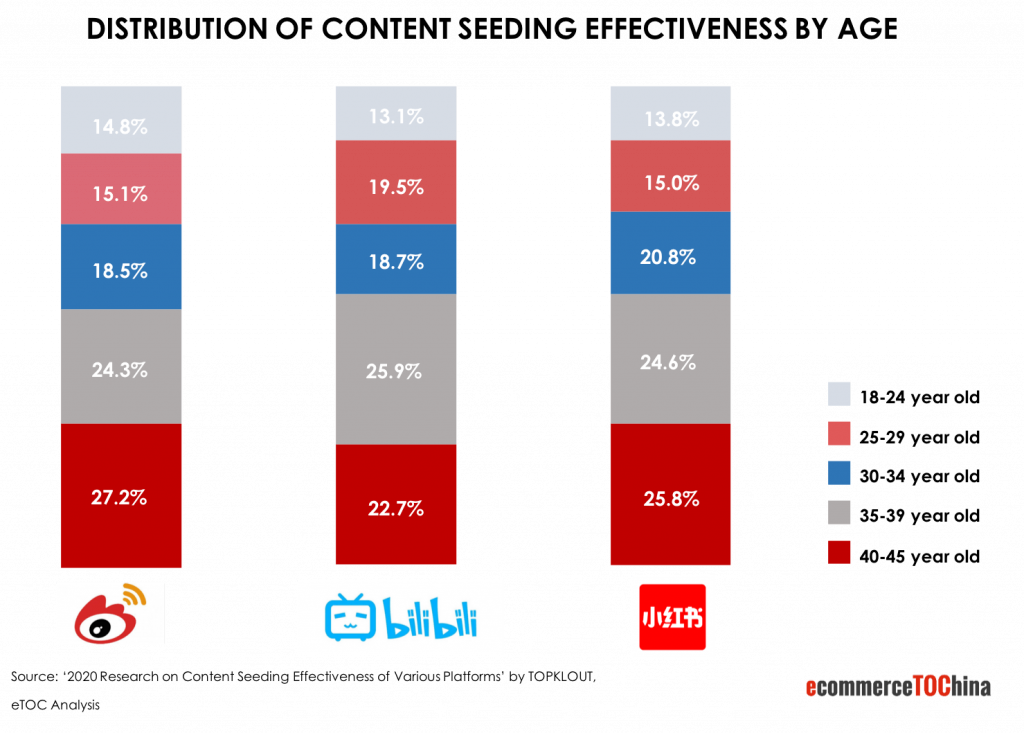

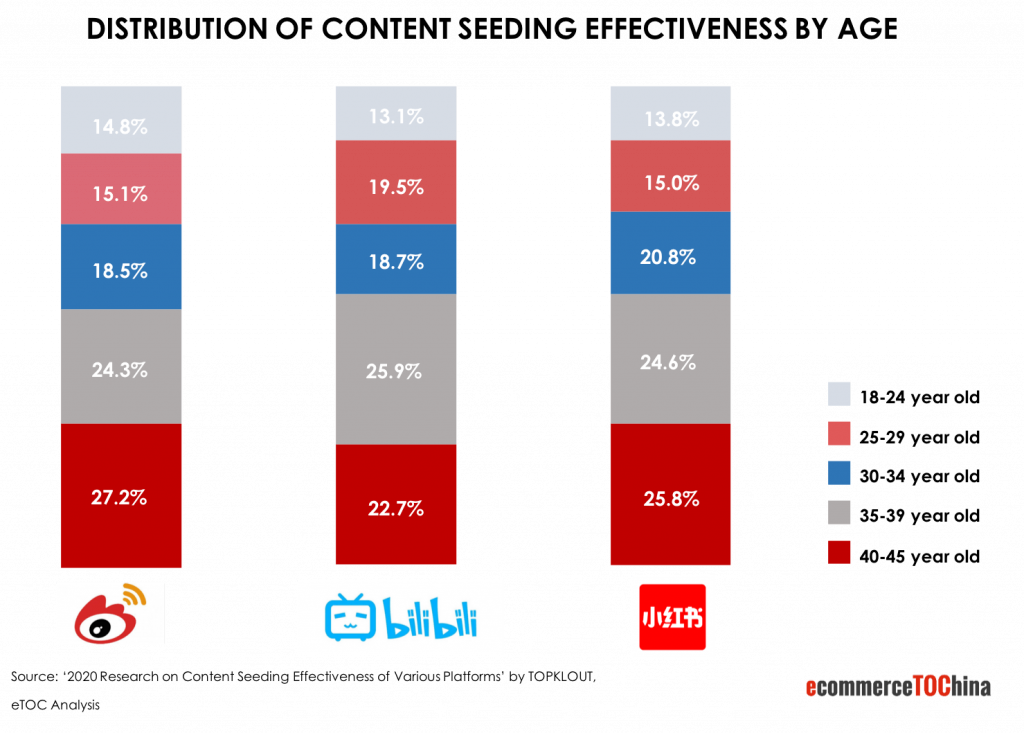

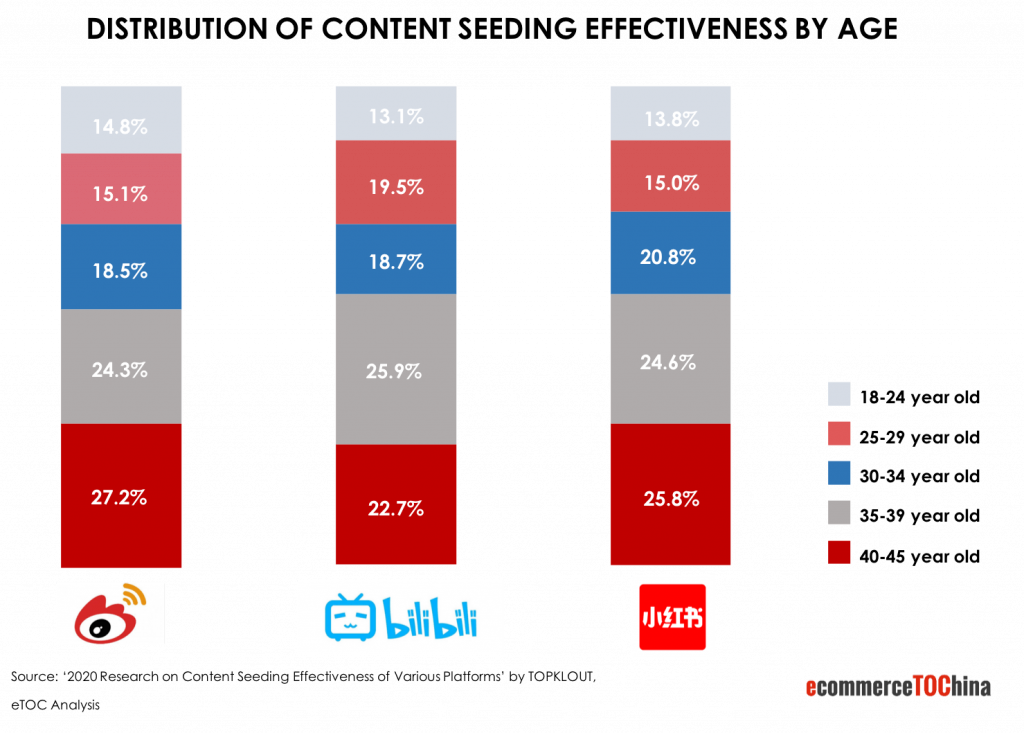

3.2 Content seeding users’ age distribution on 3 platforms:

Post-90s (18-29 years old) users are the core consumers group in digital era with active behaviors and strong consumption power. They become the most important group for content seeding among all platforms.

Weibo has the most consumers from 18-24 years old, RED has bigger portion from the age group 30-34 years old and Bilibili attracts 35-39 years old user group more than others.

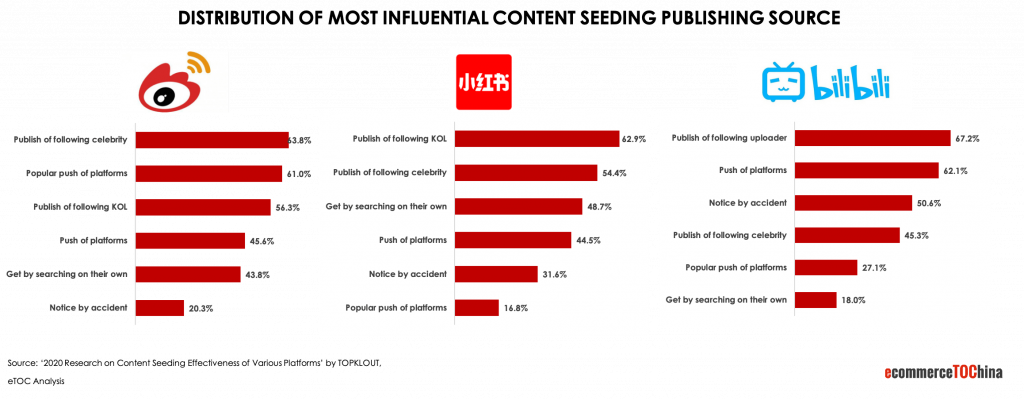

3.3 Top 5 influential content among 3 platforms

Weibo: Celebrity has the most influence on Weibo and 63.8% of the users were influenced by them, followed by platform push ads (61%) & KOL post (56.3%).

Bilibili: 67.2% of Bilibili users were influenced by professional video creators, followed by platform push ads (62.1%) and precise recommendation (50.6%). Celebrity on Bilibili is less influential (45.3%) compared to RED and Weibo.

RED: KOL plays the most influential role on RED. 67.2% of RED users were influenced by KOLs, followed by celebrity (54.4%). Different from Weibo & Bilibili, search was ranked as No.3 most influential channel, 48.7% of the RED users visited seeded content through keyword search.

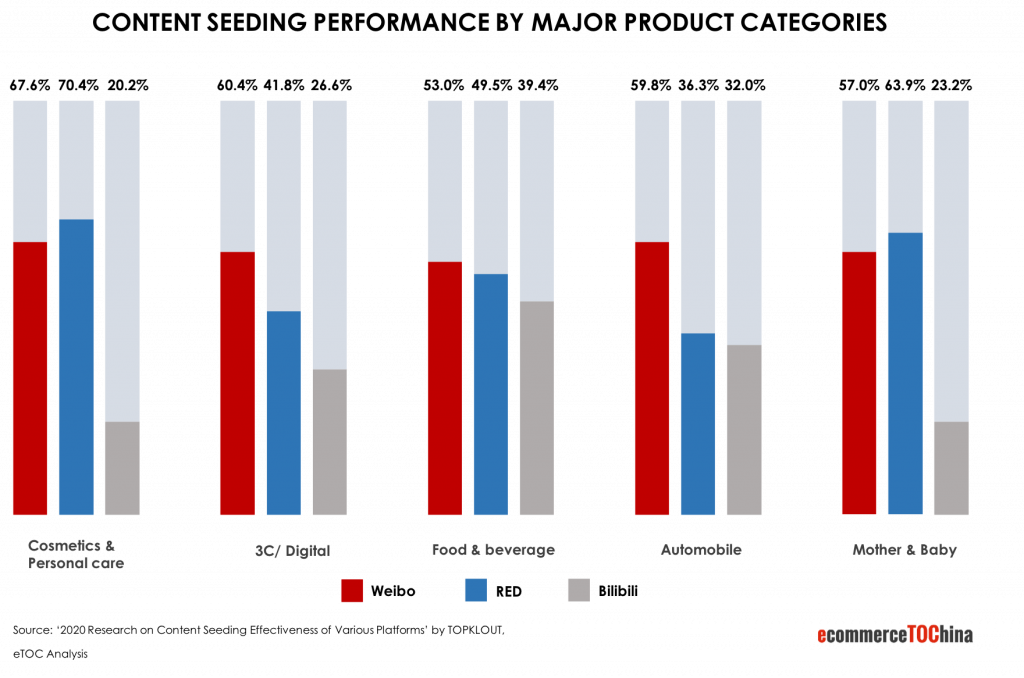

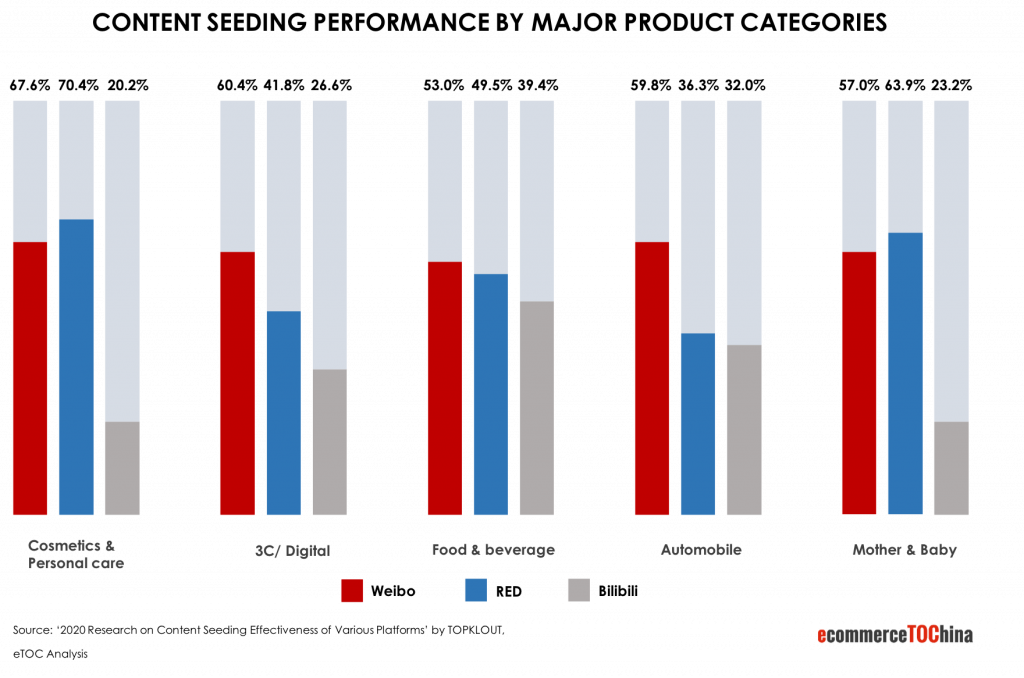

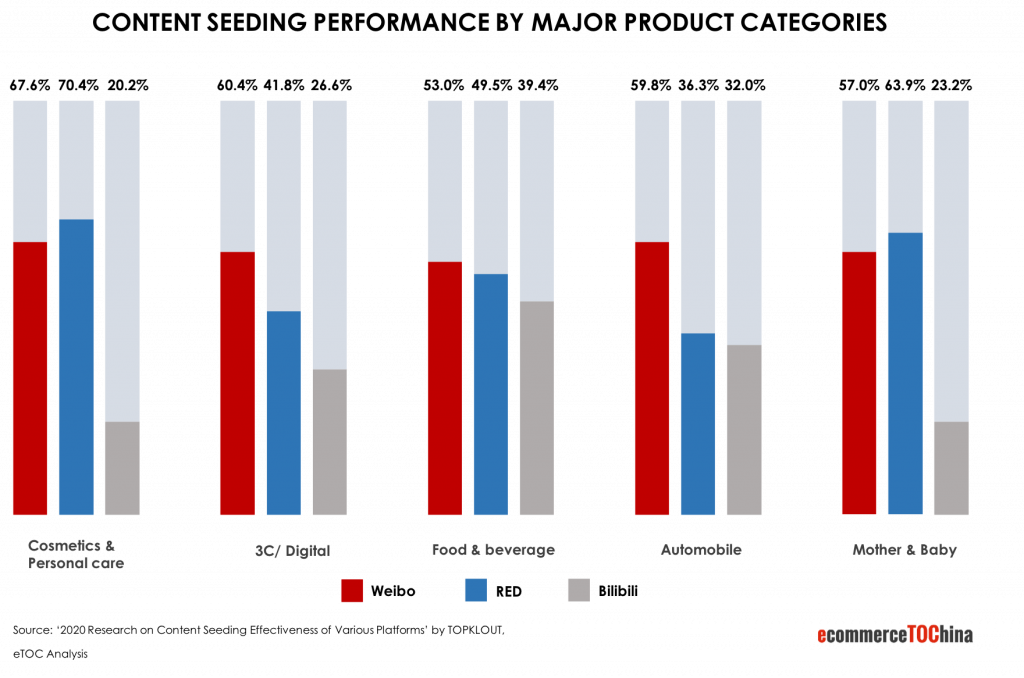

3.4 Content seeding performance by major product categories

Weibo has high content seeding performance for all major product categories.

Cosmetics, personal care and baby categories on RED had the best content seeding performance among 3 platforms given a large female user base.

3C digital, food/beverage and auto had relatively higher content seeding performance on Bilibili benefiting from the young male user base. In general, the average content seeding performance on Bilibili is still behind Weibo and RED.

4. Key takeaways of content seeding platform comparison:

1) There are obviously different features for content seeding among 3 platforms:

- Weibo’s celebrity effect, rapid topic development and other advantages attract brands to do product seeding on Weibo. These features can be leveraged to drive wider attention and impact in a short period of time.

- KOLs and KOCs on RED show product features and user experience from multiple dimensions, attracting users by their real and lifelike content. Brands often leverage RED to create an extensive base of word-of-mouth effect over the long run and increase the credibility for sales conversion.

- Content on Bilibili are more creative and professional. The professional content creators leveraging their knowledge from technology, popular science and all kinds of professional areas are more suitable for brands who have professional background or in-depth communication needs.

2) Celebrity has a greater content seeding influence among all platforms. 61% of the respondents tend to trust product recommendations by the celebrities.

3) Weibo and RED have better content seeding coverage compared to Bilibili. RED has the most consumers influenced by content seeding (83.8% RED users) and the largest female consumers base among 3 platforms. Followed by Weibo, 79.6% Weibo users were influenced via content seeding, relatively even ratio of male and female. Bilibili had 50.2% users influenced on the platform and male accounts for 52.2%.

4) Post-90s (18-29 years old) users are core consumers group among all platforms. Weibo has the biggest young consumers from 18-24 years old. RED has bigger portion from the age group 30-34 years old and Bilibili attracts 35-39 years old user group more than others.

5) Each platform has its own advantages for different categories: Weibo has high content seeding performance for all major product categories. Cosmetics, personal care and baby categories on RED had the best content seeding performance. 3C digital, food/beverage and auto had relatively higher content seeding performance on Bilibili.

For more information about content seeding or digital marketing, please feel free to reach out to us.

Want to have a first free consultation session about how to do marketing in China? Contact us.