1. The Chinese Mainland luxury market with continuous and moderate growth

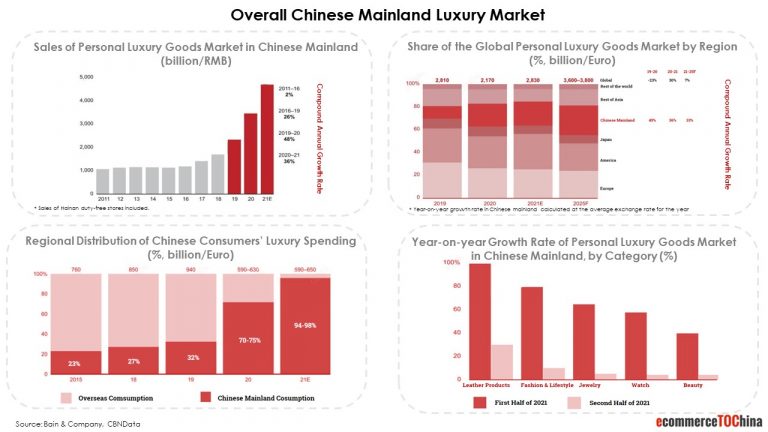

According to Bain & Company, the overall luxury market in Chinese Mainland is booming in 2021, with the personal luxury market doubling in size compared to 2019. After achieving 48% growth in 2020, the Chinese mainland luxury market is expected to achieve 36% growth for the full year 2021, reaching nearly RMB 471 billion ($74billion). The growth rate differs greatly among brands, ranging from 10% to 70%. The growth rate of different categories also varies greatly, topping out at 60% for leather products and lowest for beauty at 20%.

Chinese mainland luxury market accounted for approximately 21% of the global market in 2021, up from approximately 20% in 2020, and is expected to become the world’s largest luxury market in 2025.

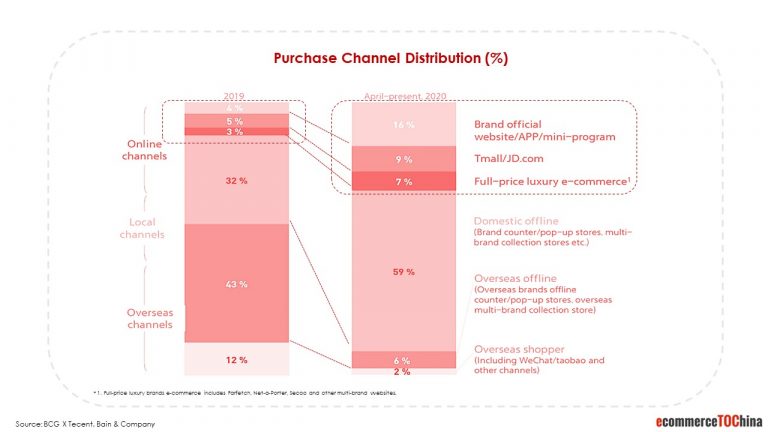

Meanwhile, Chinese consumers are more likely to buy luxury goods in Chinese Mainland as outbound travel is disrupted. The Chinese Mainland market accounted for 70-75% of Chinese consumers’ global luxury consumption in 2020, and is expected to rise to 90% in 2021.

Despite the strong overall growth of the luxury market in Chinese Mainland in 2021, the first and second halves differ significantly. The first half of the year is growing rapidly, with year-on-year growth rates ranging from 40%-100%, while the second half is expected to fall to anywhere from 0%-25%.

This is mainly influenced by four factors:

- a very high base for the same period comparison in the second half of 2020: China was the first to recover from the Covid-19 in 2020, with a high base in Q3-Q4, while Europe and the US were deep in the Covid-19 during the same period.

- COVID-19 affecting urban offline store: Since June, there have been sporadic cases of coronavirus disease in China, with higher tier cities being more influenced. Reduced traffic to luxury offline shops has affected the revenue side.

- the cooling of the stock market and real estate, leading to an increasingly conservative outlook on spending

- the new regulations for KOLs and celebrities, which reduced marketing spending by brands

Overall, the Chinese Mainland market is expected to grow moderately in 2022, with personal luxury consumption expected to return to pre-epidemic levels between late 2022 and the first half of 2023.

2. To be solved: Price disparity

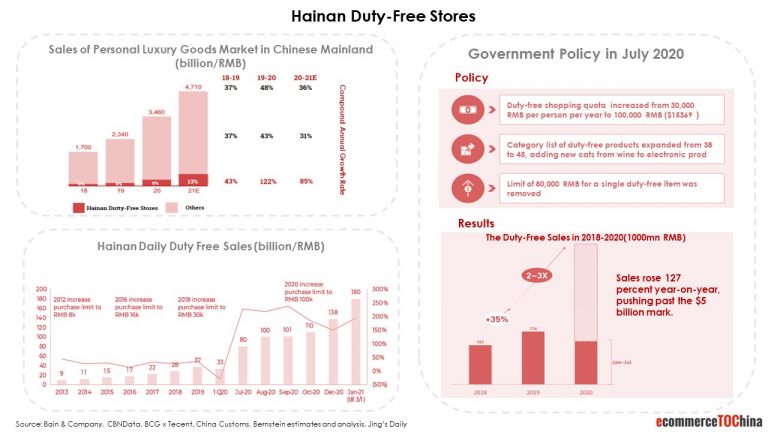

The price disparity is still an important factor that prevents Chinese consumers from buying luxury goods in the Chinese Mainland. According to Morgan Stanley, the price difference between China and Europe for major brands has reached 35-40% in the past few months. During the COVID-19, Hainan Duty Free has become one of the main drivers of China’s luxury market.

According to Bain & Company, the luxury sales of Hainan Duty Free Store exceeded 120% growth in 2020 and is expected to grow 85% in 2021, accounting for 5% of total sales growth within Chinese Mainland. However, this success is mostly driven by huge discounts. Taking beauty luxury brands, their label prices are 30-55% below the official brand markup. However, huge discounts can instead have a negative impact on the brand equity of luxury goods.

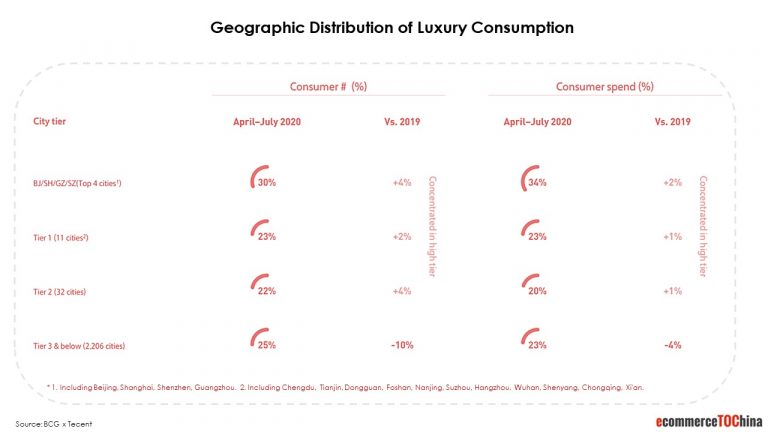

3. Expansion: Seeking to Lower-Tier cities

Another way for luxury to expand is by seeking to Lower-Tier cities. According to the BCG x Tencent 2019 report, nearly half of the country’s luxury consumption comes from tier 2 and 3 cities. 2021 Tmall’s Double 11 also recorded a 50 percent increase in new luxury shoppers from third-tier cities. Therefore, many new brick-and-mortars were located in the lower-tier cities to acquire new luxury consumers. However, brands still need to remain cautious because they also face a shortage of HNWI (high-net-worth individuals), inventory management, and oversupply.

According to LADYMAX, what luxury brands should do is not unlimited sinking and catering to the middle class to expand the consumer base, but to change the consumption structure from entry and discount products to mid-to-high-end products that are closer to the brand spirit.

For example, in November 2021 Louis Vuitton held its Spring/Summer 2022 womenswear collection in Shanghai. It’s the first time to show its women’s collection in China in the form of a fashion show in nearly nine years, demonstrating that Louis Vuitton will take women’s ready-to-wear as its market focus, shifting from chasing scale to pursuing quality of growth.

4. Future: Digitalization goes deeper

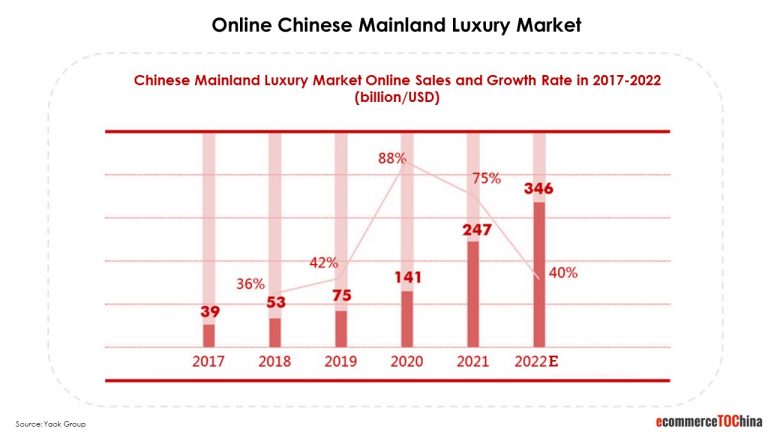

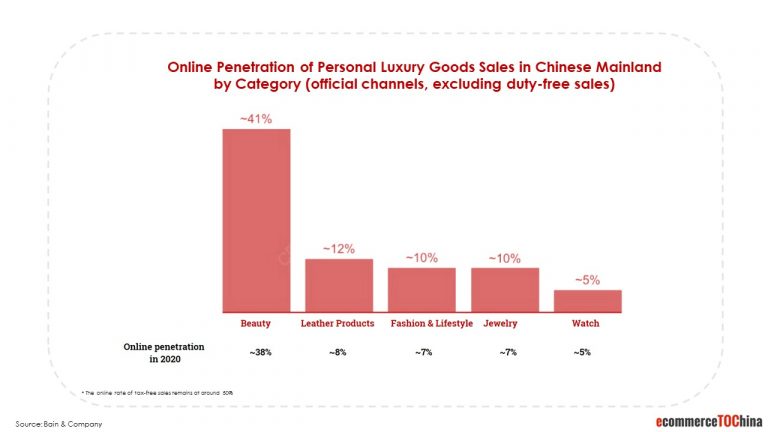

According to Yaok Group, in 2021, online sales has grown 75% year-over-year, reaching $24.7 billion, accounting for 26% of the Chinese mainland market sales. However, online penetration rate varies greatly, except for the beauty category which reached 38%, the rest are below 10%.

From March to May this year, Beijing and Shanghai were affected by the COVID-19 and about 50% of luxury stores faced closure or reduced traffic. Luxury brand store efficiency all fell except for Hermes. Therefore, in Q2’s important marketing node, 618 Shopping Festival, more than 200 luxury brands are participating and more than 20,000 new products will make their debut in 2022. Luxury brands are attracting more consumers through pre-sales, interest-free installments and live streaming.

The results show that luxury goods performance is improving. On the first day of Tmall pre-sale, more than 300 new products were sold out, and brands such as Bottega Veneta, Lanvin and Carven exceeded last year’s full-day sales within three minutes of the pre-sale opening. According to DSB.CN, on JD.com 618 luxury goods main promotion day, the turnover increased 93% year on year.

Unlike Tmall’s flagship store, some luxury brands on JD.com take the embedded official website applet, such as Louis Vuitton, Loewe and Givenchy. JD.com’s focus with luxury brands is on the integration of the supply chain so that the brands can reach the precise customer base through omnichannel.

5. Conclusion

The Chinese market has supported the global luxury industry through the toughest times of the COVID-19, but brands still have a lot to overcome in China.

Overall, the Chinese market holds great potential and remains gentle growth in 2022. Digitalization and online sales are the focus of the future, with differences between each category. What luxury goods need to overcome in the Chinese market is not only the problem of price disparity and expansion but also how to change the consumption structure of luxury goods in China and make Chinese consumers truly understand the brand spirit as well as pay for it.

Want to have a first free consultation session about how to do marketing in China? Contact us.