1. The small but fast-growing Chinese perfume market

The change in lifestyle under the influence of Covid-19 has also led to a change in consumption habits, with the wearing of masks causing the demand for lipstick to drop significantly. The “lipstick effect”, which had an emotional comforting impact, was replaced by the “perfume effect”.

According to iResearch, the China perfume market accounted for only 2.5% of the global fragrance market in 2020, but it is growing at a rapid pace. According to Euromonitor, the China perfume market has grown at a CAGR of 14.9% from 2015 to 2020 and is expected to be 22.5% in the next five years, which is about three times the global market. The China perfume market retail sales are expected to reach RMB 30 billion in 2025.

Based on CBNData, the cumulative number of registered perfume companies in China has exceeded 2,000 since 2017. Domestic and international capitals continue to intervene in the Chinese perfume market. 2020-2021 investment and financing continue, with several multi-million RMB financing rounds completed. Meanwhile, brands and companies are also expanding their perfume market in China. For example, in January 2021, Hermes opened its official Tmall flagship perfume store; Byte Dance launched its own perfume brand Emotif in October 2021.

2. Niche perfumes with accelerated presence

Although big beauty companies dominate and lead in the arena, such as LVMH, Chanel, Coty, L’Oréal, and Estée Lauder, niche perfumes are performing particularly well. Data from Tmall Global showed that imported perfumes on the platform increased by 70% year on year in the first half of 2020, featuring niche brands having the largest growth rate, with three-digit year-on-year growth. Tmall also mentioned its niche perfumes sales have almost doubled in 2020.

As a result, Tmall Global and the logistics unit Cainiao Network co-launched its first “perfume route” — a dedicated daily flight to transport fragrances between Europe and China in December 2020. Consumers can receive their products from Europe in as little as three days’ time. Previously, airfreight was usually rejected due to the flammable components of perfumes, and niche brands were difficult to meet the minimum volume requirements to ship by sea freight because of its smaller production scale. The direct flight route provides a convenient cross-border logistics solution for niche perfumes, exploring a new opportunity for European brands to expand in China.

During the Covid-19, niche brands accelerated their presence in e-commerce platforms, including Penhaligon’s, L’Artisan Parfumeur, MEMO PARIS, CREED, Serge Lutens, ACCA KAPPA, Replica, etc. It is worth mentioning that there is also an e-commerce platform dedicated to niche perfumes: Minorité.

The consumers of niche perfumes are mainly Gen Zs. They believe that the initially popular classics, such as Chanel’s NO.5 and Dior’s J’adore, Gucci’s Bloom, are too common to express their identities.

3. The popular high-related category: Home Fragrance

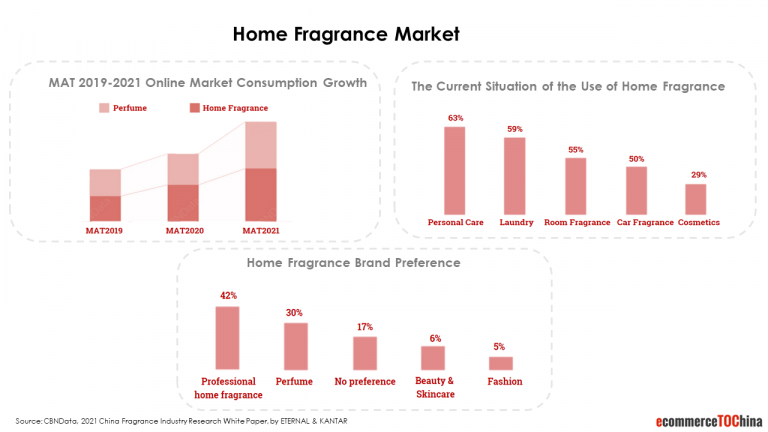

According to the 2021 China Fragrance Industry Research White Paper, the extended length of stay at home under the Covid-19 also stimulated the attention and purchase rate of the home fragrance category. Several brands have paid attention to this category, such as Loewe announced the launch of a home fragrance and scented candle collection in November 2020; Byredo launched 13 scented candles with IKEA co-branding in the same month.

Consumers are more likely to buy scented personal care and laundry products, followed by room fragrances, such as scented candles and scented oils + diffuser stones.

For the brand, consumers are more likely to recognize professional lifestyle brands than perfume brands.

4. Chinese brands with inherent advantage

Domestic competitors have also grown rapidly. Growing localism gives domestic names a unique advantage to leverage Chinese heritage to connect with consumers.

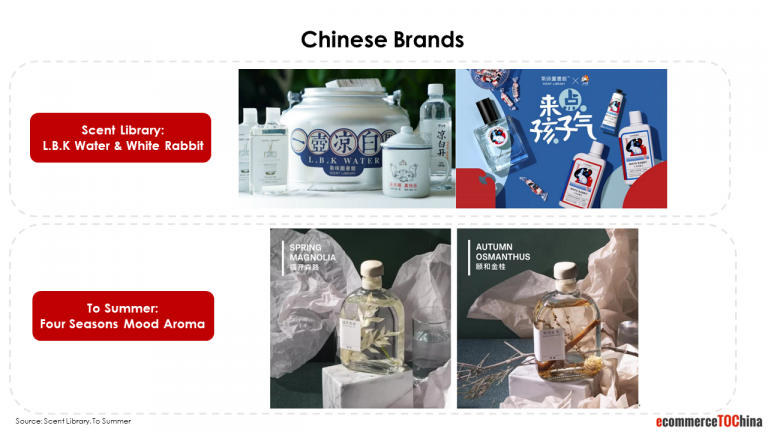

Scent Library(气味图书馆) has been particularly innovative at leveraging the psychology and nostalgia aspect of smell: L.B.K Water(凉白开) reminds consumers of the situation decades ago when Chinese families boiled water in aluminum pots; White Rabbit, as a popular childhood Chinese sweet, evokes traditional flavors from the past with smell.

To Summer(观夏) is another successful Chinese brand featuring original eastern botanic scents. To Summer aspires to recollect deeply rooted, affectionate memories by creating eastern scents so that all the product inspiration is about the eastern image. E.g. Inspired by different symbolic oriental plants in four seasons, Four Seasons Mood Aroma uses traditional floral design to interpret the fragrance and scene of the four seasons, with both the packaging and the name featuring an eastern image, like “福开森路Spring Magnolia”, ”颐和金桂 Autumn Osmanthus”, etc.

5. Online & Offline marketing channels

Online Online can be divided into e-commerce platforms and social media platforms, the former as a purchase channel, the latter as a promotion channel, with the cooperation of KOLs can establish brand awareness. Furthermore, private domain traffic(私域流量) is very important for building and maintaining a customer database. To Summer(观夏) can be a good example. As of May 2021, it owns a million WeChat subscriptions, 100,000+ loyal users, a 60% repurchase rate, and a GMV of over 100 million RMB only in the WeChat mini program store.

Offline As a category of experiential consumption, perfume brands also attach great importance to the creation of offline channels and stores. For example, Byredo opened three stores from May to July 2020. In addition to stores, other creative forms of immersive experiences are very popular. On August 23, 2021, Chanel held a 1-month perfume exhibition in Shanghai; on September 11, 2021, Diptyque held an art exhibition in Shanghai to commemorate the brand’s 60th anniversary.

6.Conclusion

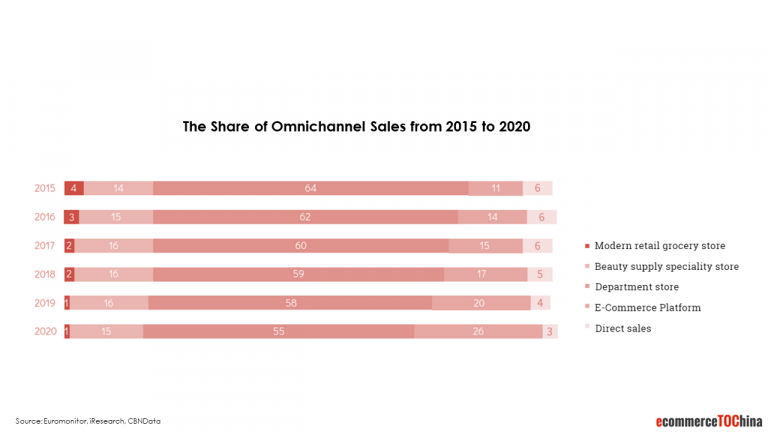

The perfume industry in China is booming, with niche perfumes, home fragrances, and local Chinese brands growing particularly rapidly. Brands often enter the Chinese market through online e-commerce platforms and partnering with influencers on social media to build brand awareness. For offline channels, the brand enhances the consumer experience by opening stores and pop-up exhibitions. Along with the development of digital technology, brands are committed to creating omnichannel operations and accelerating the flow of online and offline channels.

Want to have a first free consultation session about how to do marketing in China? Contact us.