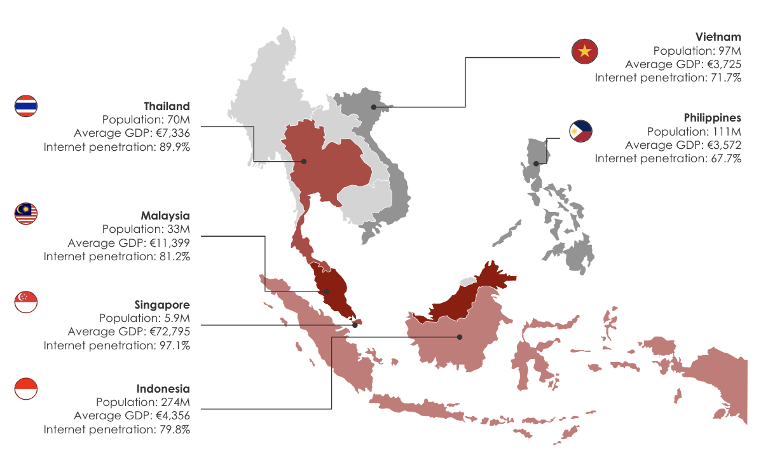

Southeast Asia is widely regarded as one of the most promising regions in the world, with projections indicating it will possess the world’s third-largest economy by 2030, following only China and the United States. With a population of over 650 million people, representing 9% of the global population, the region offers an enormous market potential. The prominent presence of the big 6 countries, namely Singapore, Thailand, Vietnam, Indonesia, Philippines, and Malaysia, in the market signifies their critical role in shaping the demographic and economic landscape of the region.

The booming e-commerce market with huge potential

In recent years, Southeast Asia has witnessed a significant surge in e-commerce development. According to a report by Meta & Bain & Company, the region’s e-commerce market reached a staggering $129 billion in GMV in 2022 and is projected to maintain a double-digit growth rate until 2027.

While all markets in the region are flourishing:

- Indonesia is currently leading the way, accounting for nearly 50% of the total e-commerce market in Southeast Asia.

- Thailand is also projected to become the second-largest e-commerce market in the region by 2025, with a compound annual growth rate (CAGR) of 14%, followed closely by Vietnam.

- As the only wealthy country in the region – Singapore still enjoys double-digit growth in e-commerce.

However, the e-commerce market is not saturated yet if we compare the penetration rate of digital economy over GDP: Per 2022 data from the Asia Development Bank, the digital economy accounts for only 7% of southeast Asia’s GDP, comparable to 16% in the People’s Republic of China, 27% in the European Union-5 (France, Germany, Italy, Spain, and the United Kingdom), and 35% in the United States.

The region’s e-commerce potential is promising in long-term, with below growth drivers:

1. Population benefits:

Southeast Asia boasts a rapidly expanding population of over 650 million individuals, a significant portion of whom are young and part of the burgeoning middle class. This dynamic has led to the creation of a massive consumer market with considerable purchasing power.

Young working population:

The growing number of individuals within Southeast Asia’s labour pool (between 15 to 64 years old) presents an opportunity for businesses and organizations.

The region’s growing labour pool, defined as people between 15 to 64 years old, presents an opportunity for businesses and companies. As per data from worldometers.info, the percentage of the working-age population within Southeast Asia countries is currently around 60% or even greater than 60% in countries like Vietnam, Indonesia, Philippines, and Malaysia, which already exceeds that of China. (source: worldometers.info)

Emerging middle-class:

The emerging middle class in Southeast Asia is another essential growth driver. According to Business Sweden, by 2022, the middle-class population in the region is projected to reach 350 million, almost doubling since 2012. As this significant, emerging middle class becomes more affluent and accustomed to a higher quality of life, the demand for high-quality foreign brands and sustainable products is expected to rise. (source: Sweden business)

2. Accelerated digital transformation

The region is experiencing a digital transformation, with an increasing number of people gaining access to the internet and mobile devices.

High internet penetration rate:

Internet use has risen steadily across the region. According to Google, 75% of the region’s total population is online (China – 70% ), while 60% of online populations in are 34 years old or younger. They are digital-savvy, spending about 60% of their waking lives online, which is 10 hours/per day. (sources: ecinsider/datareportal)

A surge in mobile usage:

Being late adopters of the internet, most consumers in the region have never owned a desktop computer. Mobile popularity, especially in rural areas, makes online shopping easier for everyone regardless of the economic situation, education level or desktop access. Indonesia emerged as the world’s most enthusiastic adopter of mobile e-commerce last year, with about 79% of Indonesia’s internet users purchasing something online via a mobile device, followed by Thailand (74%) and the Philippines (70%). (sources: datareportal)

3. Foreign investment promoted by government

The governments of Southeast Asian countries have been actively promoting foreign investment, creating a more business-friendly environment and further driving economic growth.

In 2021, Southeast Asia ’s internet economy investments hit an all-time high despite the pandemic. Investments maintained strong momentum in H1 2022. The Chinese giants Alibaba and Tencent have already invested in the region and are bringing technology and experience from the world’s largest e-commerce market to the region.

Decoding Southeast Asia e-commerce landscape:

1. Key market players:

The region has a rich landscape of local e-commerce companies with brands that few people outside southeast Asia will recognise. The largest players, including Shopee, Lazada and Tokopedia, are online marketplaces selling a diverse range of goods, similar to the Amazon model. They take a large share of Southeast Asia’s total online retail sales, which are forecast to reach $71 billion in 202. (source: webretailer)

2. Consumption trends

Electronics, fashion & clothing and baby care are the always-hot categories in the region. Due to the Covid-19, consumers purchase for basic daily needs like essentials: food and grocery enjoyed a considerable growth rate (+20%).

Consumer in search of value for money & better delivery options: According to a 2021 survey by PwC, 67% of Southeast Asia consumers consider price to be the most important factor when shopping online. Therefore, big promotion festivals like 11.11 and 12.12 are the critical moment to harvest the consumers (account for 50% of total sales) since consumers were educated to get the greatest deal during these festivals.

The same survey also indicates that 63% of Southeast Asia consumers are willing to pay extra for same-day or next-day delivery due to the region’s complect geographic issues. In Thailand, free shipping is the No.1 (57.7%) online shopping driver. In Malaysia, the rate is 67.3 %, and in Singapore, the rate is 57.3%.

Purchasing journey takes a detour between social media and e-commerce: E-commerce platform is the critical search tool instead of searching engine for Southeast Asia consumers (27% of consumers cited that e-commerce is the top choice for discovery). At the same time, videos on social media platforms also play an essential role, helping consumers discover the product recently (21% of consumers cited that social media with video is the top choice for discovery).

What’s more, 32.7% of consumers decide to buy a product after getting recommendations from influencers within a period. Also, 25% of Southeast Asian consumers are influenced by influencers many times before making product purchases.(Source: Southeast Asia’s Digital Consumers: A New Stage of Evolution published by Meta & Bain & Company)

A unique region needs more specific attention and localised strategy

Despite the market potential, the logistic limits, complicated payment methods and culture diversity differ from what we may be used to, bringing more challenges for doing business in the region.

1. Last-mile logistic limits:

Due to its vast and complex geography, Southeast Asian countries present logistical challenges to e-commerce companies. Island countries, long rivers, mountain ranges, and seas divide the region, and underdeveloped infrastructure in some areas can make it difficult to deliver goods and services to customers. Therefore, logistics costs and timeliness have become crucial factors for consumers when making purchasing decisions. To address this issue, many big e-commerce platforms have started investing in their own warehouses or logistics arms, which can ensure efficient and reliable last-mile logistics for their customers.

2. Complex payment methods:

SE Asia payment methods vary due to currency and economic development. Consumers in Singapore (75%) and Indonesia (34%) prefer credit/debit cards, while Malaysia (50%) and Thailand (29%) prefer bank transfers. Cash-on-delivery is popular, with Vietnam (52%), Thailand (20%), and Indonesia (15%) being top users. Mobile payment is growing in emerging markets, with Grab, Airpay, true money, and Bukalapak providing digital payment services. Digital wallets are gaining traction and expected to be used more, except in Singapore where credit cards still dominate.

3. Culture & economic Diversity:

The region is culturally and ethnically diverse, with hundreds of languages spoken by different ethnic groups. They often continue to take pride in their traditional customs, dances and dress.

In addition, the income level is also unbalanced. Singapore is the only developed country with a high-income level, where the consumers are more mature and rich. Malaysia and Thailand belong to the mid-to-high group, while Indonesia, Vietnam and the Philippines are relatively low-income regions.

The multi-lingual, multi-religious, and multi-cultural differences in Southeast Asia place higher demands on the localized operation strategy of brands (product assortment, customer service, etc.) as there is no one-for-all strategy for the whole region.

What eTOC could help you?

Understanding the vivid but diverse Southeast Asian market could be a challenge for many Western or even Chinese brands. As an e-commerce expert, eToc is here to help you identify market opportunities, find the right go-to-market strategy, and accompany you for long-term growth in the future.

Download our APAC E-Commerce Whitepaper

Free Download

Want to expand to the southeast asian e-commerce market? Contact us for a first free consultation.