The Chinese Pet Market

1. An overview of the Chinese pet industry

With marriage rates declining and the aging trend increasing, the companionship of pets is becoming increasingly important for many people living alone in cities today. Most recently, the restrictions imposed by the COVID-19 pandemic have further increased the need for pets.

The demand for keeping pets is therefore based on psychological aspects and has developed into a common way of life in the cities. According to the 2018 China Pet Industry Report, pet households grew from 69 million in 2013 to 99 million in 2018, a five-year growth of 43.9%. The latest number show, that in 2021 the number already reached 112.35 million.

The increasing number of potential pet owners can also be attributed to the popularity of pet videos on short video platforms such as Douyin (aka Tiktok). The rapid economic development not only has an impact on the urbanization of the population but also ensures an enormous increase in the income of city dwellers, which in turn enables them to spend more and more on their pets.

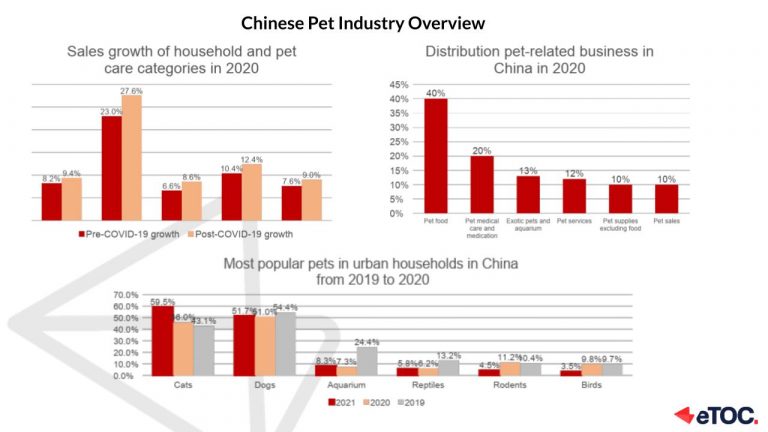

The annual demand for pet care products is increasing worldwide, but the trend is particularly strong in China. While pre-covid 19 growth was already above average at 23%, it reached up to 27.6% after the pandemic.

2. Three stages of the pet industry in China

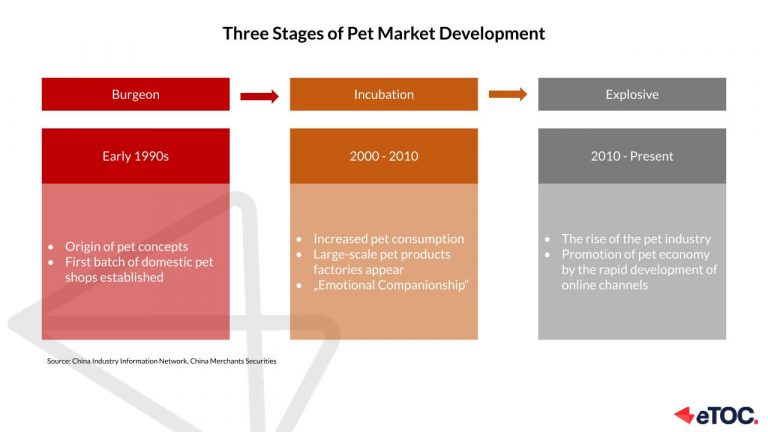

Keeping a pet has a long tradition in Chinese history, but the modernized market only flourished in the 1990s. Since then, the Chinese pet products market has gone through three stages of development.

Since the early 1990s, owning a pet has become more attractive to many people. This trend was followed by the first batch of offline pet products stores, fueling the growth of the pet-specific economy. In this decade, China’s pet industry has entered a period of prosperity and development of the pet products market.

In the following decade, in the 2000s, the second phase of the pet market, the incubation phase, began. Pets have come to be seen as “emotional companions” for many people and increasingly as part of the family. The increase in consumption of pet products brought about by this change in mentality has also encouraged the expansion of pet product production in large factories in China.

At the beginning of the 2010s, China’s pet industry entered the explosive phase, and the pet product market entered a rapid development phase. People who choose to keep pets are no longer a minority in the city. In addition, the consumption volume of the pet products market has also grown tremendously along with the number of households keeping pets.

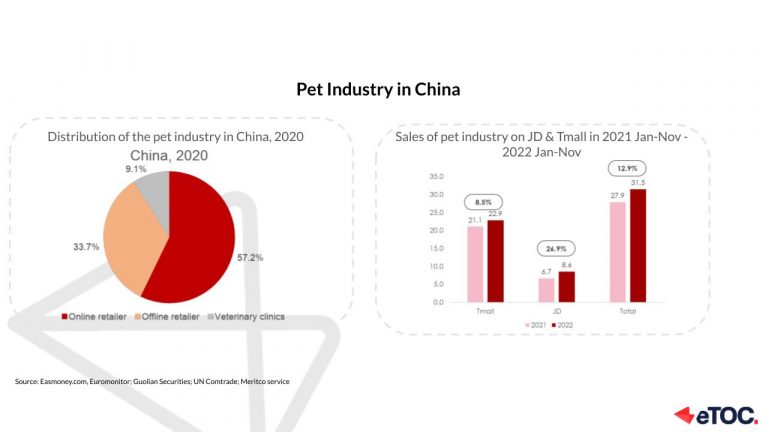

The most striking feature of this phase is the explosion in online consumption of pet products. Today, the online consumer market for pet products far outstrips the scale of offline consumption.

3. Rising online market

According to the most recent data, most pet food is purchased by online retailers. E-commerce platforms provide Chinese pet owners with more convenient purchasing channels and more diverse choices than offline stores, causing the online pet market’s consumption volume to grow rapidly. In 2022, Tmall and JD showed a combined YoY growth rate of 12.9% compared with the same period from Jan to Nov 2021.

4. Chinese consumer profiles

To gain a better understanding of the online market, it can be helpful to look into the profile of the key consumer.

Looking at online consumers by region, one finds that the number of consumers from rural areas is very small and almost all online consumption is attributed to urban pet owners. Consumption is particularly strong in first-tier cities.

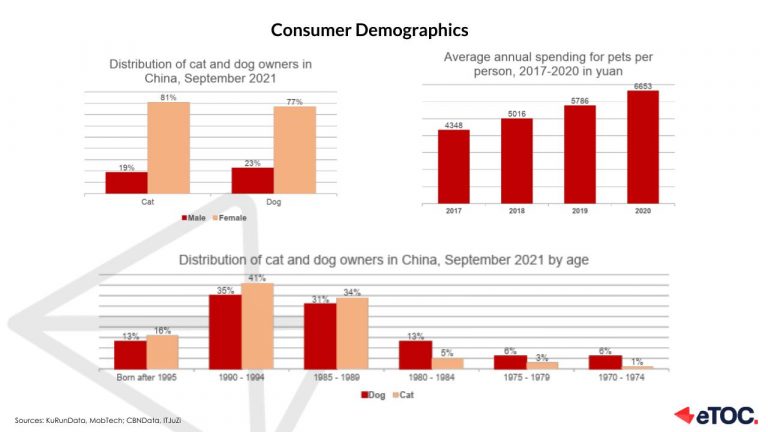

There are also gender differences in online shopping among consumers of pet products. Female customers make up 60% of consumers and male customers the remaining 40%. At the same time, young consumers (born after 1990/95) account for the largest share of consumption of all age groups, which is more than 40%. Here, too, female consumers make up the largest proportion. Interestingly, the age and gender distribution of pet owners who shop online also represent the distribution among pet owners. This may be related to the rapid development of online e-commerce, while offline stores are still immature and still need to improve.

The driving forces behind the rapid increase in sales are millennials and Gen Z consumers. Gen Z refers to those born between 1995 and 2010, so they are younger than Millenials. One of the reasons they prefer to have a cat rather than a dog is that cats are cheaper to keep and take up less time. Also, cats are very popular on social media platforms like Douyin.

In general, social media platforms like Xiaohongshu (RED) or Weibo, Douyin or WeChat contribute a lot to young people’s interest in pets. So-called pet live streams are attracting more and more attention and creating imitators. At the same time, they are used to promote dog food, for example, or to show off other, new toys.

As described, online purchasing is becoming more and more attractive for most pet consumers. This is due to 67% pure convenience. In addition, many customers rely on trusted platforms such as Taobao (56%), the wider selection, many promotions and other online reviews also play an important role. When it comes to the pure pet food purchase criteria, the three most important factors are 1. nutrition and ingredients, 2. palatability, and 3. reputation of products among users (CBNData 2021).

5. Trend: Refined pet food and pet smart supplies

5.1 Huge potential for refined and multi-functional food

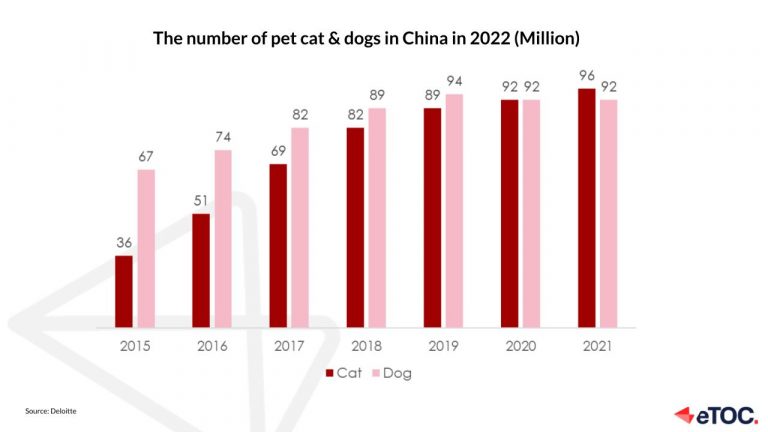

Cats > Dogs: Due to fast-paced urban life, small living spaces and strict restrictions on dog ownership in the city, people living in the city seem to prefer cats over dogs, resulting in the number of cats surpassing that of dogs in 2021, in terms of house pets.

Cat food sales in 2022 accounted for 59.6% of total pet food sales with a YoY growth rate of 29.5% which is faster than that of dogs.

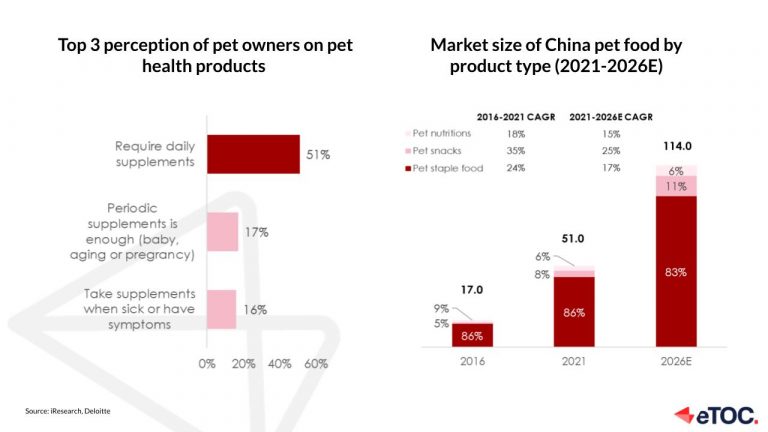

Pet snacks with specific nutritional and healthy functions will gain increasing popularity: They are the fastest-growing category in 2016-2021 and are expected to continue by 2026. Cat snacks advertising cheek fattening, teeth-grinding and hairball digestion increased sales by 29.6% YoY.

This shows that pet owners are paying more and more attention to their pet’s diets, so the selection and purchase of essential pet foods have also become more sophisticated.

Compared to staple foods, there is a clearer trend toward improvement in dietary supplements. In addition to the frequently used and very popular dietary supplements such as vitamins, probiotics and calcium tablets, there is also a trend towards customized pet food supplements.

Depending on the type of pet, the effectiveness of the top products responsible for high consumption of cat and dog nutritional products is not uniform. When it comes to cat nutrition, products to prevent hairballs caused by cat-licking habits account for the highest percentage of consumption. Since most cats have a weaker gastrointestinal tract, gastrointestinal conditioning nutrients follow in second place among functional nutrients for cats.

From a dog supplement perspective, pet owners prefer basic immunity and calcium supplements when choosing products. In addition, hair care food is used in both cats and dogs.

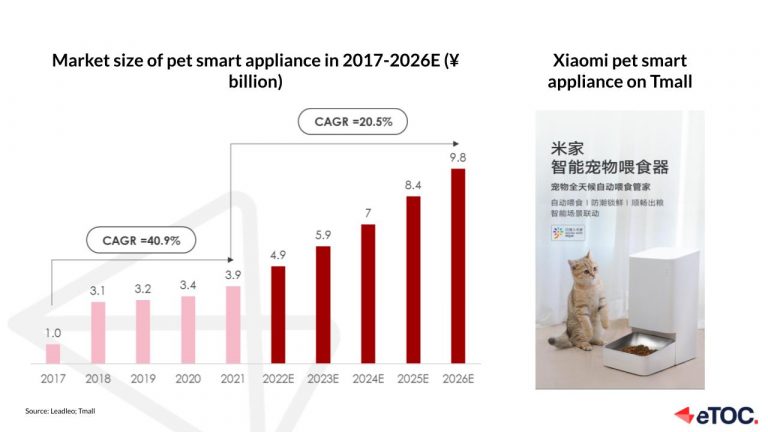

5.2 Pet smart supplies market is a growth engine

The demand for smart pet supplies such as smart water dispensers and smart feeding machines is also increasing. 52.9% of pet owners purchased smart pet supplies in 2021 compared with 43.1% in 2020. The market is expected to reach ¥9.8 billion in 2026 with a CAGR of 20.5%.

E-commerce platforms started to provide support to the pet industry. Tmall upgraded the “pet” category to a first-tier category in 2021, focusing on incubating new brands. Smart pet supplies’ sales increased by 500%+ during the Double 11 shopping festival in 2021.

During the same year, JD announced that it would incubate more than 50 new brands, mainly focusing on pet food, pet supplies and pet services.

As one of the categories that was showing growth, the pet market will continue to grow, especially in the subcategories of pet foods and snacks. With more companies and platforms participating in the market, competition will intensify.

6. Conclusion

Stimulated by new e-commerce offers such as live streaming, short videos and the changing attitude of owners to treat pets as family members, new needs and new consumption habits are constantly emerging.

The refinement and functionalization of the pet food market and rising pet smart supplies have presented challenges to various brands in the market. Brands need to grasp the new market trends, meet new consumer preferences and mature their own products to achieve growth in their own sales performance and gain brand advantages.

Want to expand to the Chinese market? Contact us for a first free consultation.