How to choose logistics solutions for new brands China entry?

With the rapid development of China’s e-commerce market, more and more brands have entered the Chinese market and achieved outstanding results. Choosing a suitable logistics solution is very important and can help brands save a lot of unnecessary costs. In this article, you will learn how to choose an appropriate logistics solution based on your products’ characteristics, and other important knowledge and regulations for cross-border e-commerce (CBEC):

- Can my products be sold to China via Cross Border E-Commerce?

- How to choose a suitable CBEC logistics solution?

- Bonded Warehouse Model

- B2C Direct Shipping Imports

- C2C Direct Mailing Imports

- Who handles the currency exchange?

- What are the steps for CBEC logistics custom clearance?

1. Is China a mature CBEC market?

Currently, China’s CBEC market can be divided into three phases:

- CBEC 1.0 | Daigou era | 2005-2007

- CBEC 2.0 | Haitao era | 2007-2014

- CBEC 3.0 | CBEC era | 2014-now

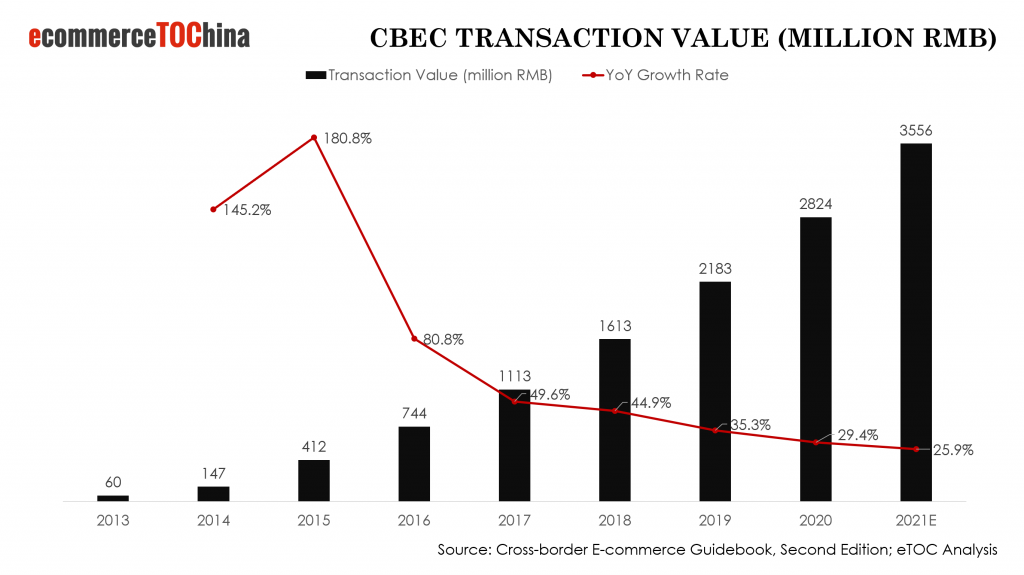

From the above chart, we can see that since China entered the CBEC era, the cross-border e-commerce transaction value has entered the rapid growing stage. Even in 2020, China’s CBEC still maintained a high growth rate of about 30%.

2. Can my products be sold to China via Cross Border E-Commerce?

After understanding the situation of China’s CBEC market, your first question might be: can my products be shipped to China legally?

2.1. Positive list

Only products that fall into the List of Goods under CBEC Retail Import (also known as the “Positive List”) are permitted to be traded to China via CBEC.

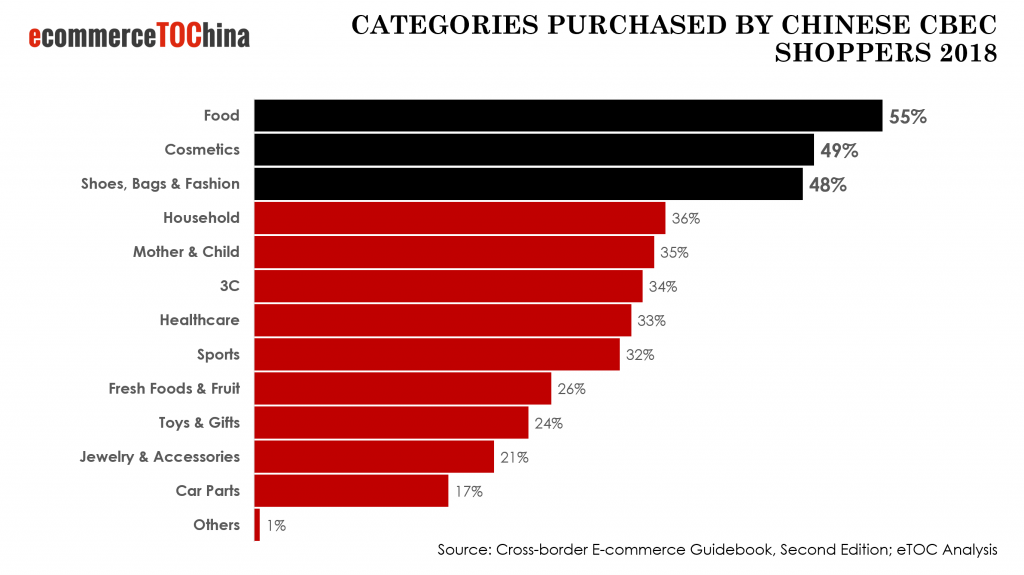

Below is the chart about popular categories purchased by Chinese CBEC shoppers. We can find that most of the products can be sold to China through CBEC. If you want to double-check whether your products are qualified or not, you can click the link below to explore the List of Products Authorized for Retail Import via China’s CBEC: LIST_OF_PRODUCTS_AUTHORIZED_TO_BE_TRADED_VIA_CBEC_EU_SME_CENTRE.pdf

The full list of allowed items (in Chinese) can be found here.

2.2. CBEC pilot regions

The CBEC Pilot Zones are designated areas, generally near large trade ports, that provide a favorable business environment and infrastructure for CBEC activities. The main features of these pilot zones are the so-called bonded warehouses.

Initially the advantages of these zones were that it made the physical distance between the product and consumer much shorter. Furthermore, no import licenses or test reports were required, and only a one-time company and product registration was needed. Moreover, lower taxes are applied for brands that used bonded warehouses, making CBEC Pilot Zones both an easier and cheaper to launch new and unknown products from abroad. The Pilot Zones have boosted the growth in Cross-Border E-Commerce.

More and more pilot cities and regions are approved to conduct CBEC since first approved in 2015. In January 2020, China announced the expansion of CBEC pilot areas to Hainan Island and 50 other cities, including Jinan, Lhasa, and Urumqi. Till now, the total number of CBEC pilot cities and regions has reached 86 (Source: Ministry of commerce of people´s republic of China).

3. How to choose a suitable China CBEC logistics solution?

3.1. Bonded Warehouse Imports

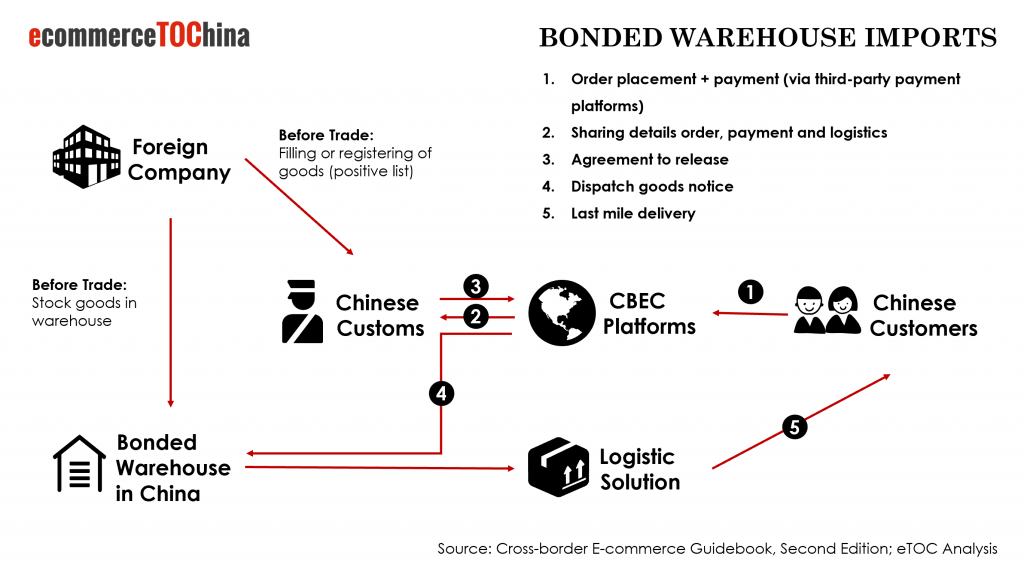

Bonded warehousing (B2B2C) is a quicker option in terms of logistics to sell products in China via cross-border e- commerce. A bonded warehouse is a building or secured area in a special customs supervision area in China where dutiable goods may be stored without payment of duty. So, ordered products generally arrive quickly at the customer’s home.

Only if a brand’s goods are on the positive list, it can consider holding its goods in stock in a bonded warehouse. Simplified and faster product registration will apply, overseas companies can postpone import duty and VAT charges, and it is easier to move their revenue to a foreign bank account. Furthermore, no local Chinese business entity is required.

Therefore, bonded import is an excellent method to test new products on the Chinese market. By stocking a small initial batch of goods in bonded warehouses, which can quickly be distributed to the Chinese consumer, companies can simulate selling CBEC in China without risking large losses as a result of high investment in stock. Thus, for new to the market, medium turnover, or larger items with steady demand, reasonable stocking in China is advisable to decrease operational costs, logistics costs and turnaround time.

Please refer to below graphic to understand the China Bonded Warehouse process:

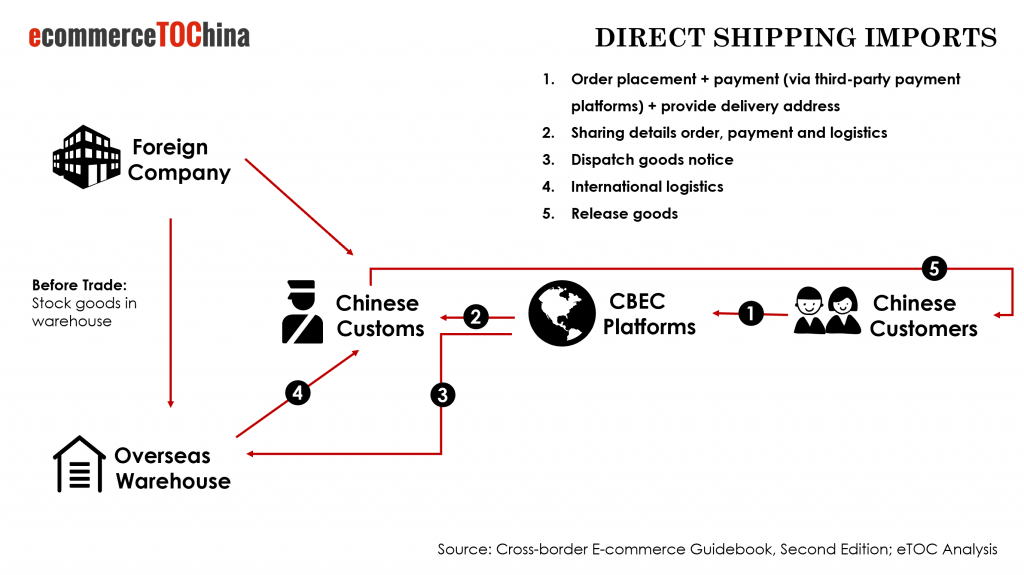

3.2. B2C Direct Shipping Imports

As the second dedicated method for eCommerce shipping promoted by China government since 2014, B2C direct shipping imports only takes 24 hours to complete clearance, which reduces the total transit time to 5 to 12 days. Some logistic providers will handle the custom tax on behalf of the merchants. The parcels will be consolidated to bulky goods and freight forwarded to a China bonded area for swift custom clearance. At the same time, the merchant’s eCommerce website or selling platform needs to host Chinese payment methods like Alipay or WeChat Pay, as the China customs requires payment information from the payment company in order to validate the goods value.

Since the products are stored in merchants´ oversea warehouse, there is no initial shipping costs unless an order is placed. This offers the merchants a lot of inventory flexibility and often used in the beginning phase of CBEC selling to China. It is also often used by relatively high value items with smaller order numbers. Most of eTOC´s WeChat Mini Program Store merchants prefer to use this method.

Tax rates for CBEC, which applies for both Bonded Warehouse Imports and B2C Direct Shipping Imports:

The Chinese Ministry of Finance announced a new set of regulation affecting cross-border purchases. The new rules will take effect on the 1st of January 2019.

The main change of the new regulation is the increase of the cut-off amount for tax-free cross-border purchases:

- Single-transaction amount increased from 2,000 RMB (256 EUR) to 5,000 RMB (641 EUR)

- Yearly amounts of cross-border purchases increased from 20,000 RMB (2560 EUR) to 26,000 RMB (3333 EUR)

According to the existing CBEC policy, on the condition that a single transaction value is under RMB 5,000, and the annual transaction value is within RMB 26,000, the import tariff rate is fixed at 0%, and at the same time, the import VAT and consumption tax enjoys 70% of the tax payable.

Therefore, the CBEC tax rate is calculated as below:

CBEC Comprehensive Tax Rate = [(VAT rate + Consumption tax rate) ÷ (1 – Consumption tax rate)] × 70%

Starting from April 1st 2019, China’s VAT rate was updated as follows:

- Manufacturing sector (including imported goods): dropped from 16% to 13%

- Construction and transport: dropped from 10% to 9%

- Services: remained at 6%

This reduction of VAT tax will significantly impact the tax rate of CBEC:

- For most products (with 0% consumption tax), the CBEC integrated tax is lowered from 11.2% to 9.1%

- For high-end cosmetics, CBEC integrated tax rate is lowered from 25.53% to 23.05%

*High-end cosmetics refers to products with an after-tax wholesale import price above 10 RMB/ml(g) or 15 RMB/piece.

Here is a list of CBEC integrated tax rate for each product category (in Chinese).

In practice, this reform opens the cross-border market for a lot of luxury retailers with products in the 2,000 to 5,000 RMB range. For industries such as high-end fashion and cosmetics which strongly appeal to Chinese cross-border buyers, this is a game-changing move.

But on the condition that a single transaction exceeds RMB 5,000 or/and the annual transaction value beyond RMB 26,000, the products imported via CBEC should be subject to the same rates of the taxes under general trade mode, i.e. cannot enjoy the 0% import tariff, and no more 70% VAT and consumption tax rate.

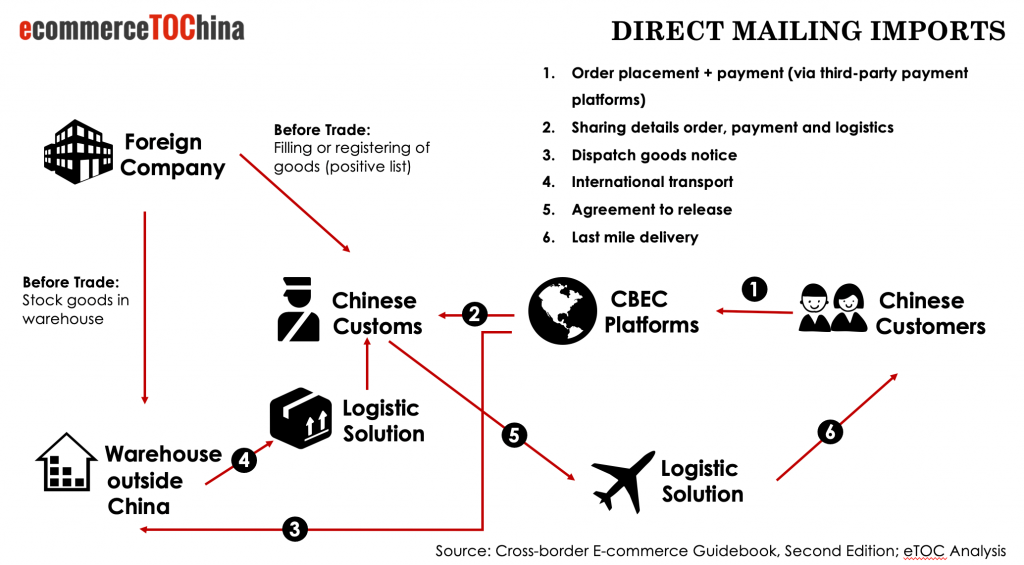

3.3. C2C Direct Mailing Imports

After the goods have been ordered online and the product, VAT and customs duty have been paid by the consumer, the goods (in individual parcels) will be dispatched from overseas warehouses by direct mailing. This solution is suitable for brands that seek to introduce new to the market products, small products, or low turnover, high value items. There are two types of direct mailing imports – postal and personal express- and they differ significantly.

3.3.1. Postal

In this mode, the goods are custom cleared by China Post, which since 2019 has merged with the well-known EMS service but operates solely under the China Post name. No data interface is required as clearance will be based on the description and value written on the postal label. The customs inspection will be done on a sample size, so there is a chance that products will not be taxed.

However, the customs system has recently been integrated into a nationwide system which gives a comprehensive database for stricter checks on goods sent by post. Since the introduction of the following personal express and direct purchase import options, the total volume sent by post has reduced significantly.

3.3.2. Personal Express

The parcels will be consolidated to bulky goods and freight forwarded to a China local custom port for express clearance. Each parcel requires separate, accurate and detailed declaration manifest including recipient’s ID info, item specification (category, name, brand, net weight, gross weight, unit, value etc.)

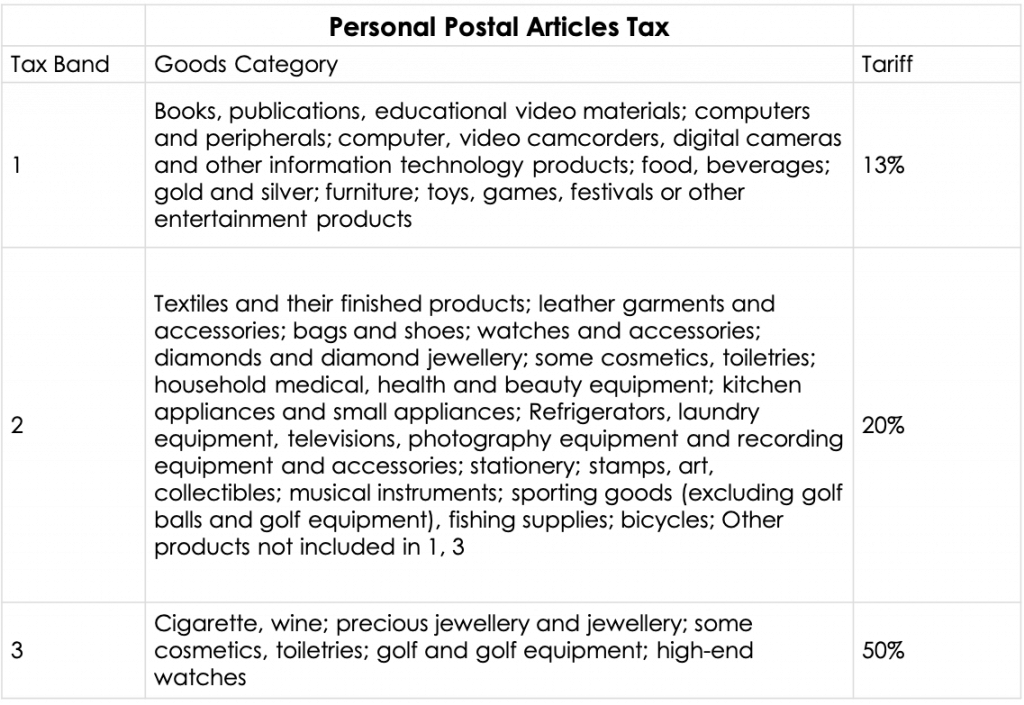

The total value of the parcel content is limited to 1000RMB unless it contains only single item which cannot be divided (e.g. a handbag or a pair of shoes). By using this method, personal postal articles tax will be applied (please refer to Personal Postal Articles Tax) and tax will be waived off at a tax value below 50RMB.

3.4. How to choose the right logistics solutions for China?

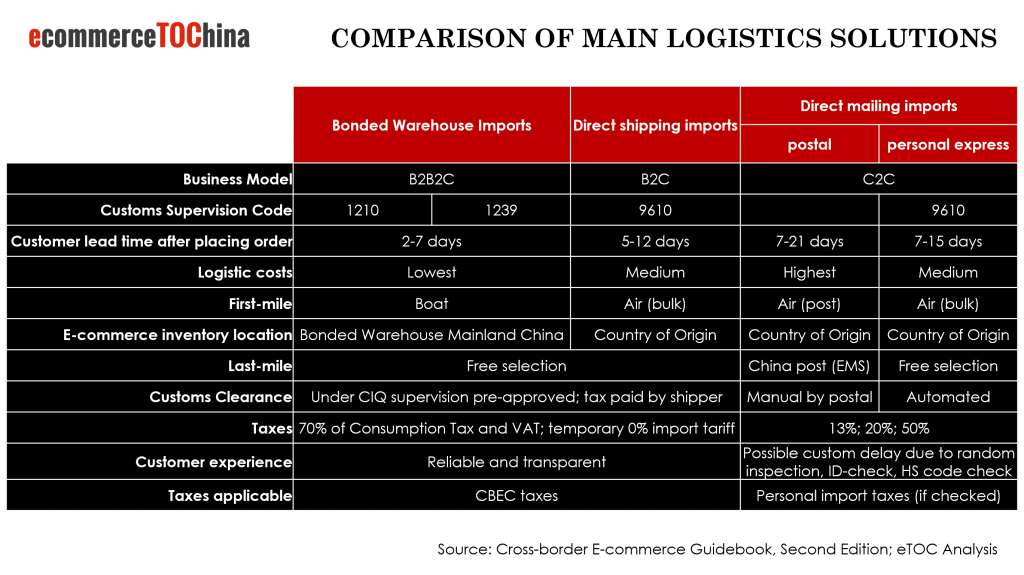

After introducing the main CBEC logistic solutions, we simply compared their basic status to help you better understand the differences between these models:

Which solutions to choose depends on the type, weight and value of the products. Companies should consider different import modes for different products if they want to take advantage of lower tax schemes.

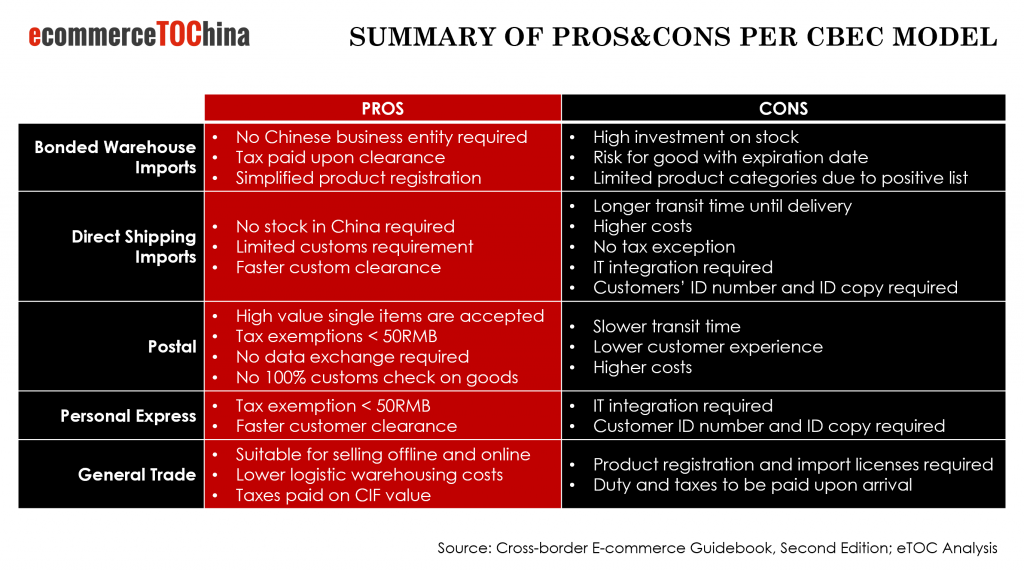

Companies should take into account that their import modes can change dramatically over time. The advantages and disadvantages of each logistic solutions are summarized in the table below:

4. How is the international payment handled for CBEC transactions?

For foreign companies without a legal entity or bank account in China, getting paid for selling their goods on Chinese CBEC platforms can seem challenging at first. However, Chinese cross-border payment methods are generally very sophisticated and convenient, and international companies should not be discouraged to engage in cross-border e-commerce because of them.

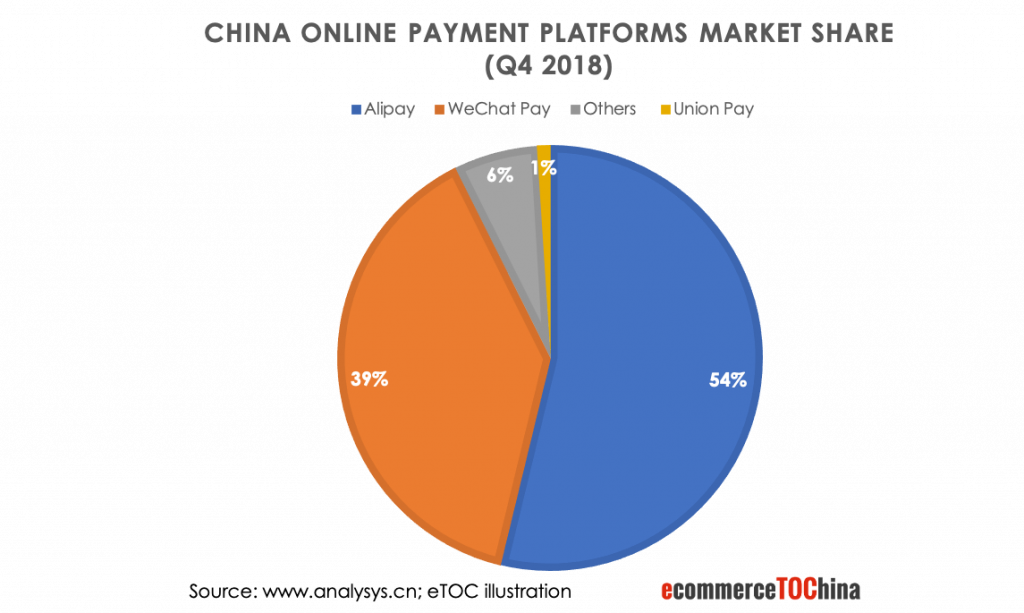

Chinese consumers pay for their purchases through a single transaction via the overarching marketplace or platform (e.g. eTOC WeChat Mini Program Shop System) checkout system. Although available, credit cards (MasterCard and Visa) are not popular payment methods for Chinese consumers. Instead, they usually opt to pay via third-party online payment platforms such as Alipay, WeChat Pay or Union Pay. These have been integrated into all cross- border marketplaces and serve as transaction intermediaries.

For companies without a bank account in China, Alipay and WeChat pay, among others, offer cross-border e-payment solutions. This allows Chinese shoppers to pay in RMB for their CBEC purchases. Accordingly, once the RMB payment is converted into a foreign currency, the sum will be remitted into the company’s overseas bank account. For these services no Chinese bank account is required.

To sell on their marketplaces many CBEC platforms require a mandatory connection with their integrated online payment system. For example, opening a flagship store on Tmall Global requires a corporate Alipay account. When using eTOC´s WeChat Mini Program Shop System, a third-party payment provider is also integrated. Therefore, in order to get paid, foreign brands that seek to engage in CBEC in China should consider what cross- border e-payment solutions they want to, should or can use when choosing for a CBEC marketplace. Although all e-commerce platforms have integrated online payment systems, government regulation stipulated that e- payments have to be independent from e-commerce platforms as to ensure transaction safety. At the same time international companies are advised to choose a licensed, certified third party payment service provider with a foreign trade license.

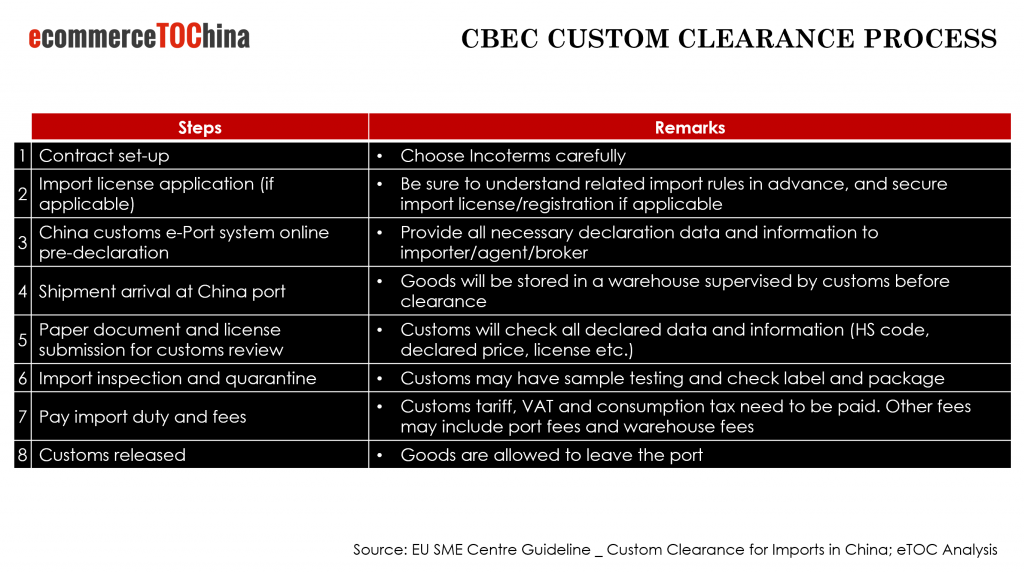

5. What are the steps for CBEC logistics custom clearance?

According to customs regulation, all CBEC players are required to register at customs. Foreign companies undertaking CBEC should authorize a China domestic agent to register at customs for them. The authorized agent will take joint liability on product safety and quality.

The customs clearance under CBEC is different from general trade mode. The whole process has been significantly shortened since 2015. China customs are required to provide all-year-round services to CBEC, and customs clearance is required to be processed within 24 hours, provided all required documents and data are correct. In practice, some products can be cleared within a few hours.

Before arrival of shipments, customs clearance data should be online submitted to the system of China customs at the port of entry. The port customs will check whether all the 3 types of data can match with each other, i.e. transaction data, payment data, and logistics data. Other key information need customs check before clearance including: name and ID information of buyer, transaction value and annual transaction value, import price, import taxes etc.

To illustrate key steps for EU exporters, we summarized major customs clearance steps to better understand the whole clearance process:

This process is often handled by an experienced 3rd party agency (e.g. eTOC) or a logistic service provider, so that merchants only have to provide the necessary documents and do not have to particularly worry about it.

6. How can eTOC assist you with CBEC logistics?

We help international brands sell and grow in China via e-commerce and digital marketing. We can assist you to:

- Choose the right CBEC platforms for your brand.

- Choose the right CBEC logistics model for your products.

- Make the delivery process as smooth as possible.

- Build your own WeChat store in China.

- Develop a strong ecommerce marketing strategy on Chinese platforms.

- Optimize your customer service performance.

……Explore more about eCommerce to China at our official website:

www.ecommercetochina.com or contact us:

Want to have a first free consultation session about selling and growing in China via e-commerce and digital marketing? Contact us.