Key Takeaways from eTOC:

We have identified the Double 11 key insights to understand how platforms and brands keep growing and what is new opportunities in China’s retail landscape.

1. Loyal customers bring long-term business growth opportunities. There needs to be more than price discounts to retain customers. The platform empowered brands to better serve and convert customers by upgrading the shopping experiences: consumer-friendly starting time (8 pm instead of midnight), Smooth ordering process (shopping cart upgraded) and various loyalty membership benefits.

2. The older population has become the new online consumption driver. The growing ageing population, the high internet penetration rate and the emergence of more convenient and easy shopping formats (i.e. live streaming) are the key driving force behind them. Besides, this year’s serious lockdown also accelerated their online shopping behaviours.

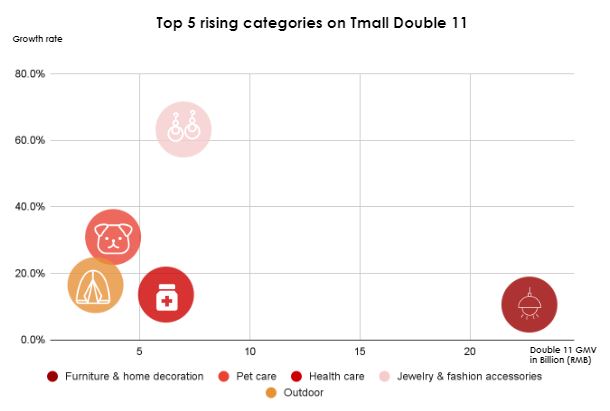

3. The epidemic brings both challenges and opportunities to product categories. In the post-covid era, consumers transferred their focus to “in-home” activities and self-pleasing/self-caring products: pet care, home furniture, jewellery, and health care are the top rising categories.

4. There is a huge shift in Chinese consumers’ consumption habits. The impact of Covid still exists in China. For brands, keeping a close eye on the different emerging needs of different target audiences is critical.

Decoding 2022 Double 11 with five key initiatives

- Celebrating everyone’s life instead of being a business engine

With the impact of the domestic lockdown, the growth rate of e-commerce in China slowed down. This double 11 aimed at stimulating domestic demand and enhancing consumer enthusiasm.

Tmall:生活就该这么爱 (Life is love)

The language of communication has been centered on “emotion”, creating the ideal life atmosphere of Double 11.

JD.com: 给生活多一点实在 (Enrich life with more practical products and best deals)

The center of the strategy shifted to the daily necessities goods. Supermarket business became the main force of JD’s second retail venture.

Douyin:遇见懂你的好物(Meet good things that understand you)

The posts collaborated with brands to strengthen the perception of “Douyin brand official flagship stores”.

- Empowering SMEs with more benefits & supports

There is a consensus between Tmall and JD.com in supporting SMEs.

With Taobao and Tmall’s back-end operations set to be unified, Alibaba this year provided more initiatives to help young people and SMEs in their entrepreneurial development. Through four new initiatives, JD.com aims to achieve over 100% YoY increase in the number of new merchants. The sales of SMEs are objected to increasing 100% YoY.

- Offering the biggest discount without complex promotional rules

All platforms and brands have shifted their focus to retaining users and bringing them a better shopping experience this year.

Tmall promotion this time is a 50 RMB discount on every 300 RMB across participating stores – one of the biggest discounts recorded in recent years. Moreover, enticing incentives for merchants and consumers were introduced, i.e. access to Alibaba’s marketing management platform “DMP” for all merchants.

JD.com implemented an automatic 50 RMB discount on every 299 RMB and a 100 RMB discount on every 1000 RMB across all stores, which participated in Double 11.

Douyin is stepping up to challenge Tmall and JD.com with its own in-app retail stores. They are giving a discount of 30 RMB on every 299 RMB across all participating stores.

- Bringing a better shopping experience

To optimize the ordering process, Tmall upgraded the volume of a shopping cart from 120 to 300 products and enabled one-time order with multiple shipping addresses.

Moreover, Tmall extended the Double 11 price guarantee period from 15 days after the order to 27 days.

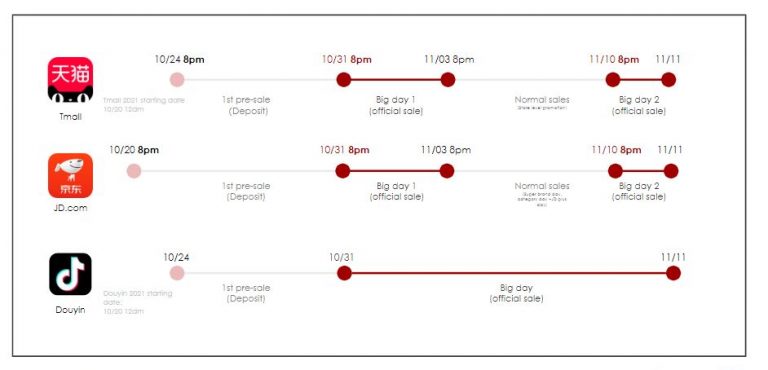

All the platforms advanced the pre-sales and official days from 12 am to 8 pm, preventing consumers from staying up late.

Double 11 performance recap

In an unprecedented move, neither Tmall nor JD.com announced their GMV (Gross Merchandise Volume) results for this year’s Double 11.

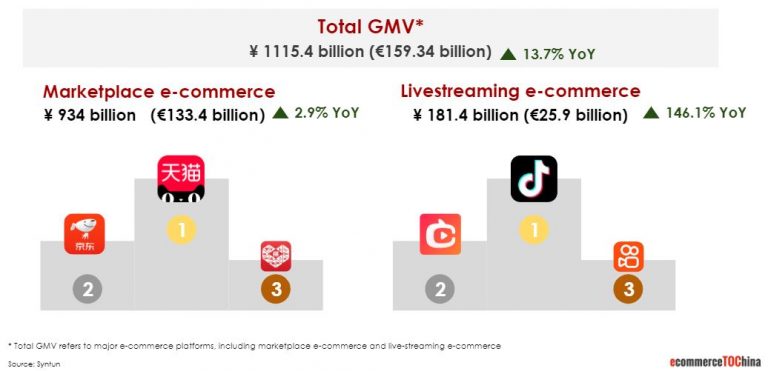

According to Syntun – as third-party data provider, the Double 11 festival keeps growing in terms of total online sales value. From 20:00 Oct 31 to 23:59 Nov 11, the total online GMV achieved ¥ 1,115.4 billion, with 13.7% YoY.

1. Marketplace e-commerce still dominates the market (83.74% sales share) by exceeding ¥ 934 billion. But the growth rate slowed down to 2.9%.

Tmall still ranked first in marketplace e-commerce, with the same GMV as last year (¥540.3 billion). Regarding its Top 100 categories, the total amount dropped by 2.68%, but ATV (average transaction value) rose by 7.57%.

This might be influenced by three factors:

1)The general environment of tight consumption; (beauty, personal care, male cosmetics, shampoo)

2)Emerging channels that divided traffic;

3)Shortened duration (Double 11 last year with four more days than this year);

2. Livestreaming e-commerce platforms performed brilliantly, with a GMV of 181 billion, a total increase of 146.1%.

Douyin ranked first in the live-streaming e-commerce. During pre-sale, the GMV increased by 405% YoY. During Double 11, 7,667 live streaming channels exceeded ¥ 1 million GMV. Merchants who joined Douyin Double 11 have grown 86% YoY.

For Taobao Live, over 500,000 new hosts joined it over the past 12 months, including Luo Yonghao who used to stream exclusively on Douyin and has over 19 million followers. More than 300 million users have watched the live streaming. On the first day of Tmall Double 11, new live streamers(684% YoY), mid-tier live streamers (365% YoY), and live agency (165% YoY) burst into growth. The back of Austin LI in Taobao live brought 33 billion GMV.

Key trends to watch:

- Quality of life & spiritual needs of consumption on the rise

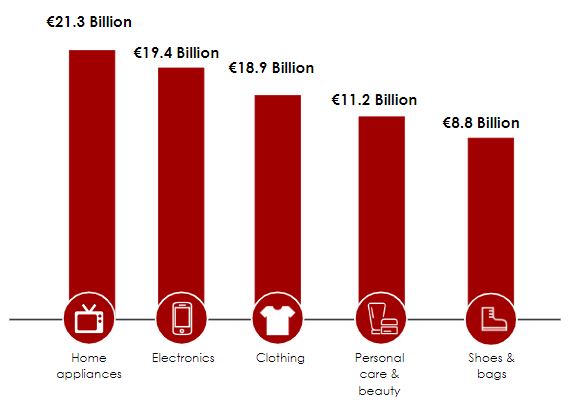

Home appliances(15.7% sales share), electronics(14.3% sales share), clothing(13.9% sales share), personal care & beauty (8.2% sales share) and shoes & bags (6.5% sales share) still ranked top 5 in terms of total online GMV.

On Tmall platform, jewelry & fashion accessories, pet care, outdoors, health care, and furniture are new winning categories with high growth rates.

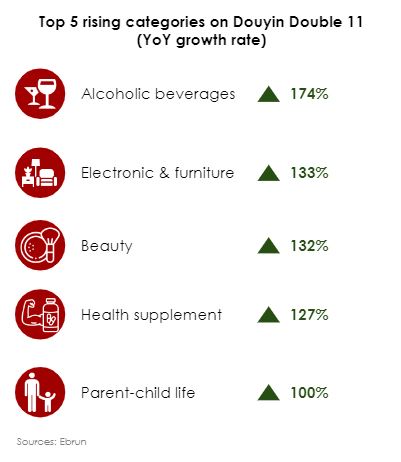

On Douyin, beauty, parent-child life, electronic & furniture, health supplements, and alcoholic beverage categories gained more than doubled growth.

2. “China-chic” products maintain popularity

Domestic products continue to be the first choice of consumers. Alibaba’s Tmall reported that 102 brands surpassed RMB 100 million in total sales in the first hour, of which more than half are domestic Chinese brands. “China-chic” products inspired by traditional culture also led the way at JD.com. According to Douyin’s 2022 Double 11 report, domestic goods accounted for more than 90 percent of the top 100 best-selling products.

3. Green consumption a norm

Green consumption is becoming a way of life. Beyond commercial value, the platforms continue to enhance their ability to create social value, leading the way to a green and low-carbon lifestyle by offering more green and low-carbon consumption options.

According to Tmall data, more than 16.33 million people bought green goods during the Double 11 period;6 million pieces of packaging are expected to be recycled; over 7 million Xianyu users have participated in phone valuation and recycling, reducing carbon equivalent to planting 3.5 million trees.

4. The elderly may be the next growth engine

Impacted by the macro environment (domestic lockdown, tech layoffs, etc), part of the young generation shifted to rational & minimal consumption with the depressed sentiment. However, the elderly started enjoying the online shopping festival. According to JD.com, from 8 pm October 20th to 12 am October 27th, the per volume by the elderly increased by 47% year-on-year.

Taobao also launched exclusive customer service for the elderly ahead of Double 11 to help them.

According to Taobao, Douyin, Pinduouo, physical examination services, health supplements and home medical devices saw significant growth.

5. Membership becomes the main force of brand “repurchase”

After 14 years of development, it became harder to acquire new traffic during double 11. Platforms and brands have shifted their focus on transforming consumer awareness into customer loyalty by offering Double 11 member benefits.

Many brands, such as Lego, Pizza Hut, Royal Pet, have realized an omnichannel membership system, connecting offline and online. Membership calendar, 0.01RMB member gifts, 0 RMB free product tryon, and 9.9 RMB lucky draw are popular membership mechanisms on Tmall.

The sales on Tmall also reflect the strong purchasing power of store members.

130 brands achieved over RMB 100 million GMV on membership alone. More than 5,600 brands saw over 100% YoY in member transactions.

Want to have a first free consultation session about how to do marketing in China? Contact us.