1. China's rapidly developing camping industry in the post-epidemic era

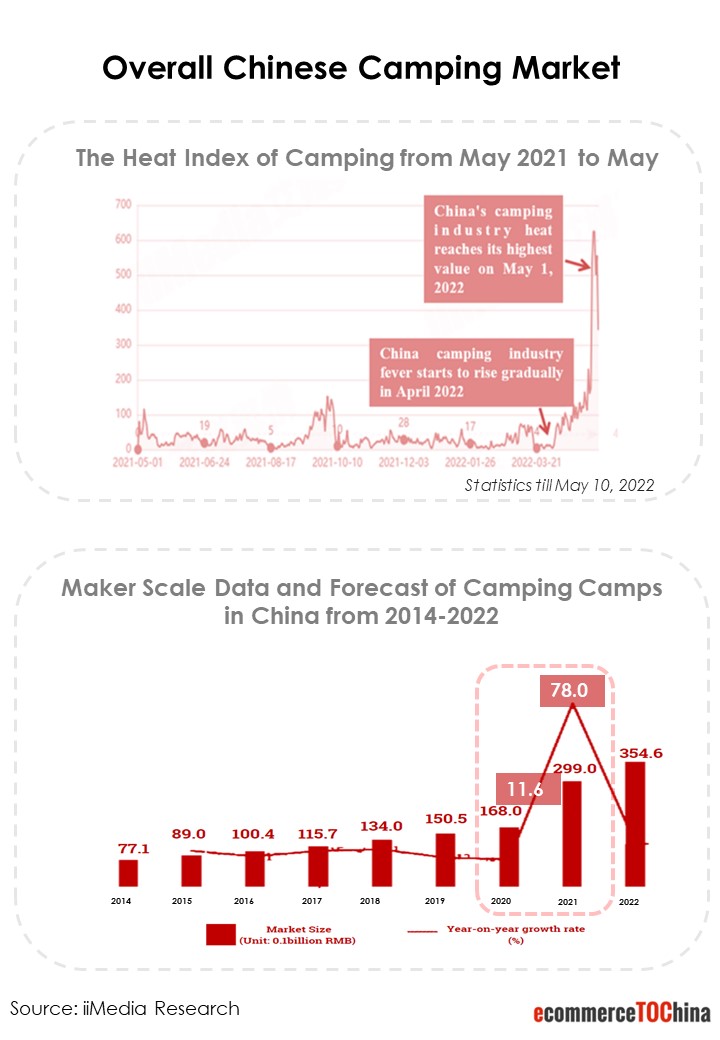

According to iiMedia Research, in 2021, the core market size of China’s camping economy has reached 74.75 billion RMB, up 62.5% year-on-year; the driving market size is 381.23 billion RMB, with a year-on-year growth rate of 58.5%. As of October 2021, there are nearly 37,000 camping-related companies, with 40% established in 2021.

The enthusiasm of Chinese consumers for camping is unprecedented, with a 258% increase in hot search heat in 2021 compared to the same period the previous year and a historical peak on Trip.com (a major Chinese travel website) during the past Labor Day

In China, camping is divided into three main categories: traditional camping; portable camping; and glamping. Among them, glamping is growing rapidly during the epidemic, accounting for 20% of the 360 million domestic campers in 2020.

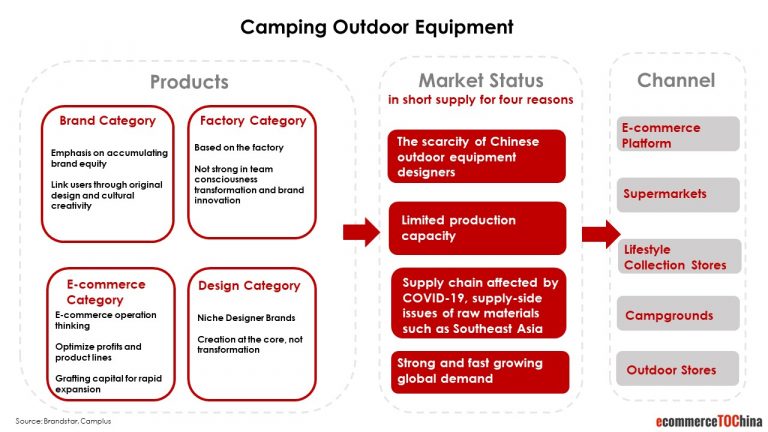

In 2021, the growth rate of the camping outdoor equipment division in e-commerce platforms is more than three times higher than the growth rate of the whole platform: Tmall 68%; Taobao over 100%; JD.com over 150%. According to BrandStar, the camping market as a whole is in short supply for four reasons: the scarcity of Chinese outdoor equipment designers; the limited capacity of camping equipment at the production end; the international supply chain not fully recovered because of the epidemic, and the strong global demand.

2. Why is camping booming: Nature & Socialization

The coronavirus-related restrictions in many Chinese areas make long-distance travel with riskiness, leading to the rapid development of local and peripheral tours. In this context, camping has gained attention as a short-distance, low-cost, and innovative travel option.

The reasons for the “camping boom” can be summarized as natural and social.

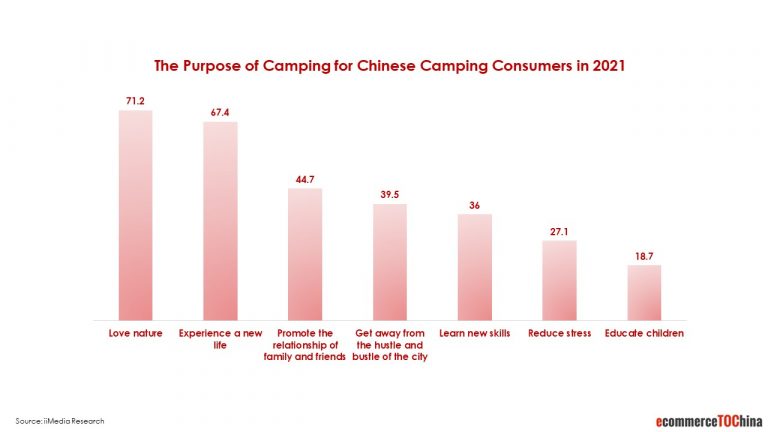

“Nature” has become the most attractive part of camping. It also alludes to the contemporary society’s aspiration for freedom and return to nature. Since camping is mainly located in natural environments such as grasslands and lakes and requires the establishment of a temporary living base, it is a way for people who have been living in the city for a long time to change their living environment and experience a new life. 71.2% of consumers choose to get close to nature by camping, 67.4% choose to experience a new life in this way, and 38.5% want to get away from the hustle and bustle of the city.

Furthermore, camping is a new social way to promote family and friend relationships, accounting for 44.7%. According to iiMedia Research, only 1.7% of consumers chose to camp by themselves, while 62.8%, 55.0% and 42.4% chose to camp with family, friends and lovers, respectively. With the rise of camping on social media, it’s not just a process of simply bonding with the people going camping together, it’s also a process of building identity on social media. According to the Little Red Book, during the period of January-May 2021, the search volume of camping keywords on Little Red Book increased by 428% year-on-year, and the volume of related notes posted increased by 271% year-on-year. Camping, as it continues to rise in popularity, is gradually becoming a way to gain social identity and traffic.

The “camping boom” reflects the rapid shift of Chinese consumers towards the development of enjoyable consumption and many brands have also launched campaigns to capitalize on it.

3. How can brands capitalize on it: Camping +

Many industries are getting more traffic by adding camping elements.

Coffee X Camping is a prominent way. In Tier 1 and 2 cities, there are many cafes that open in the city center and are decorated as camping scenes to cater to consumers who lack time but want to experience camping. It is divided into three different forms: purely outdoor immersion forms, mainly opened in resorts or outside the city; semi-open-air forms, such as terraces, rooftops; purely indoor forms, designed to create a sense of camping with camping equipment, home and decoration details. Furthermore, the cafes have their own special features, including summer open-air movie nights, pet friendliness, selling camping supplies, organizing camping activities, etc.

In addition to coffee, many restaurants and bars have also added camping elements. The F&B industry is determined to get a piece of the camping boom.

The social media platform is also involved. From April 28 to May 15, Little Red Book(小红书)launched the “go camping” campaign(露营季). First, through a set of user-shared content as poster material, with the theme of “Camping is the Play House Game of Adults”(露营是成年人的过家家), sharing the life of camping enthusiasts. Secondly, the Little Red Book station provides one-stop services, setting up virtualized image services, providing users with reservation services for more than 100 campsites, and camping goodies for purchase.

During June 3-June 5, The Little Red Book and Aranya camp in Hebei Province co-organized a camping conference with the theme “Meet at Sunset”(日落月升时), inviting brands, organizations, and KOLs from different fields to generate more buzz on the platform and promote the local tourism industry.

4. Conclusion

After the COVID-19, camping is growing rapidly in China as a short-haul and low-cost way to meet the demand for “vacation”. Among them, the development of glamping is the most remarkable. The main reasons are nature and socialization. Camping satisfies the need for people to be close to nature, to get away from the city and to feel free. Moreover, camping is a social choice, not only with camping partners, but also reflected in social media.

This high demand is not only reflected in the short supply of the camping market itself, but also in the various industries that are trying to profit from the “camping +” approach, such as F&B industry and Little Red Book. However, how to solve the supply problem of this emerging industry in China and how other industries can make differentiation will be further issues to be considered

Want to have a first free consultation session about how to do marketing in China? Contact us.