At the end of 2022, the three-year epidemic was over in China. Chinese consumers will be looking forward to and preparing for the return to normalcy in their work and life. All these will stimulate the long-dormant consumer enthusiasm in 2023 when the consumer market will achieve a “gradual rebound.” What are key consumer purchasing trends that we need to keep a close eye on in the next year?

1. Maintain prudent consumption for value for money and quality of life

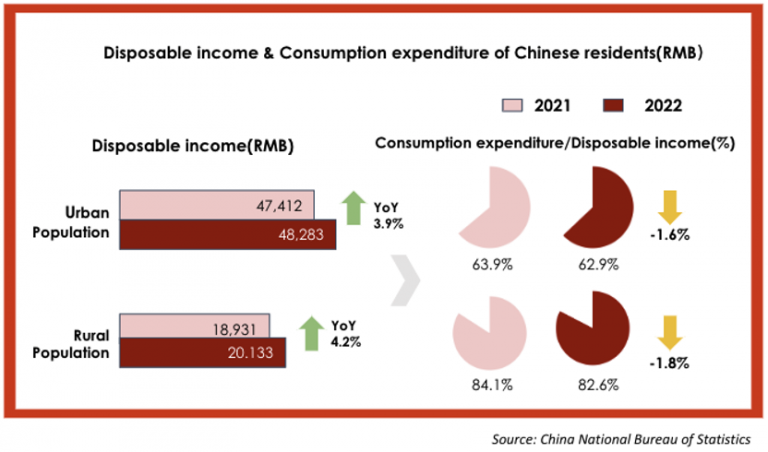

“Uncertainty” is still the biggest certainty at the moment, and in the face of this uncertainty, “saving” has become the key attitude. Consumers are beginning to make more conscious and wise spending decisions. Both urban and rural residents decreased their spending in 2022. They proactively research products and compare prices and channels on social media platforms to make rational choices. According to Bytedance’s survey, 83% of respondents use Douyin as their main platform to acquire consumption knowledge.

Rational consumption does not mean sacrificing the quality of life. 87.2% of consumers “care about the taste of their working and living space.” “Looking for affordable alternatives with the same quality” has become a way of life. Value for money is at the heart of this, from housing to food, covering all aspects of our lives.

2. Enjoy sensorial life with a focus on good vibes and spiritual comfort

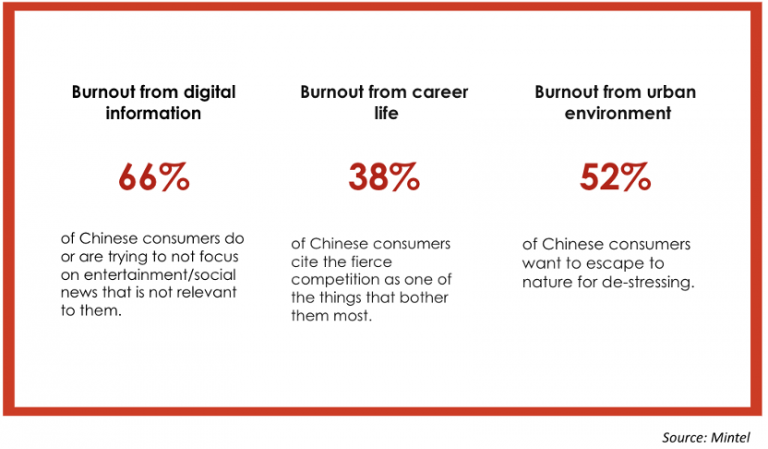

Nowadays, in the face of burnout caused by fierce competition, urbanisation, and uncertainty, consumers are increasingly aware that the key to physical and mental health lies in building a comfortable and relaxed rhythm with a self-care focus. According to Mintel, 66% of Chinese consumers have done or are trying not to pay attention to entertainment/social news that is irrelevant to them. Treed’s data shows that 52.9% of consumers in 2022 have chosen to delight their minds and bodies and relax. This has given rise to a range of consumer choices on enjoyable sensorial products and experiences:

Outdoor sports & travel:

Data from Bytedancce shows that 42.2% of Douyin users will use outdoor leisure activities like fishing, camping, hiking, climbing mountains, and surfing, as an essential form of entertainment. With the release of the zero-covid policy, the bookings for travel products during the Chinese Spring Festival rose 45% year-on-year, and per capita travel spending was up 53% year-on-year, according to Ctrip.

Home decoration & fashion accessories with joyful vibe:

Consumers are apt to create a space that pleases them, for example, by buying creative ornaments, speakers, tea sets, cute figurines, lamps, flower arrangements, and candle holders. Consumers are also more conscious of the overall vibe of their outfits and use a variety of accessories, such as rings, necklaces, and headpieces, to create an overall look.

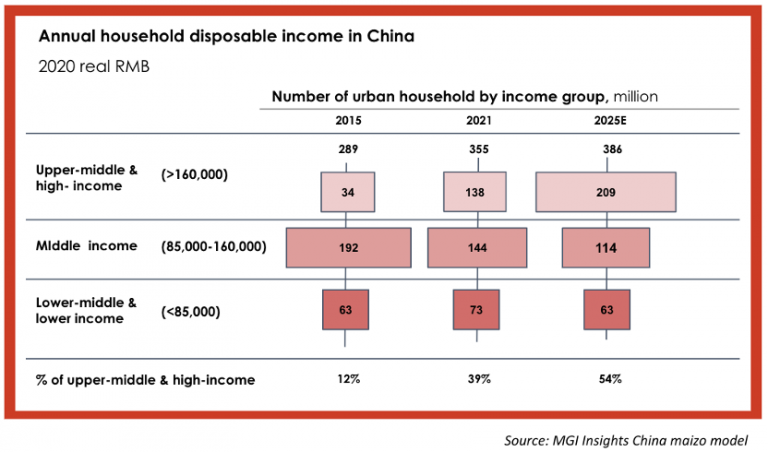

3. Pursuit of premiumization driven by upper-middle class

According to McKinsey China, more middle-class households are joining the ranks of the upper-middle and high-income bracket, with annual incomes above RMB 160,000 (Euro 219,014). Over the next three years, China is expected to add another 71 million upper-middle and high-income households. The willingness of high-income consumers to spend remains strong: 26% of respondents say they are spending more than last year, while only 14% say they are spending less. The growth and spending power of the upper-middle and high-income consumer segments are further driving the growth of high-quality and premium brands.

Premiumization is particularly evident in the beauty industry: Tmall’s premium skincare brands have an annual sales growth rate of 52% between 2019 and 2021, compared to 16% for mass-market brands. High-end skincare is expected to account for 47% of China’s skincare market share in 2025. National products are also accelerating the entering to mid-to-high-end skincare market (new anti-aging products are increasing).

In the haircare industry, this phenomenon is also pronounced. The hair care market is upgrading and expanding to high-end, functional, personalized care. Online consumption data shows that the consumption of hair care products above ¥300(€40) is growing significantly.

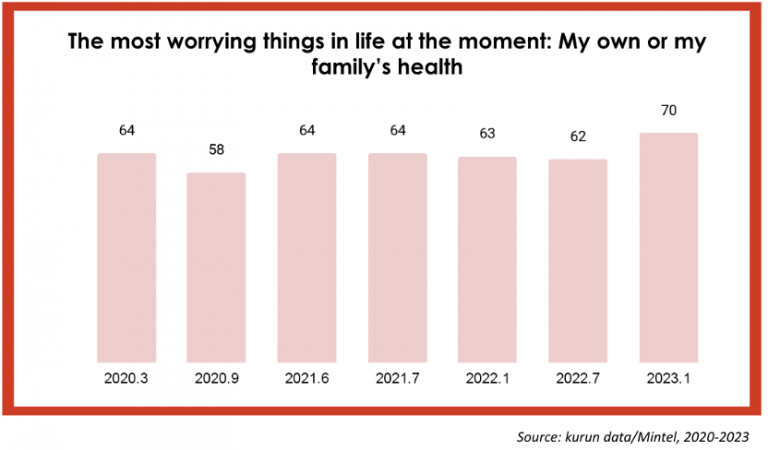

4. Health-conscious but lazy, in search of efficiency and convenience

Affected by the pandemic, people have been living in uncertainty and coupled with the growing pressure of life and work, consumers are increasingly passionate about health care. The outbreak of Covid at the end of 2022 enhanced consumers’ health consciousness. According to Mintel, in January 2023, 70% of consumers are currently living with the greatest concern for the health of their families and themselves. The public’s concern for health has brought about an explosive growth of some health supplement products, especially immune-boosting products. The turnover of vitamin C goods has increased 10 times in Tmall recently.

Health will be the top concern not only among the growing old population, but also for young generation. Young people usually need to obtain health with health products because of excessive late nights and unbalanced daily diets. They tend to maintain their health at any time, at a low cost, and with high efficiency and achieve “fragmented” health care during eating, drinking, and playing.

To ride on the trend, health supplement products are becoming snackable and ready-to-eat, such as ready-to-eat probiotics and meal replacements. In addition, healthy and convenient instant food has become consumers’ new favorites, such as instant pasta, instant soup, and other products.

Young people also pay more attention to the appearance of health supplement products. According to Xinhua Report, 40% of young people prefer health supplement products with a more beautiful appearance and creative format.

On Douyin, beauty, parent-child life, electronic & furniture, health supplements, and alcoholic beverage categories gained more than doubled growth.

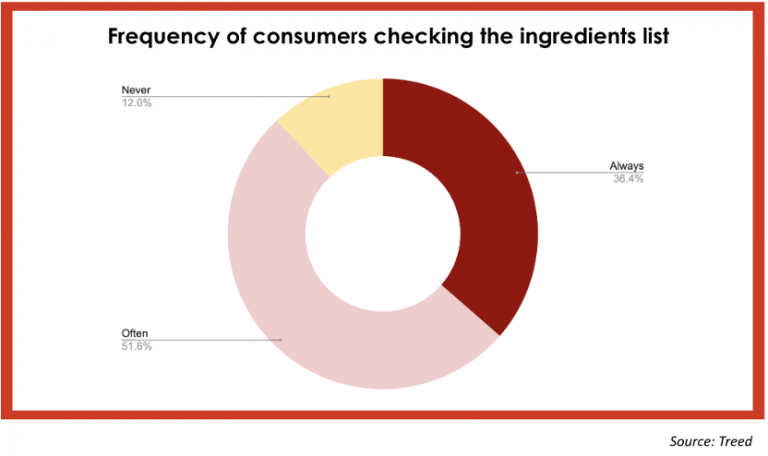

5. Care ingredient safety and transparency

Due to the emphasis on health, consumers are very concerned about the safety of raw materials, ingredients, and materials. From the “ingredient-centric consumers” (成分党)for beauty products, to the “material-centric consumers”(材料党) for furniture decoration, and to “raw materials-centric consumers” (原料党) in food and beverage, consumers’ enthusiasm for research on raw materials and ingredients has increased all the time. Under this situation, the boundaries between each industry are broken by creative “crossover’. For example, brands start to add food ingredients to cosmetics or beauty benefits to food – “food supplement for beauty.”

Finally, consumers’ quest for transparency is reflected in the control and traceability of products. Control means that the processes, materials, and packaging must be “pure.” In contrast, traceability means that consumers should know and monitor every step of the food process, from origin to serving. Control and traceability mean a new era of transparent ingredients. In the era of transparent ingredients, materials need to be purified, processes need to be refined, and packaging needs to be simplified.

Want to test your products through e-commerce & digital marketing on the Chinese market? Contact us for a first free consultation.