China’s Credit Card Disappearance?

Image Source: Getty Images

China has somehow forgone the credit card era and went straight to mobile payments.

This is largely due to China going through a huge and sudden burst of economic development over the recent decades.

Credit cards were never able to gain a strong foothold in the Chinese payment market before mobile payment appeared.

The Trend

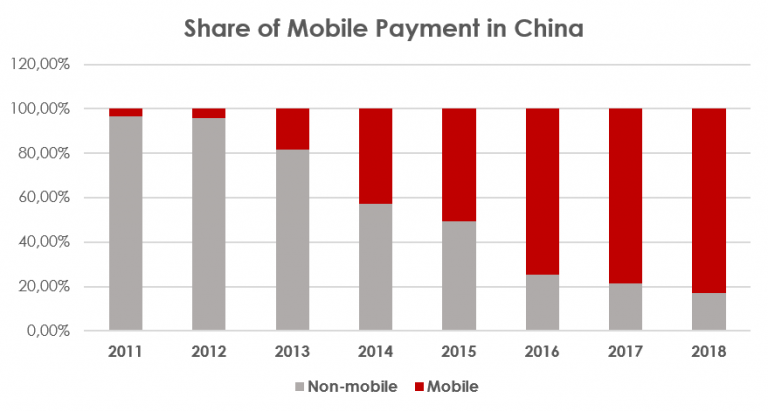

Data Source: IPSOS, WalktheChat

As we can see from the figure above, in 7 short years, mobile payments went from having less than 5% of the payment market share to controlling over 80% of the market.

Mobile payment penetration in large cities reach over 80%. In rural areas, we are still seeing approx. 66.5% mobile payment penetration. This is truly insane!

People normally living in rural areas that wouldn’t even know what credit cards are, are using mobile payments.

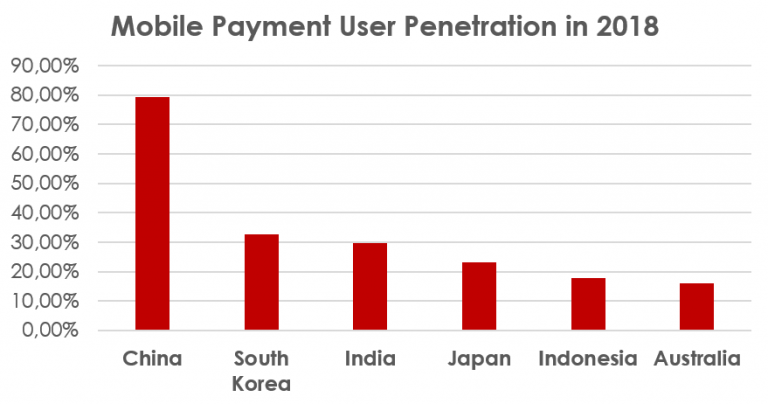

Data Source: eMarketer

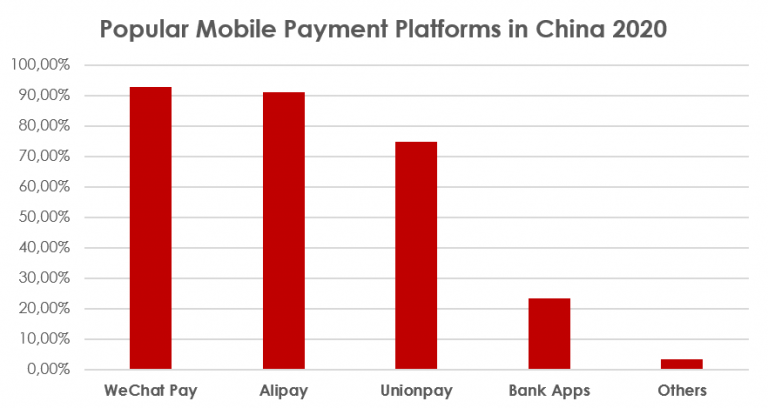

Data Source: Payment & Clearing Association of China

China leads the Asia-Pacific nations in terms of mobile payment penetration, by quite a bit.

And in China, Alipay and WeChat Pay dominate this market segment, also by quite a bit.

Want to have a first free consultation session about how to do marketing in China? Contact us.