China Industry Trends 2023

1. Outdoor sports industry is set to embrace a golden era

China’s outdoor sports industry is transforming from a niche (“minority’s privilege”) to a majority lifestyle market.

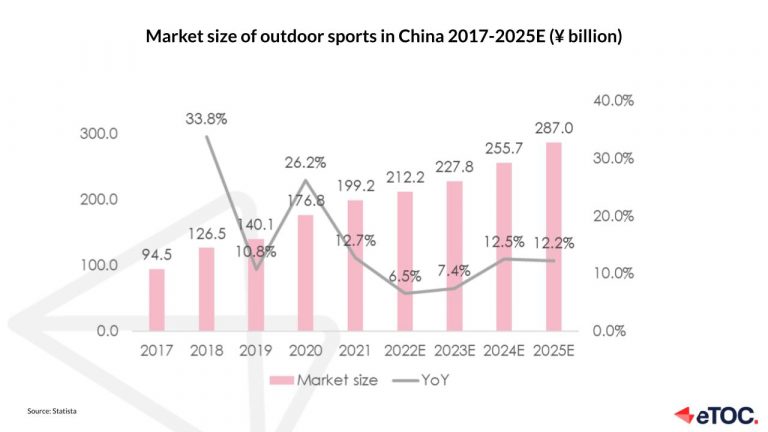

The number of outdoor sports enthusiasts reached 130 million in 2021 and the size of the outdoor sports industry reached ¥199 billion in the same year. By 2025, the total market for outdoor sports is expected to exceed ¥287 billion and over 10,000 outdoor camps will be built.

Furthermore, studies show that the average amount spent on camping equipment is ¥6,995, where 47.6% of consumers spend over ¥5,000. As China’s new middle class grows, so will their spending.

Due to travel restrictions during the pandemic, outdoor sports gained popularity as the next-best-thing. During the National Day holiday of 2022, tourists travelling to outdoor activity areas around cities accounted for 63.2% of the total tourist traffic.

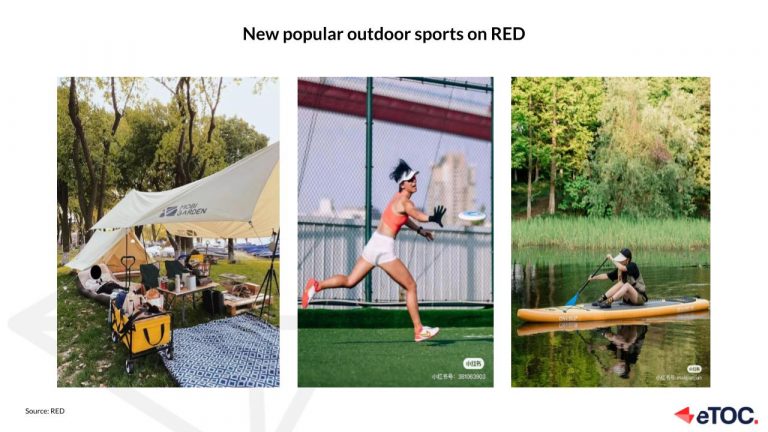

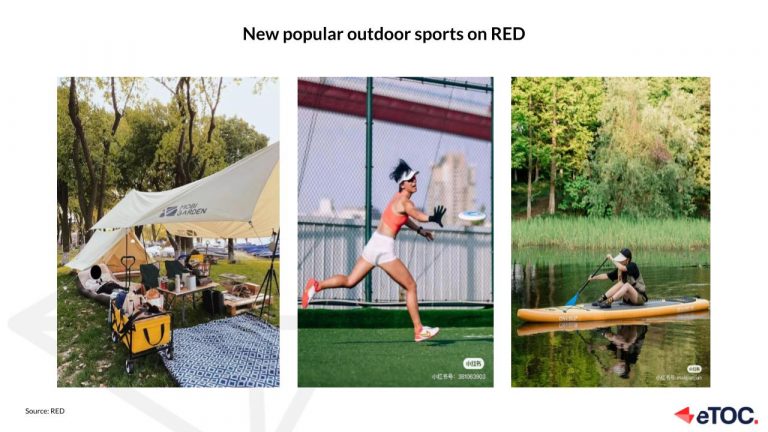

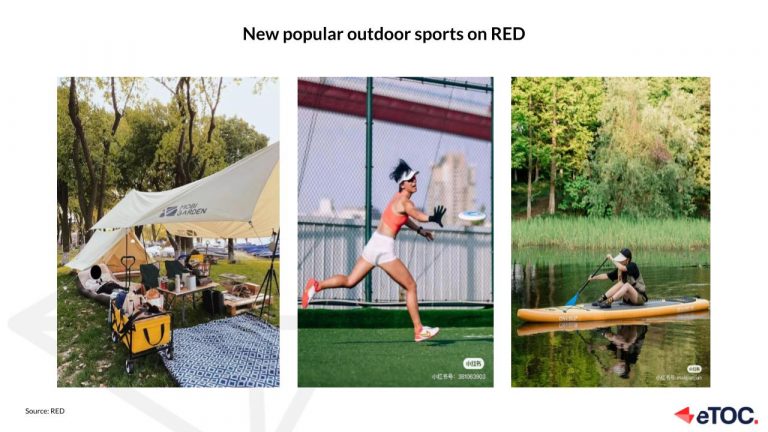

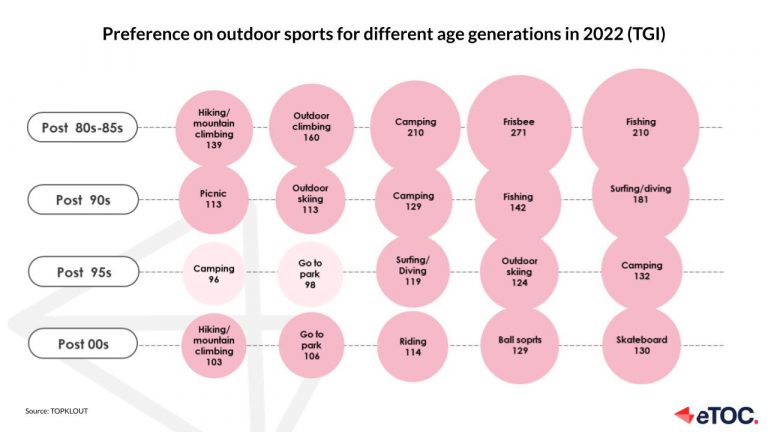

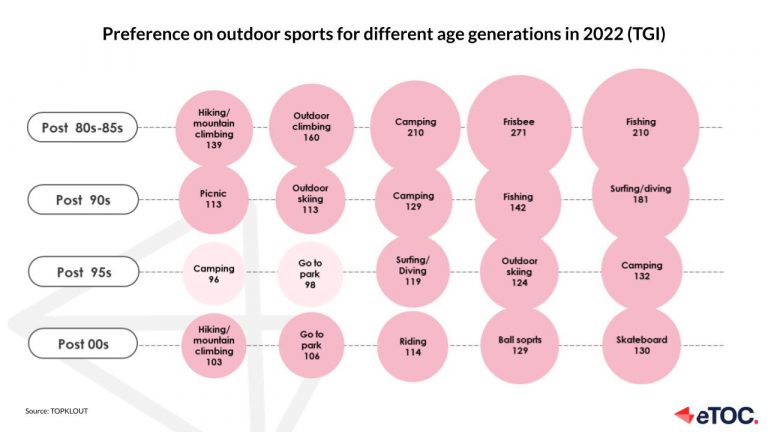

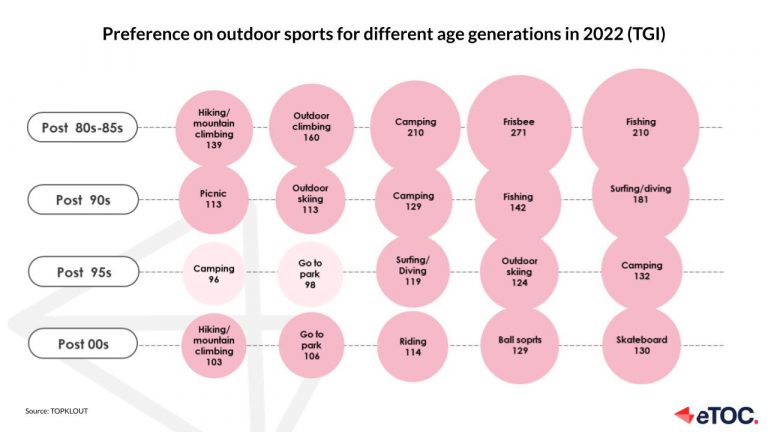

New outdoor sports emerging: The niche sports such as camping, frisbee and paddle boarding, have grown significantly. Since 2020, the new trend of “sophisticated camping” marketing on various platforms has continued to gain popularity. According to “Top 10 Life Trends 2022” released by RED, content associated with frisbee published in 2021 increased 6 times YoY and the sales of frisbee rose 340% YoY in 2022.

Low-threshold, engaging and fashionable are the core elements for outdoor sports enthusiasts. A sense of ritual, atmosphere and personalization become critical for consumers when choosing camping equipment and campsites.

In summary, the economy of outdoor sports will continue to rise with the growing number of middle-class and the ever-increasing popularity of outdoor sports in China.

2. Pet economy is on the rise

The pet industry is one of the few industries that enjoyed growth in 2022. Tmall and JD showed a combined YoY growth rate of 12.9% compared with the same period from Jan to Nov 2021.

2.1 Huge potential for refined cat food & multi-functional cat snacks

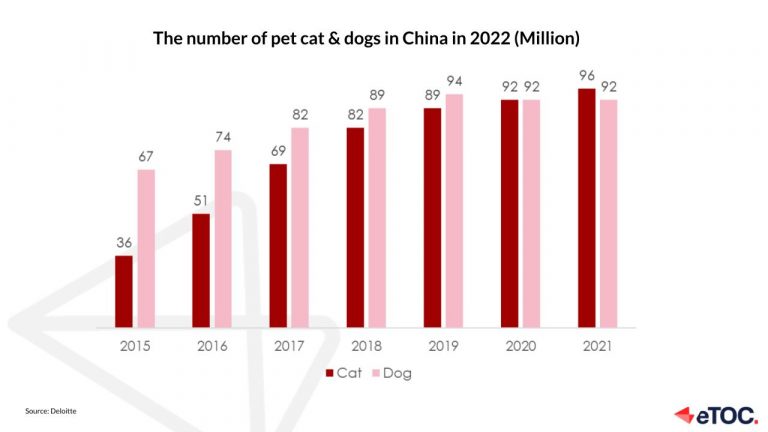

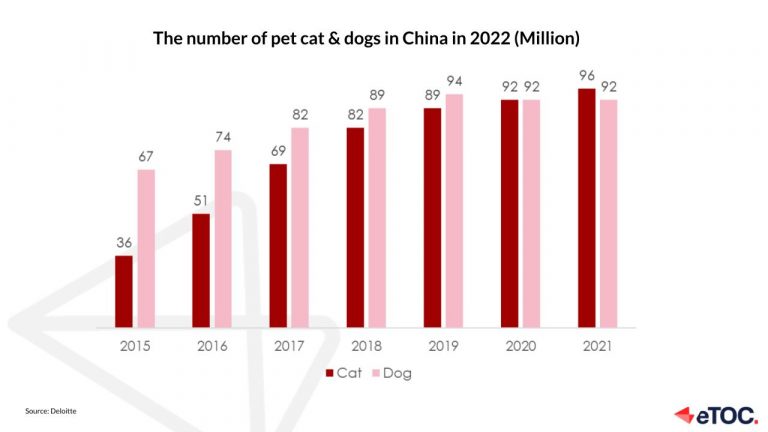

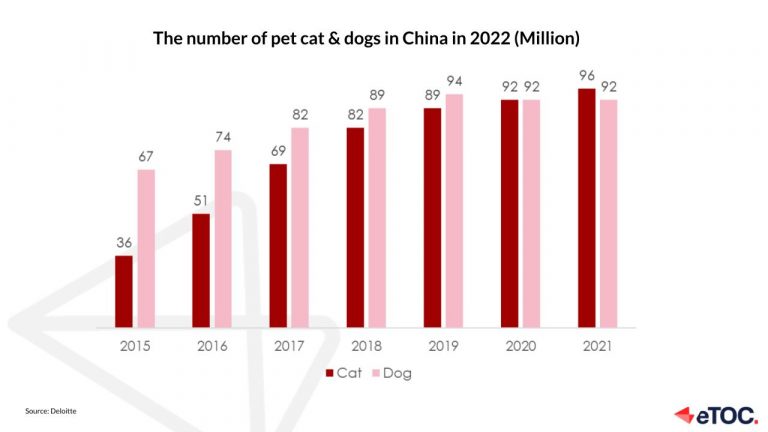

Cats > Dogs: Due to fast-paced urban life, small living spaces and strict restrictions on dog ownership in the city, people living in the city seem to prefer cats over dogs, resulting in the number of cats surpassing that of dogs in 2021, in terms of house pets.

Cat food sales in 2022 accounted for 59.6% of total pet food sales with a YoY growth rate of 29.5% which is faster than that of dogs.

Stronger emotional bonds drive higher spending: Post-80s and post-90s are the majority owners of pets, accounting for 77% in 2021. 81% of pet owners will take their pets for regular check-ups. Research shows that higher-income pet owners will also spend more on pet-related products.

Healthy, professional and balanced nutrition has become a significant feature of cat food. Products claiming bait-free and grain-free grew 26.8% YoY on Tmall in 2022.

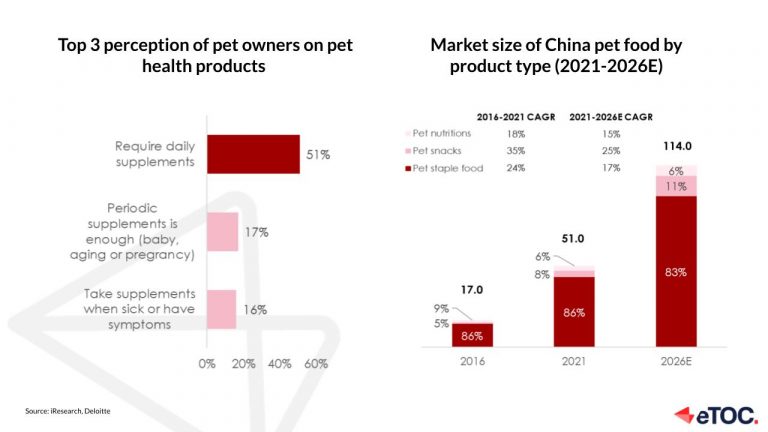

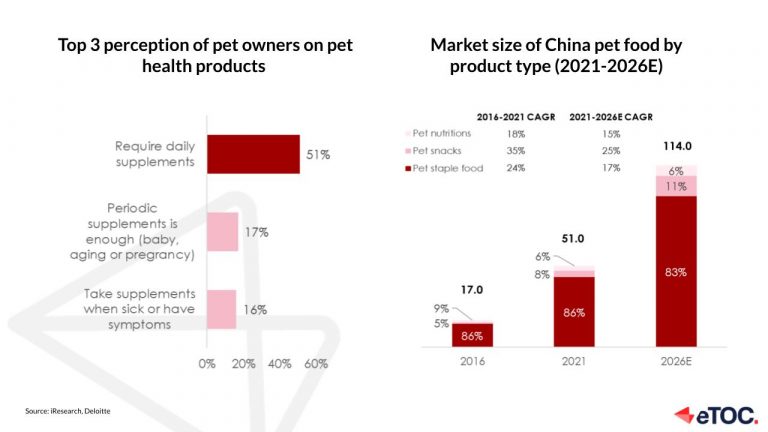

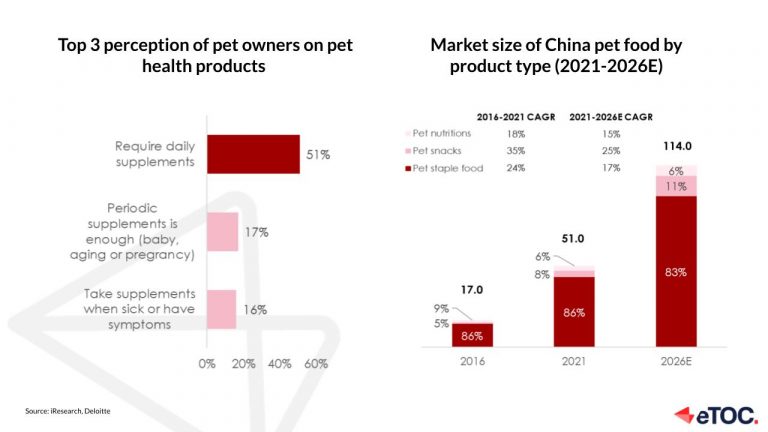

Pet snacks with specific nutritional & healthy functions will gain increasing popularity: They are the fastest growing category in 2016-2021 and are expected to continue by 2026. Cat snacks advertising cheek fattening, teeth-grinding and hairball digestion increased sales by 29.6% YoY.

2.2 Pet smart supplies market is a growth engine

The demand for smart pet supplies such as smart water dispensers and smart feeding machines is also increasing. 52.9% of pet owners purchased smart pet supplies in 2021 compared with 43.1% in 2020. The market is expected to reach ¥9.8 billion in 2026 with a CAGR of 20.5%.

E-commerce platforms started to provide support to the pet industry. Tmall upgraded the “pet” category to a first-tier category in 2021, focusing on incubating new brands. Smart pet supplies’ sales increased by 500%+ during the Double 11 shopping festival in 2021.

During the same year, JD announced that it would incubate more than 50 new brands, mainly focusing on pet food, pet supplies and pet services.

The pet market will continue to grow, especially in the subcategories of pet foods and snacks. With more companies and platforms participating in the market, competition will intensify.

3. Beauty giants continue to be optimistic about China's beauty market.

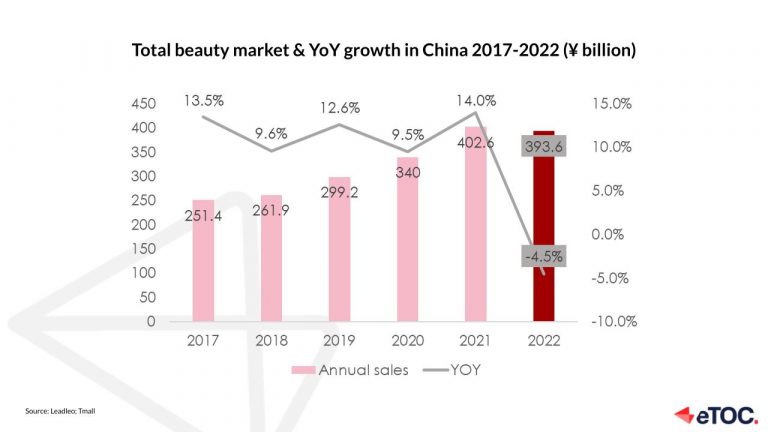

The total sales of the beauty market dropped to ¥393.6 billion in 2022 for the first time, with a decrease of 4.5% YoY compared to the previous year, mainly due to the pandemic.

3.1 International beauty giants increase investment in R&D in China.

Despite the recurring epidemic in China in 2022, multi-national beauty groups (Estee Lauder, Henkel, P&G and Shiseido) are still optimistic about their China business driving the next phase of the group’s global performance. They have continued to invest in China’s R&D and innovation infrastructure to get closer to the local market and consumers.

Gen-Z has become the main consumer group for beauty consumption in China. With the stronger influence of social media platforms and KOLs, their demand in the beauty category is diversified and complicated.

To better understand the local market and better meet consumers’ needs, beauty giants are putting more effort into R&D centres to keep up with the strong growth in China.

4. Health-related consumer goods will flourish in the post covid era.

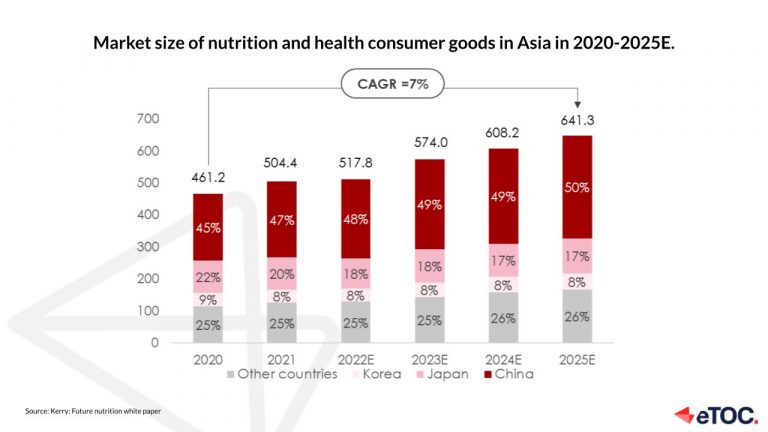

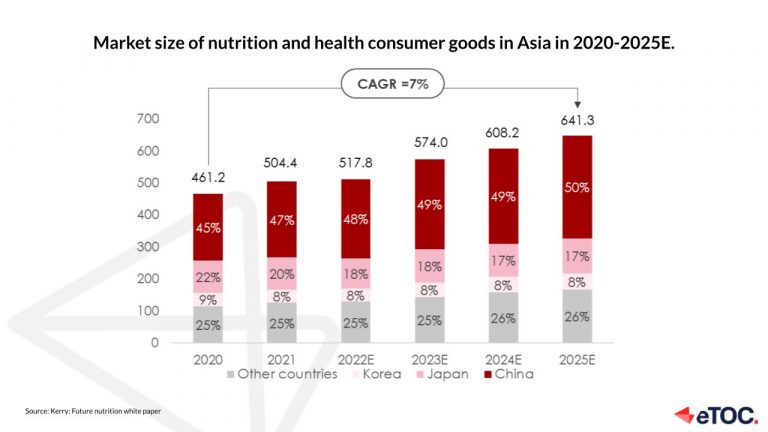

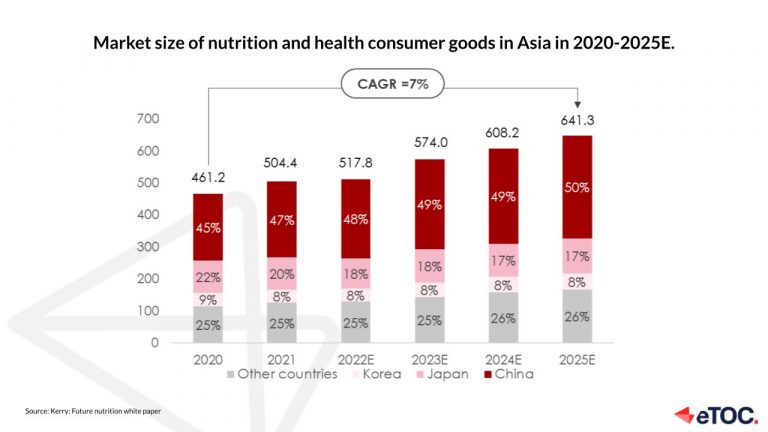

The Chinese health goods market is expected to reach 50% (¥318.8 billion) of the Asian market by 2025. “Health is everything” is a belief that has taken root in Chinese consumers since the pandemic outbreak at the end of 2022.

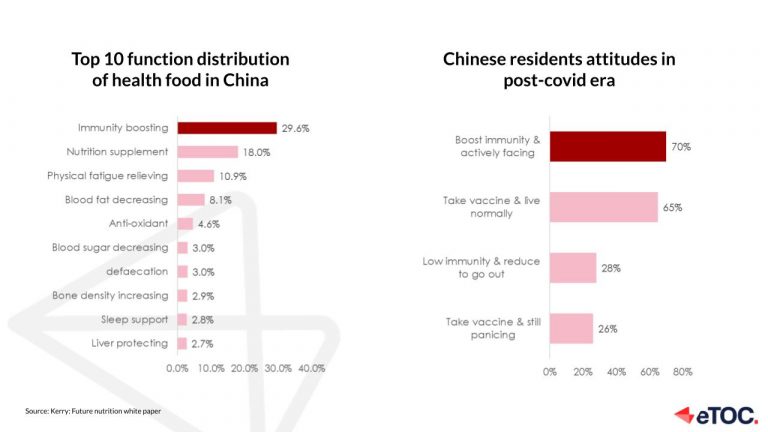

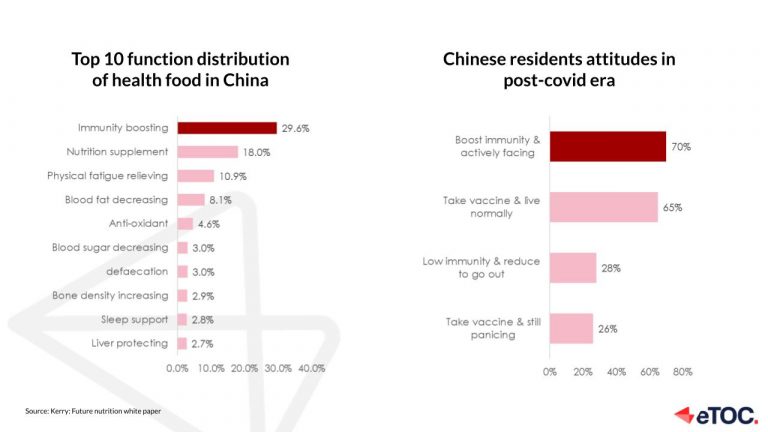

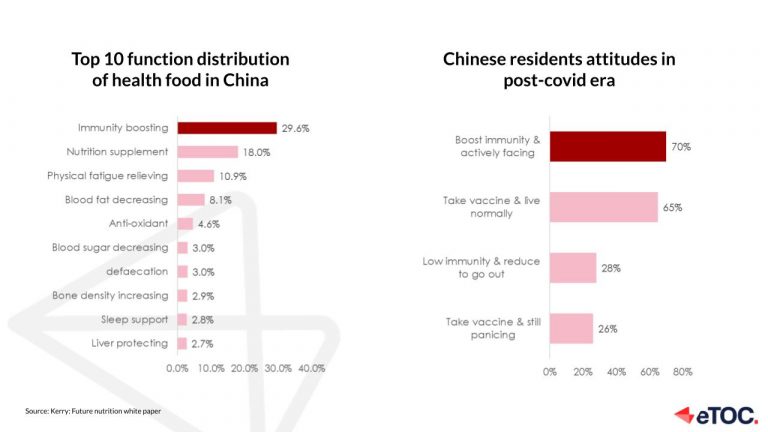

4.1 Immunity-related products will continue to lead growth

Immunity-boosting supplements have always been the top health subcategory. The immunity-related market has reached over ¥35 billion in 2021. Its growth momentum will continue as “immunity” still ranks at the top of Chinese consumers’ health concerns.

During the pandemic, the sales of immunity-boosting products in self-operated stores on Tmall, JD and Vipshop increased by 230%. Among them, vitamin C-related products grew 391% YoY, and probiotic-related products grew 312% YoY.

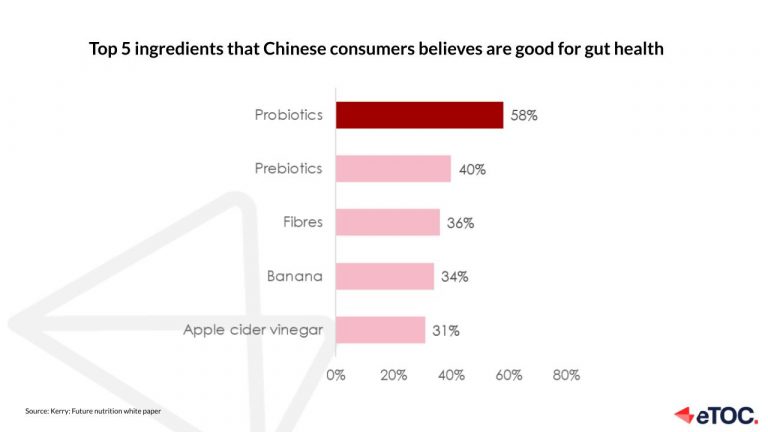

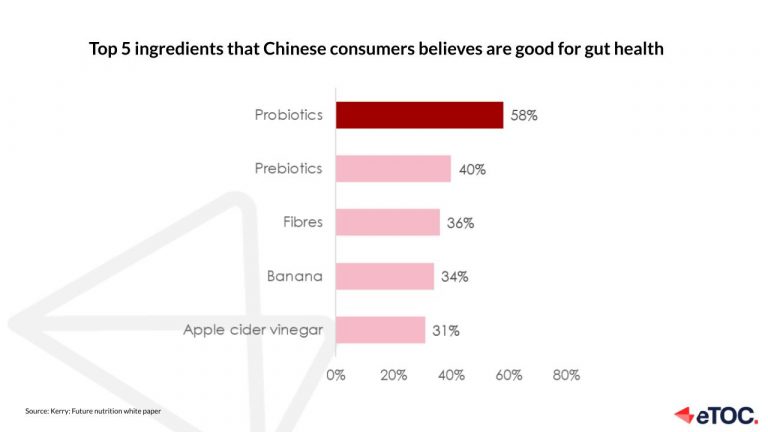

4.2 Good growth opportunities for probiotics as gut health concerns rise

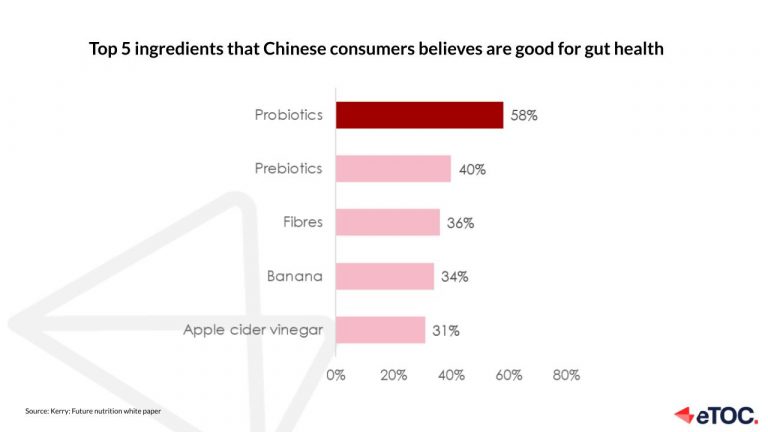

Widespread gut issues in China: Due to a widespread high-pressure, fast-paced lifestyle and irregular dietary habits, 90% of Chinese consumers have gut issues and 30% suffer from digestive problems, such as constipation and bloating. Thanks to the constant advertisement on social media and WOM from their friends, the public is gradually becoming aware of the importance of gut health to overall health, especially immunity.

Probiotics are the most well-known ingredients for intestinal health, with more than ¥95 billion sold in 2021. The sales of probiotics supplements on Tmall reached ¥6.3 billion with a YoY growth rate of 52.9%.

5. Coffee brands are digging the money in the sinking market

5.1 Fierce competition

More entry brands: In the first half of 2022 alone, 14 coffee brands received investment, with a combined value of ¥1.8 billion.

New entries such as China Post, Li Ning, Huawei, XStep and NIO have crossed into the coffee industry for business growth or cross-over marketing to attract consumers’ interests.

New tea brands have also stepped into coffee markets. Chayanyuese launched “Yuanyang coffee”; Heytea invested in multiple boutique coffee brands such as Seesaw, KUDOO, etc.

Online and offline competition: In 2021, the online coffee brand – Saturn Bird stated that it would open more offline stores to increase its brand awareness. The same year, another online coffee brand Yongpu Coffee officially opened its first offline coffee shop, “CityBorning,” in Shanghai.

On Tmall, Luckin Coffee has launched coffee products such as coffee beans, drip bag coffee and instant liquid coffee.

5.2 Turn to lower-tier cities

In the 1st & 2nd tier cities, the average consumption of coffee per capita is 326 and 261 cups, with consumption levels close to mature markets. Expanding to the 3rd and 4th tier cities has become many brands’ goal.

Coffee chain brands: The first pioneer brand is Lucky Cup. It developed rapidly by copying Honey Snow Ice City’s franchise model and leveraging a cheap price strategy (¥5 a cup). For now, the brand stores have reached 1,805, with 50% of the stores in the 3rd and 4th tier cities.

Starbucks officially unveiled its strategy for China 2025: Opening 3,000 new stores in lower-tier cities by 2025 to reach 9,000 stores, modelling it after Luckin Coffee.

In conclusion, coffee brands are digging the money in the sinking markets as high-tier cities’ coffee market is mature and there are fewer opportunities for new brands to enter the market.

Want to expand to the Chinese market? Contact us for a first free consultation.