1. Summary: The symbiosis of "content" and "e-commerce"

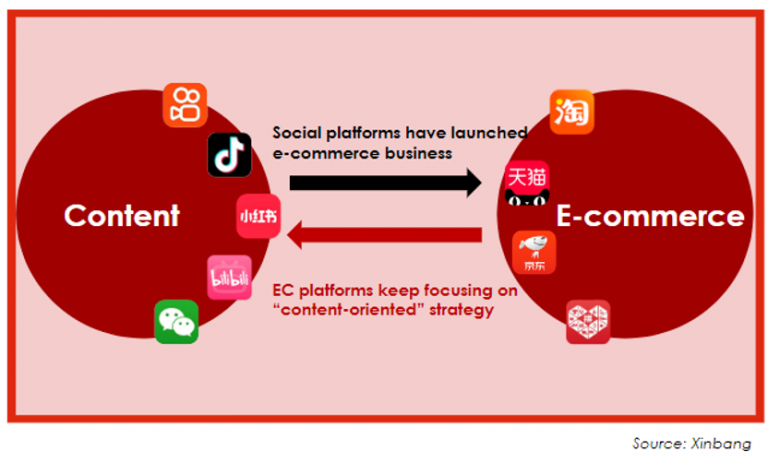

Social platforms such as WeChat, Douyin, Kuaishou, and Xiaohongshu (RED) have all launched content-oriented e-commerce businesses, grabbing market share with the traditional marketplace e-commerce giants. Marketplace e-commerce giants (Taobao, JD.com, Pinduoduo) have also made changes, taking “content-oriented” as the focus strategy for the future.

Both sides are exploring the closed journey from “seeding” to “trading”, but as of now, the consumer journey of “seeding on social platforms, purchasing on e-commerce platforms” is still the common conversion way.

KOL and brands have also made corresponding adjustments under this general trend. The advantage of the top KOL is weakened, brands vigorously develop their shop-own live-streaming rooms, and KOLs seek matrix and multi-platform operations.

2. Social Platforms

2.1 Douyin - the new e-commerce phenomenon

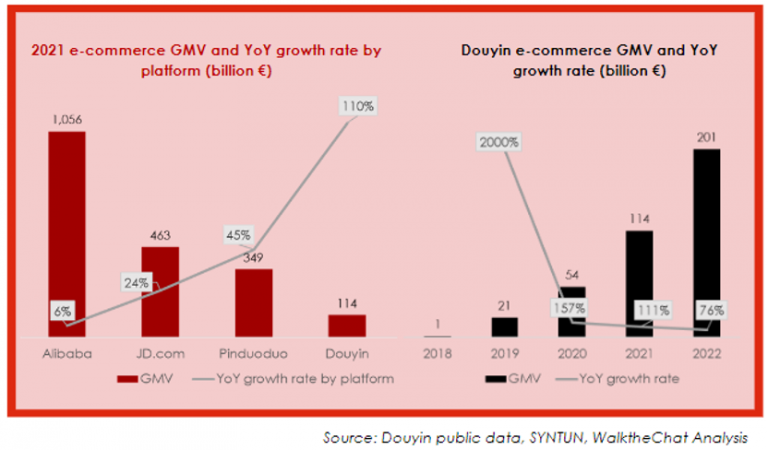

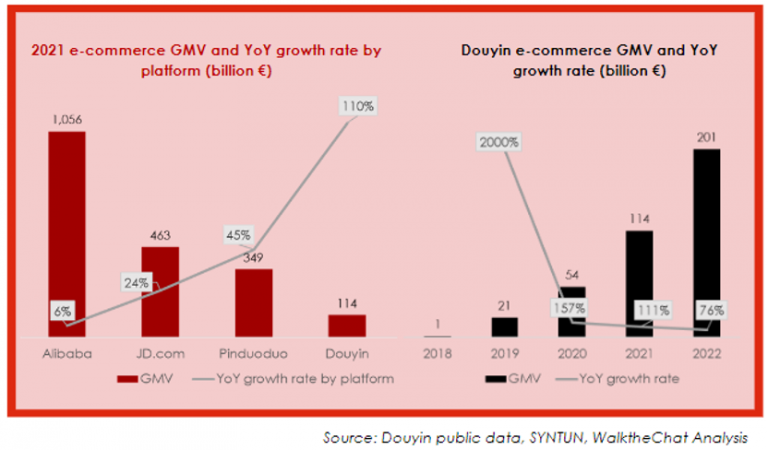

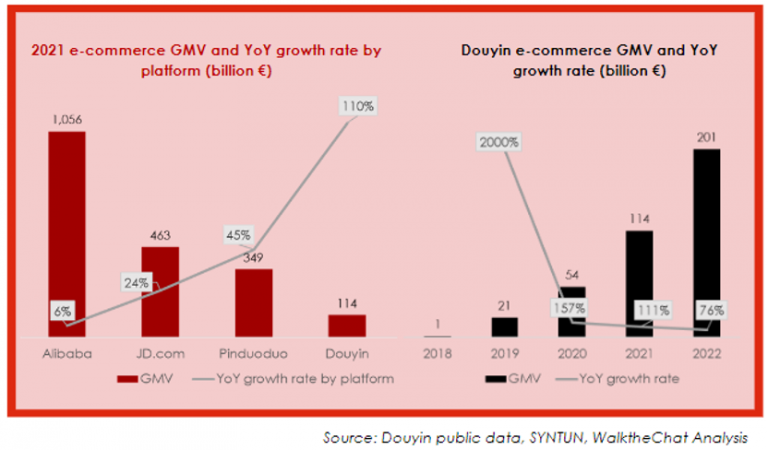

Douyin, the Chinese version of Tiktok, developed its e-commerce business in 2019. With the growth rate of e-commerce giants decelerating, Douyin achieved about 110% YoY growth in 2021 and keep it up, becoming an attractive new e-commerce phenomenon and quickly taking away the market shares.

Douyin e-commerce achieved €201 billion in 2022. Although its growth rate is slowing down, it is estimated to still be 75% in 2022. Compared to 2020, the purchased users grew 69% YoY in 2021.

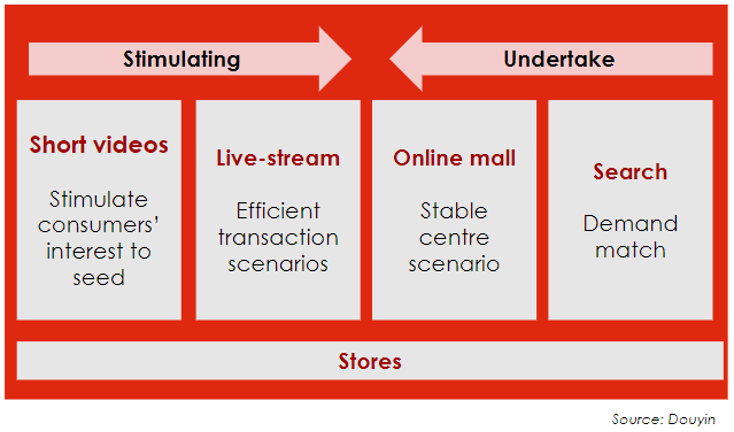

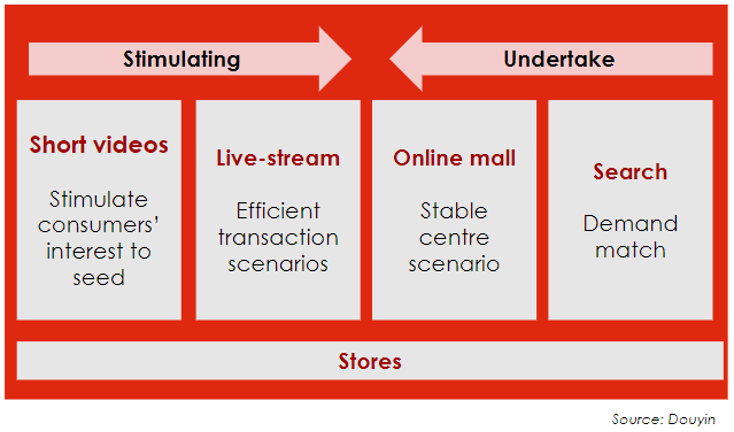

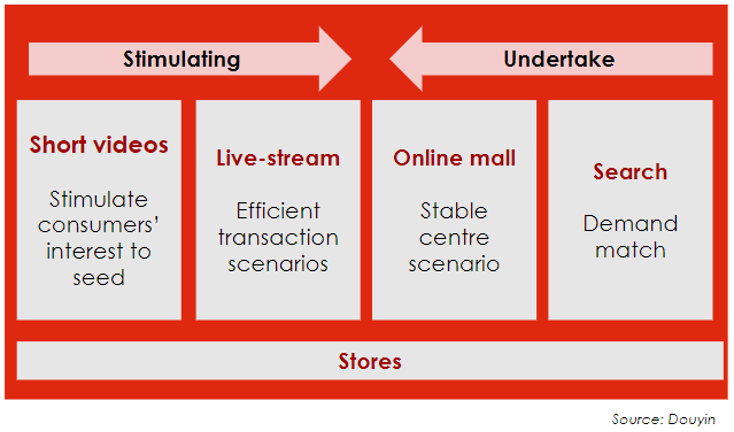

Besides its so-called interest-based e-commerce – promoting goods through short videos and live-streaming channels to help raise users’ shopping habits, Douyin also upgraded to integrated interest-based e-commerce in May 2022 to make up for the traditional marketplace e-commerce business, accelerating the development of “online mall” and “search”. In 2022 Double 11, this part of e-commerce achieved 156% YoY in average daily sales and 1.6 times exposure compared to 2022 H1.

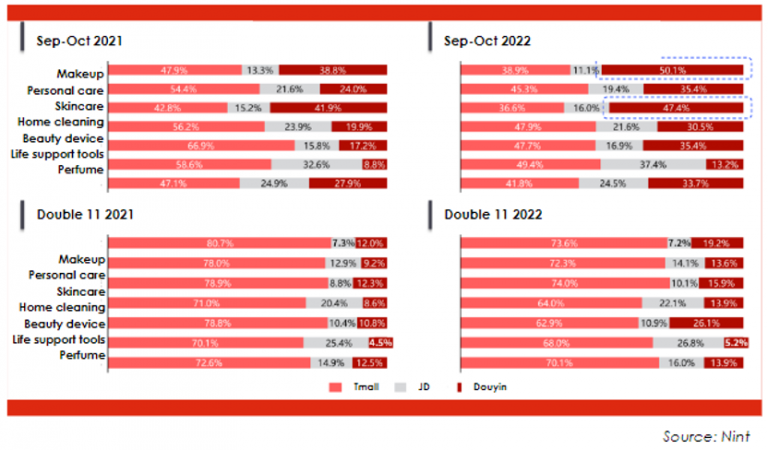

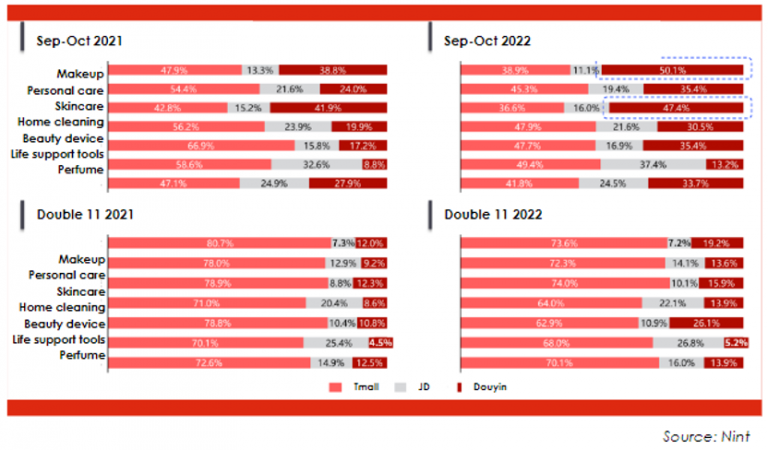

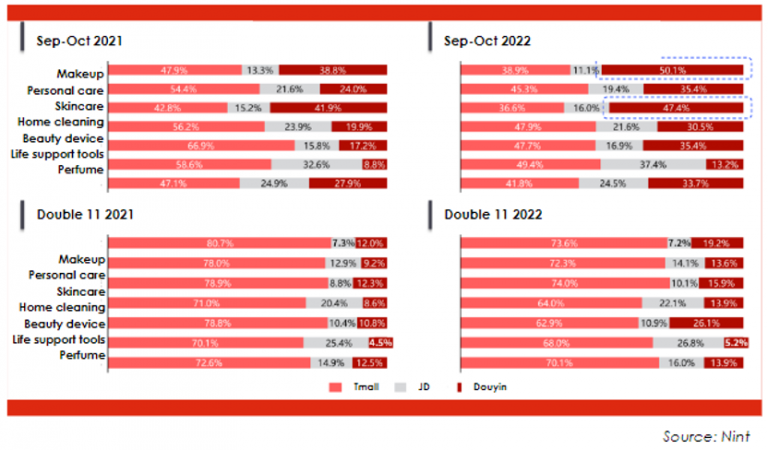

The initial results of Douyin e-commerce are intuitively reflected in the beauty industry. Although Tmall remained decidedly dominant during the big promotion (i.e. 2021 & 2022 Double 11), Douyin grew rapidly during daily sales. From Sep to Oct 2022, Douyin’s market share of makeup and skincare surpassed Tmall and JD.com.

With the rapid GMV growth of Douyin e-commerce, it also began to lay out e-commerce services and infrastructure, including Douyin pay, logistics layout (digital waybill, express home delivery “Yin Zun Da”).

In general, Douyin e-commerce business has already become a new phenomenon, however, it is not easy way for Douyin to reach as big as Alibaba’s volume.

2.2 WeChat Channel becomes Tencent's hope for e-commerce traffic

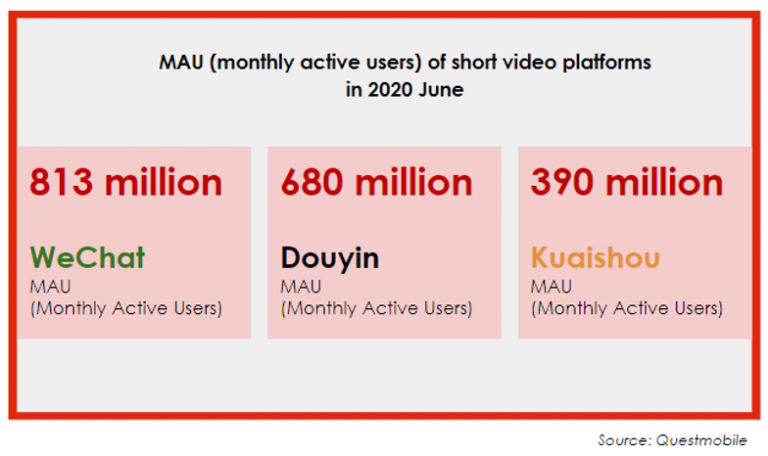

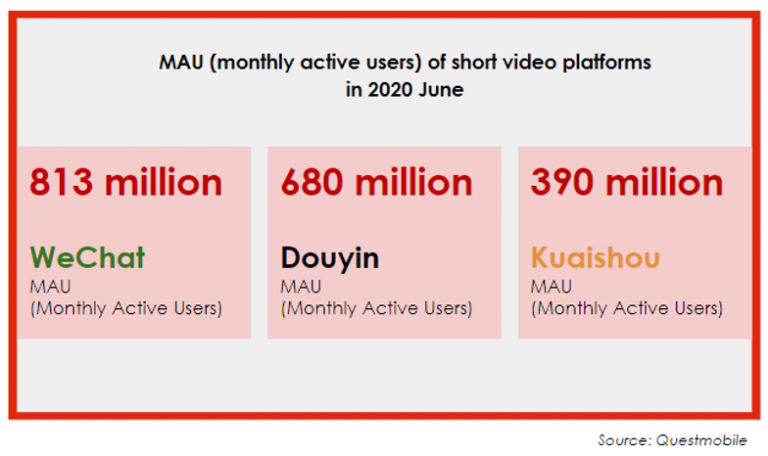

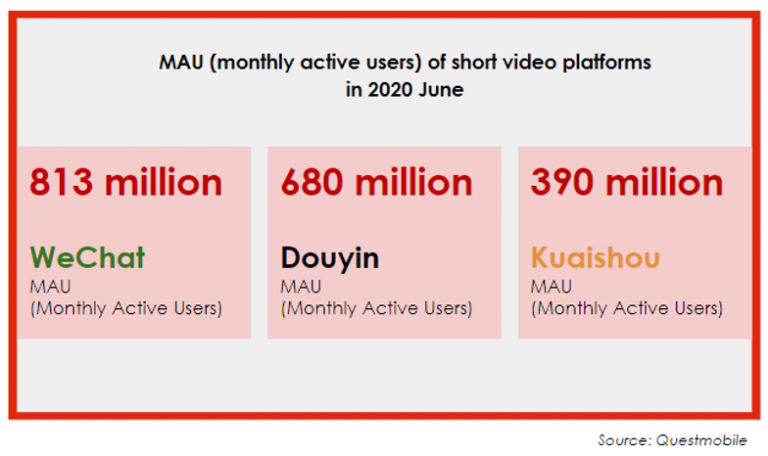

According to Questmobile, the MAU (monthly active users) of the WeChat Channel has surpassed Douyin’s 680 million to reach 813 million, ranking first among short-video platforms. The total time users spent on WeChat Channels exceeded 80% of their time on WeChat Moments (a feature similar to Facebook timeline) in 2022, roughly estimated as an hour.

The company’s CEO Pony Ma emphasized that short videos should be a new priority incorporating e-commerce features, with the unit already initiating various attempts to monetize, including the in-feed advertisement, WeChat store, live-streaming…

In Tencent’s Q3 finance report, the in-feed advertisements, newly activated on July 9, 2022, acquired robust advertising demand, particularly from the FMCG category.

The unit also saw a 200% YoY in the total number of video views, and an 800% growth in total gross merchandise value (GMV) from live-streaming shopping content with an average unit price of over RMB 200 (€28.6)

In the future, WeChat Channel Live-streaming will invest 5 billion traffic and launch more sophisticated tools and incentives to drive e-commerce growth.

2.3 Xiaohongshu (RED) leverages content benefits to promote e-commerce

Xiaohongshu, as a UGC platform where people look for information, has bigger ambitions.

In early 2022, Xiaohongshu merged the community department and e-commerce department into a new community vision, emphasizing that transactions are an important part of the community. As a result, its e-commerce business is unique.

Firstly, content is the base of the transaction. Xiaohongshu e-commerce focuses more on brand-building content than sales. The live-streaming features high unit prices, high conversion rates, high repurchase rates, and low return rates.

Secondly, the transaction is integrated into the content community. The community is the main consumption scenario, aiming to nurture users’ transaction awareness and form a transaction ecology of merchants. Xiaohongshu has launched a number of services to give merchants and products more traffic, including in-station search, merchant posts with purchasing links, and diversified transaction portals.

3. Traditional marketplace e-commerce: "Content-oriented" is the next focus strategy of Taobao

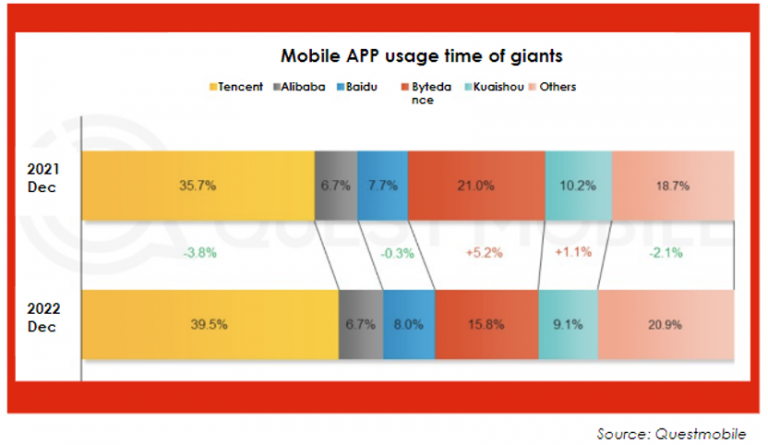

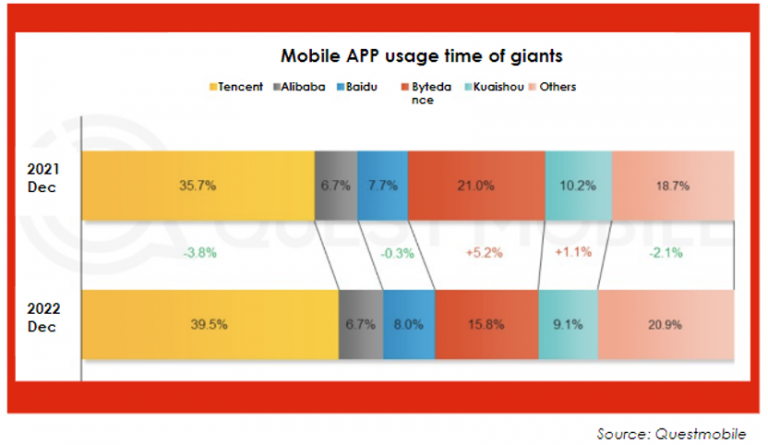

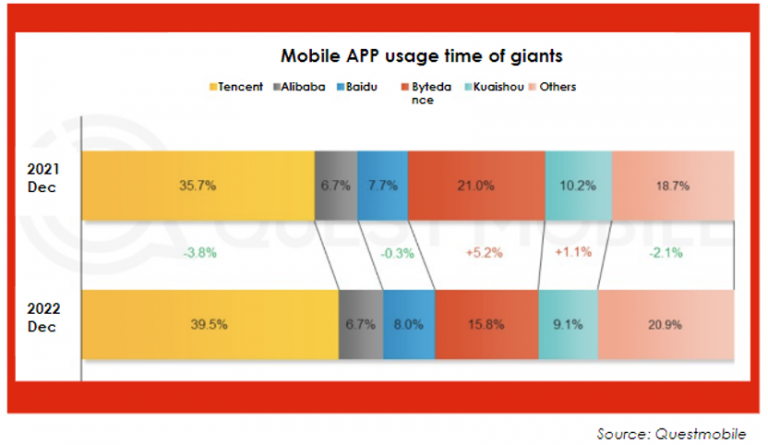

What’s behind Taobao’s “content-oriented” strategy focus is its traffic dilemma. According to QuestMobile, Alibaba’s traffic share dropped from 8% to 7.7% while Bytedance’s traffic rose from 15.8% to 21.0% in 2021 Dec. Taobao aims to use content to bring in external traffic while internalizing them into its own ecosystem.

In mid-2022 Taobao Live changed the traffic distribution logic – taking a portion of the transactional traffic to support content-based development.

Over 500,000 new live-streamers joined Taobao Live in 2022, including Luo Yonghao who used to stream exclusively on Douyin and has over 19 million followers. The average daily viewership of new live-streamers during Double 11 increased by 561% YoY.

Furthermore, Taobao is also committed to “retaining” users and being more user-centric. In recent years Double 11, Taobao’s delivery time, after-sales service, prices and pricing system have been gradually improved. For the Chinese New Year promotion in 2023, Taobao & Tmall offers a direct reduction of 5% -15% instead of a cross-store full reduction and coupons, simplifying the promotional mechanism for a better consumer shopping experience.

4. Live-streaming shifts from top KOLs to shop-own live-streanming and KOL IP matrix

In 2022, the pattern of top KOLs dominating the market changed. Viya stopped live-streaming after being banned; Austin Li interrupted live-streaming for 3 months after a sudden stop on June 3; Luo Yonghao announced his withdrawal from the live-streaming in June, although he has still appeared several times, the impact is no longer.

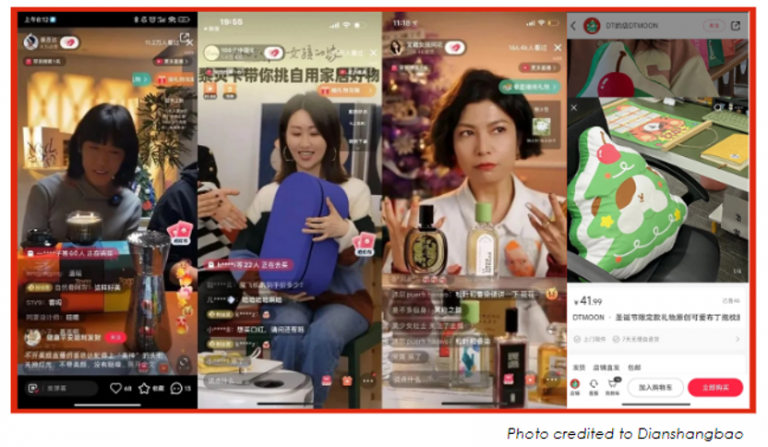

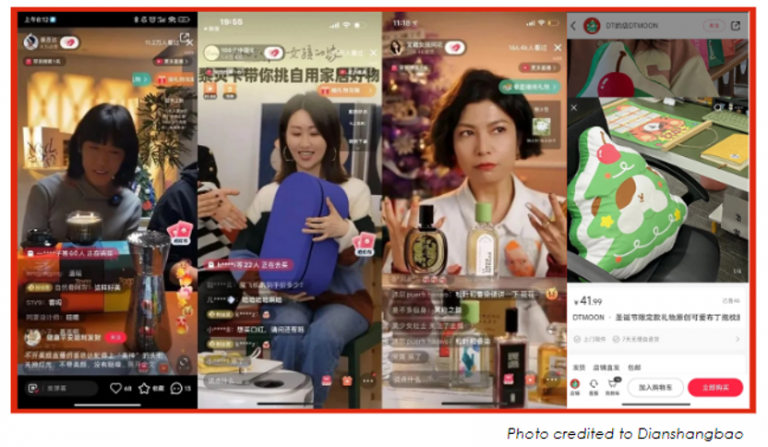

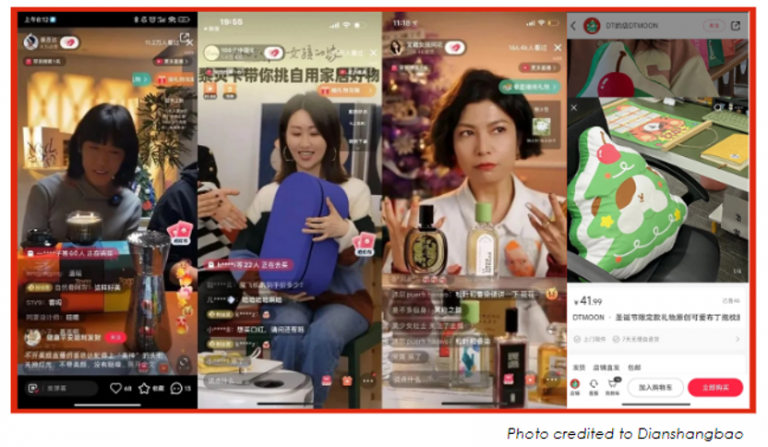

Under such circumstances, shop-own live-streaming has become a way for brands to get rid of their dependence on KOL, and grab back the initiative to build a direct relationship with consumers. At Douyin, the share of brand-own live-stream rooms rose from 26.6% to 45.4% in 2022. The sales of Estee Lauder’s Douyin store-own live-streaming has accounted for 55% in August since opening in June.

Shop-own live-streaming has also been the focus of Tmall. The supported actions include technology empowerment (e.g. AI technology), early Double 11 pre-sale links for brand live-streaming, etc. In 2022 618, brand shop-own live-streaming sales grew over 100% YoY.

KOL and MCN have also stated to seek a multi-platform layout and IP matrix. For example, Luo Yonghao’s “make a friend”, includes food & beverage, sports & outdoors, mother& child, beauty & skincare”. These new accounts are targeting more vertical industries to find more segmented consumers and reduce the reliance on top KOLs.

Want to test your products through e-commerce & digital marketing on the Chinese market? Contact us for a first free consultation.