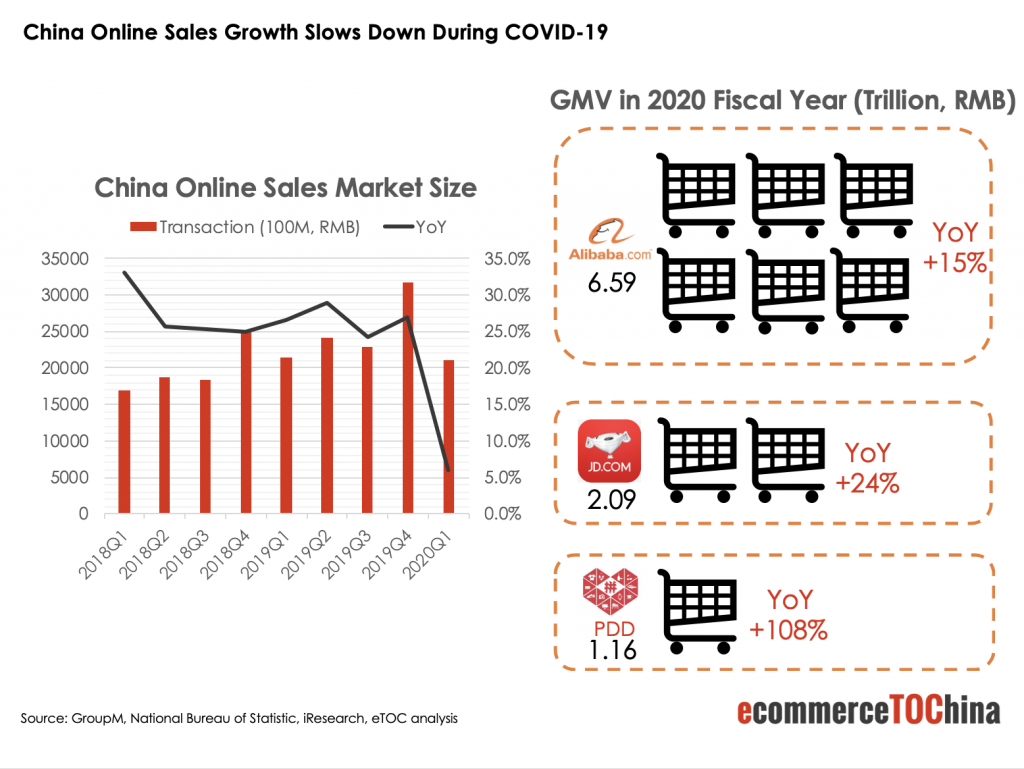

During 2018 and 2019, the online sales growth stabilized at around 25% YoY, according to GroupM. Due to the outbreak of COVID-19, it was estimated that during 2020 Q1, it would take a dive and turn negative. However, the final number is much better. The reopening of China’s economy finally enables online sales growth to keep positive, and the exuberant consumption of Chinese people is ready to free.

According to the data presented by the top two e-commerce platforms, Alibaba and JD maintain their steady GMV growth in 2020. Meanwhile, a popular new platform called PDD is growing quickly and doubled the GMV.

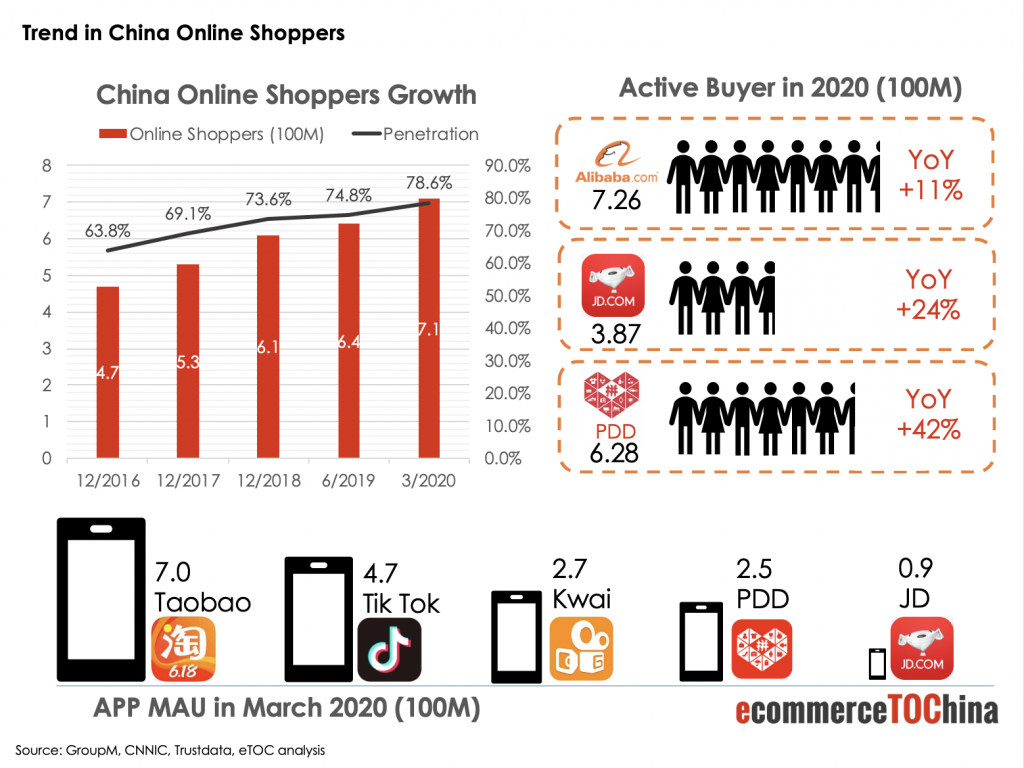

China has the largest online shoppers in the world. In recent years, China online shoppers have grown continuously. In 2020, over 710 million people enjoy online shopping, according to the latest stats by the China Internet Network Information Center (CNNIC). That is to say, half of the China population and three-quarters of netizens have embraced the e-shopping economy.

As for individual e-commerce platforms according to GroupM, Taobao, an offshoot of Alibaba, still has the most significant annual active buyer size and MAU, which has already reached half of the China population. Meanwhile, PDD has been growing at warp speed and approaching to Taobao’s annual active buyer size in 2020. Another outstanding feature is that live streaming platforms, especially short video apps like TikTok (Douyin) and Kwai (Kuaishou) also have joined the e-commerce party. These short video platforms with huge traffic advantages are taking more amount of user’s time. In 618 Online Shopping Festival 2020, Kwai (Kuaishou) had a partnership with JD. They announced the “double billions of yuan in subsidies.” Partnered with Suning, a traditional giant home appliance retailer starting its e-commerce platform, TikTok joined this year’s battle and created the “super buyer’s live streaming studio” to sell goods.

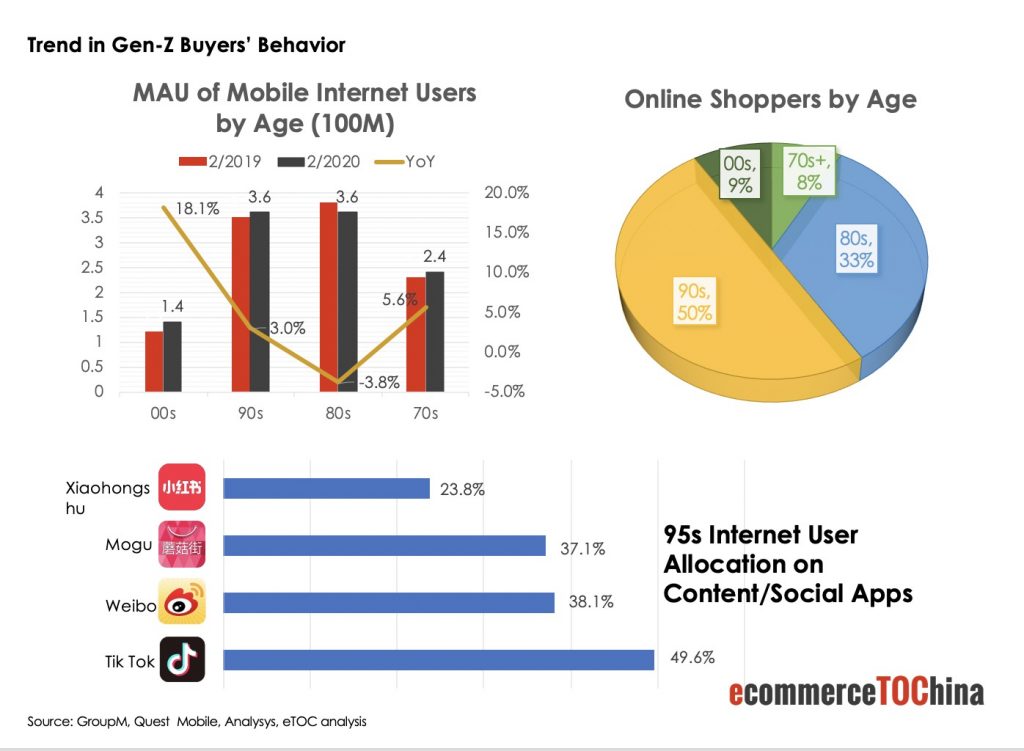

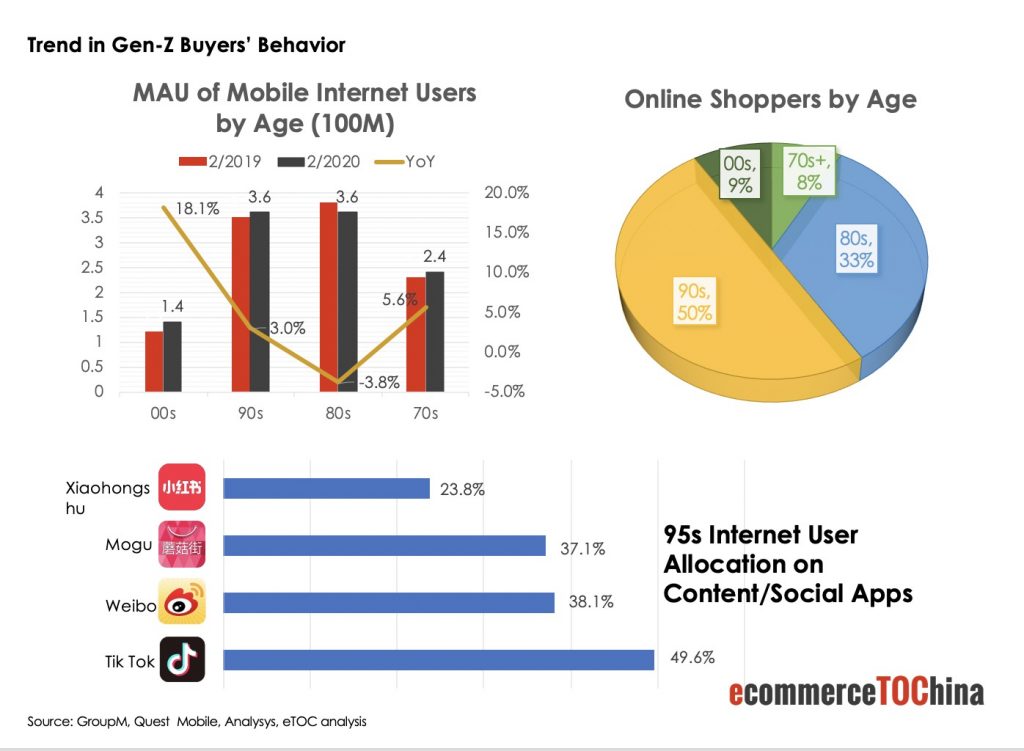

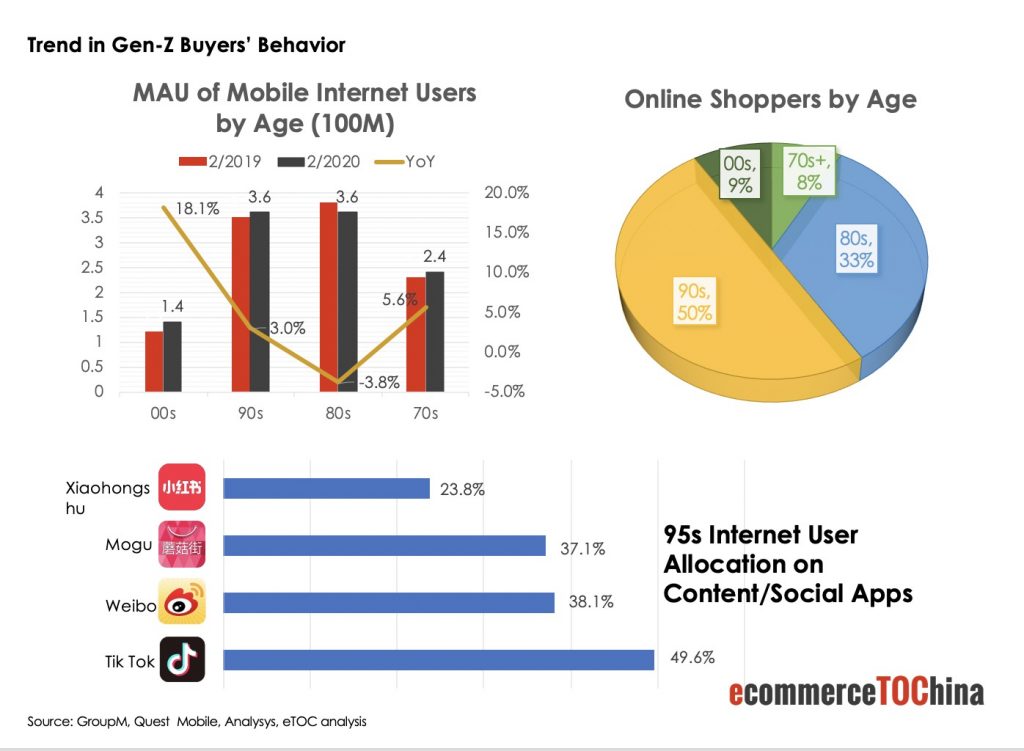

The generation after the 00s using mobile Internet surge. Also, the 90s become the key online consumption group. With the development of science and technology, the young generations’ lifestyle is changed and reshaped. According to GroupM, near 64% of the 95s browse e-commerce sites every day. The young generation after the 90s is the major contributor to the e-commerce economy. Therefore, today’s e-commerce consumption environment in China is extremely young and dynamic.

Their e-commerce consumption features engagement, diversity, individuality, and entertainment. So, they prefer interactive advertising. The live streaming sales show is a typical example of this. In addition, “seeding consumption” which means the longing to buy a product with good quality after being recommended, is now welcomed by young people. They often accept the recommendation from KOLs and stars. Some of the young consumers are crazy about products with celebrity endorsements, not only because of the belief in stars´ choice but also the starstruck behavior. Also, chasing fun, fashion, and surprise experience is a hotspot. Newfangled collaboration products are released, which can be more than you imagined. Blind box machines and online products are so popular that many people buy boxes one after another to see what the inside thing is.

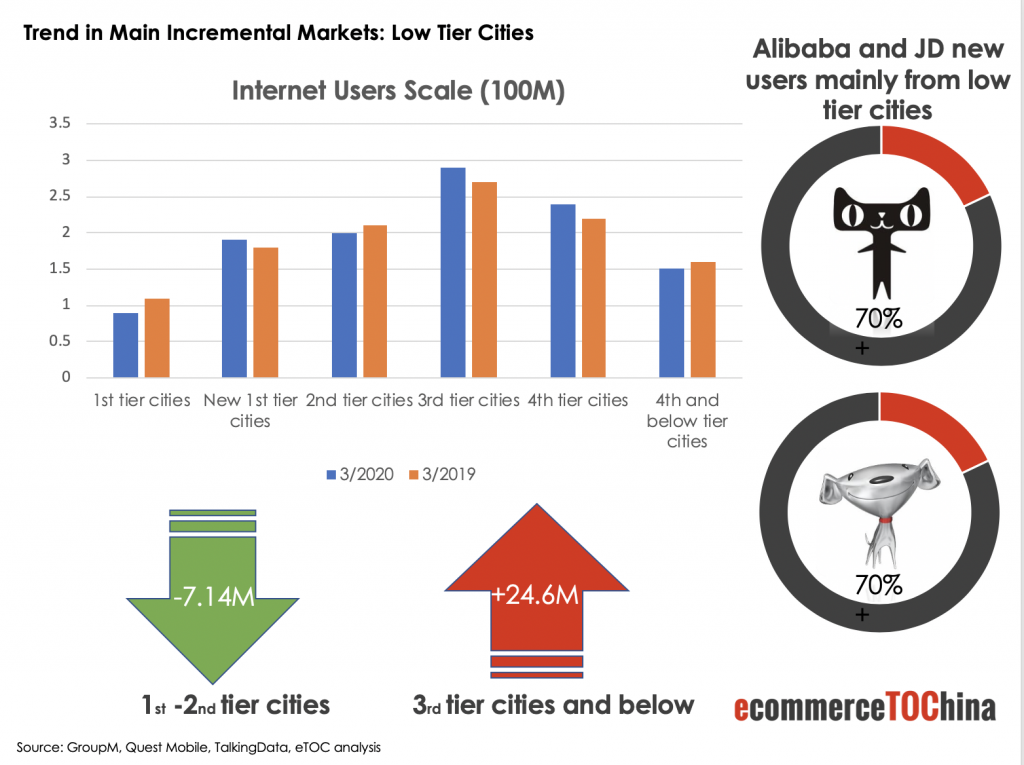

According to Quest Mobile, it is low tier cities consumers that are the chief battlegrounds. In China, the Internet users scale is more massive in 3rd and 4th tier cities. Cities of the 3rd tier and below contribute to the primary new e-commerce users today. Huge user-loving online purchases in low and small tier cities grow fast from 2019 to 2020, while users in 1st-2nd tier cities slightly decrease. At the same time, the data presented by Alibaba and JD suggest that their largest new users are from low tier cities. These low tier cities users feature different app preferences, which is low-priced and not very high-end. For example, they love shopping via PDD and Taobao, prefer watching videos via Kuaishou and TikTok. The users’ position of these platforms is relatively low-range and mid-range.

According to the report by GroupM, categories of FMCG, fresh and skincare get more sales while clothing, sports and makeup get less in Q1 2020. However, during the 618 online shopping festival 2020, categories of weaker sales volume in Q1 achieve good records. Within 10 minutes 30 minutes, respectively, Alibaba sold high-end beauty makeup three times YoY and sports with +780% YoY, respectively, on Tmall. On Tmall, 28 clothing brands used only under one hour broke one day’s sales record created on the same day. Moreover, emerging categories can also reflect the new demand trend of consumers. Vlog cameras, 5G smartphones, and floor cleaning robots are interesting products on e-commerce platforms. Moreover, over 180 luxury brands joined the 618 battle. On June 14, Dior opened its Tmall flagship store.

When the world economy is still facing downward pressure, the 618 online shopping festival seems to have delivered a strong performance. Hence, these new trends that emerged in the festival should never be ignored. Although China’s online sales growth slowed down during the outbreak, it turned out to be way better than the forecast. Besides, online shoppers in China are also continuously burgeoning. E-commerce platforms become increasingly youth-oriented. Also, users from low tier cities are on the rise.